We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

At Resolution Life, we understand that our call wait times are not where we want them to be.

We have made structural changes to our call centre and are hiring more call centre staff to make a difference here.

At the start of April, we teamed together our engagement specialists within our call centre based on call type and complexity, to better leverage team experience as well as increase the speed of our onboarding processes. Our intention in doing so is to more appropriately route calls based on their complexity, as well as ensure that we can increase capacity to handle higher call volumes as required.

Our service tiers are:

Across Australia and New Zealand we had 10 engagement specialists start on the phones this month,and will have another 10 in early May.

These changes are having a positive impact on call wait times. During January and February this year our Grade of Service (GOS) for adviser calls – which measures the % of calls answered within 90 seconds – was in the high teens. Our GOS during April has been around the mid-30s. We fully accept this needs to be higher and are aiming for a GOS during the year of 70 – 70% of calls answered within 90 seconds.

We will continue to keep you updated via the newsletter on how we are improving how we support advisers and customers.

As part of a customer’s Whole of Life or Endowment policy, customers are entitled to receive profits earned on the value of the assets in the portfolio in the form of a bonus.

There are two types of bonuses available:

1. Annual bonus

2. End/Terminal bonus.

We are declaring higher Annual bonus rates for Super and Ordinary (non-Super) policies relative to the rates declared last year. These Annual bonus rates will apply on policy anniversary from 1 April 2023 for former-NMLA policies and from 1 May 2023 for former-AMP Life policies. The Annual bonus rates declared are 0.3% higher than those declared last year for former-AMP Life Super policies, and 0.4% higher for Ordinary policies and former-NMLA Super policies.

We are declaring unchanged End/Terminal bonus rates from 1 April 2023 (former-NMLA policies) and from 1 May 2023 (former-AMP Life policies) for both Super and Ordinary policies from the rates declared last year.

The Annual Statement will show the impact of this bonus declaration on the customer’s policy.

The bonus rate appendix at the end of this article sets out a selection of Annual and End/Terminal bonus rates applicable for various types of business and bonus scales.

Resolution Life has declared higher Annual bonus rates (an increase of 0.3%-0.4%) from the rates declared last year. This means policies will receive higher annual bonuses as a proportion of Sum Insured and existing Annual bonuses compared to last year. Annual bonuses will be credited to policies on their next policy anniversary. Once credited, it is a permanent (guaranteed) addition to their policy (unless bonuses are cashed, or the policy is altered).

The End/Terminal bonuses shown on Annual Statements represent the End/Terminal bonuses that would be received if a claim or maturity benefit was paid on the date the Annual Statement was produced. Unlike Annual bonuses, End/Terminal bonuses are not guaranteed.

Resolution Life are declaring unchanged End/Terminal bonus rates (effective from either 1 April or 1 May). While End/Terminal bonus rates are unchanged, with the additional Annual bonuses credited to policies since the previous year, the End/Terminal bonuses shown on Annual Statements will be higher than the previous year.

Withdrawal benefits will also typically increase with the additional Annual bonuses and unchanged End/Terminal bonus rates. Withdrawal benefits for policies are shown on policyholders’ Annual Statements.

Please note: End/Terminal bonuses are not guaranteed which means that End/Terminal bonus rates can be increased or decreased at any time.

The bonus rate flyers are available on resolutionlife.com.au/resolution-life-conventional-products.

The investment performance of the assets supporting these policies is an important factor in the levels of bonuses that can be declared. As market values fluctuate over time, we analyse investment performance since the last bonus declaration and update bonus rates to reflect the impacts of changes to investment markets and expected future earnings rates. Bonus rates are reviewed throughout the year, although changes normally occur from 1 April (former-NMLA) and 1 May (former-AMP Life).

When setting Annual bonus rates, Resolution Life considers both past returns and estimates of future investment returns, with the aim of declaring sustainable bonus rates over the longer term. Traditionally, movements in Annual bonus rates have trended directionally with historical movements in long-term bond yields. Long-term bond yields influence our expectations for future investment returns and impact the amounts we need to set aside to ensure we can meet our contractual obligations to our policyholders. Over 2022, medium-to-long-term government bond yields in Australia increased substantially (by more than 2%), supporting increases to Annual bonus rates.

End/Terminal bonuses are a way of passing on a greater level of capital appreciation, usually from growth-oriented assets such as equities (shares) and property. While there is some smoothing of returns, End/Terminal bonuses more closely reflect actual investment returns and, as such, can be more volatile than Annual bonuses.

2022 was a turbulent year for financial markets, with concerns around rising inflation in particular impacting valuations. Against this backdrop, portfolio returns for the year from growth-type assets ended largely flat, with negative returns on equities (shares) largely offset by positive returns on property and infrastructure assets.

We aim to set Annual and End/Terminal bonus rates that are supportable and fair to our policyholders over the lifetimes of their policies. Accordingly, we are declaring increases to Annual bonus rates (an additional 0.3% - 0.4%) and unchanged End/Terminal bonus rates relative to the rates declared last year.

The bonuses for a customer’s policy are shown on their Annual Statement.

Annual bonuses are credited on each policy anniversary as guaranteed additions to the sum insured and previously accrued Annual bonuses. End/Terminal bonuses for former-AMP Life policies are based on accrued Annual bonuses and End/Terminal bonuses for former-NMLA policies are based on sum insured, accrued Annual bonuses and the number of years the policy is in force.

Annual and End/Terminal bonuses are only payable in full on claim or maturity.

Like interest on a bank account, Annual bonuses accumulate and compound over time. Annual bonuses that are yet to accrue are not guaranteed.

End/Terminal bonuses reflect the investment returns not already added as Annual bonuses and are not guaranteed. The risk that a fall in market values reduces or even erases past capital appreciation means that we cannot guarantee payment of End/Terminal bonuses in the future and End/Terminal bonus rates can rise and fall.

The amount that would be payable now on any policy is called the ‘Withdrawal benefit’.

Each Annual bonus added usually increases the Withdrawal benefit. If a policyholder does not wish to continue with their policy, a partial End/Terminal bonus may also be payable as part of the Withdrawal benefit, but this is not guaranteed. Consequently, where the End/Terminal bonus rates increase the Withdrawal benefit may increase. Conversely, reducing the End/Terminal bonus rates can result in Withdrawal benefits being lower.

As the full value of the sum insured and bonuses are only payable in full when the sum insured becomes payable (usually on claim or maturity), this means that the Withdrawal benefit for a policy is generally less than the amount received upon claim or maturity.

If bonus rates remain unchanged and premiums are paid on time as scheduled, Withdrawal benefits will typically increase as policies age.

Please call us on 133 731 or email askus@resolutionlife.com.au for more information.

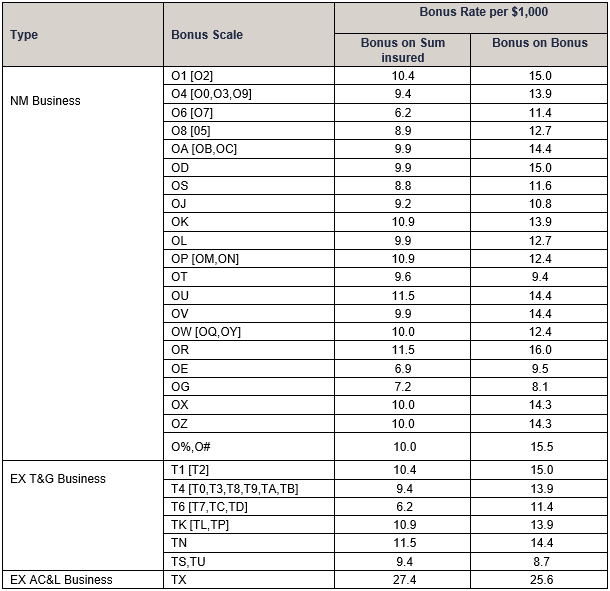

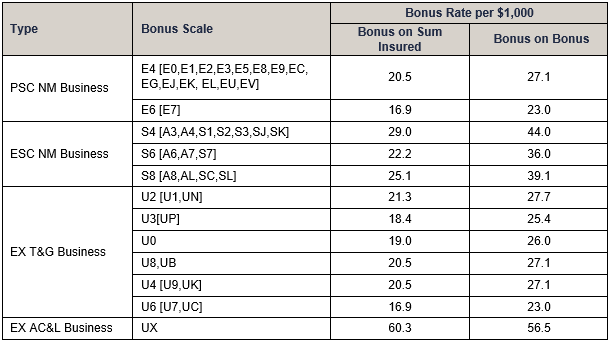

The following tables provide the Annual and End bonus rates applicable from 1 April 2023 for the former-NMLA whole of life and endowment policies for various types of business and bonus scales.

Annual bonus rates: Australia Ordinary business

Additional notes

Annual bonus rates: Australia Superannuation business

Additional notes

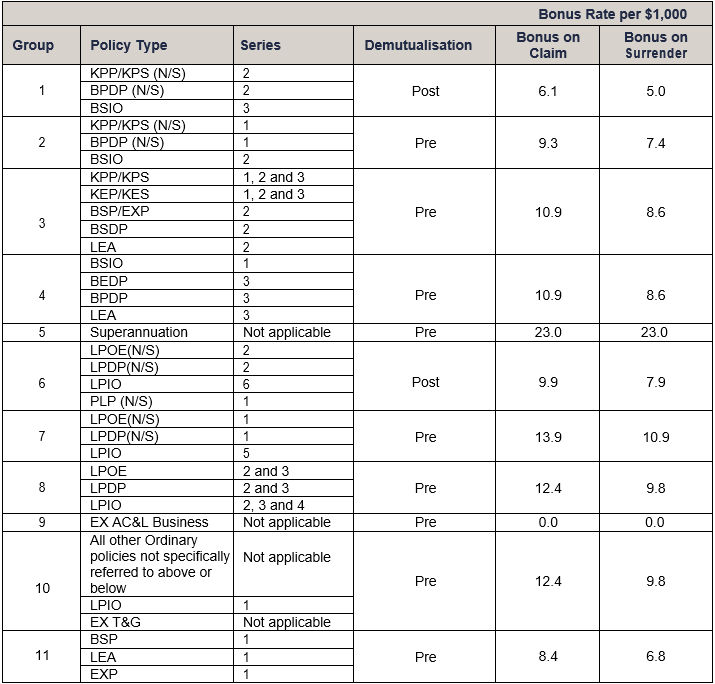

End bonus rates

Additional notes

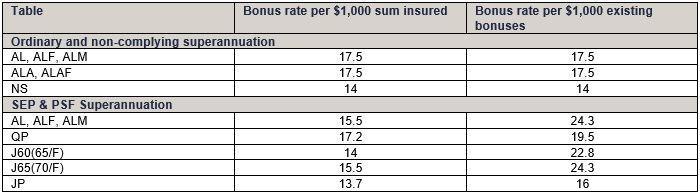

The following tables provide the Annual and Terminal bonus rates applicable from 1 May 2023 for the main bonus scales for the former-AMP Life whole of life and endowment policies.

Annual bonus rates

Note: only the main tables are shown.

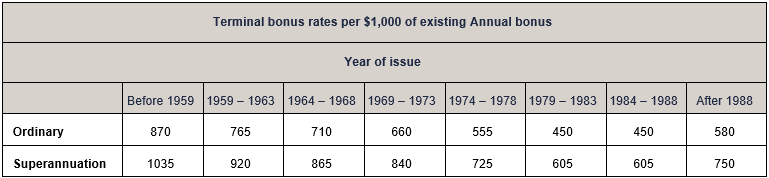

Terminal bonus rates paid on claims from 1 May 2023

How to read the table

Example – a policy under the class of business Superannuation commenced in 1956 will have a Terminal bonus rate of $1035 per $1,000 (103.5%) of existing Annual bonuses. Accrued Annual bonuses can be found on the customer’s annual statement.

Notes

We’ve recently made updates to how your staff members can access My Resolution Life. These updates add an extra layer of security for your staff members when they log in to My Resolution Life.

We have detailed instructions in our newly launched My Resolution Life help centre.

We’re gradually expanding this help centre with more instructions on other features of the portal, so bookmark the page to easily access it in the future.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.