We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

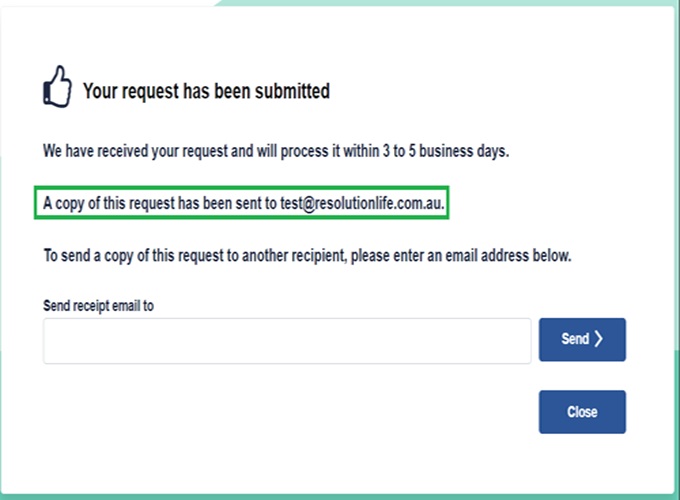

We have made the process of providing us with an Authority to release information, called Third Party Authority (TPA), easier using our new webform available here. This allows you to access information about your customer’s account/s quickly and securely (excluding SMSF and company owned accounts/policies) by providing us with their details in our form.

Follow these steps to complete this request.

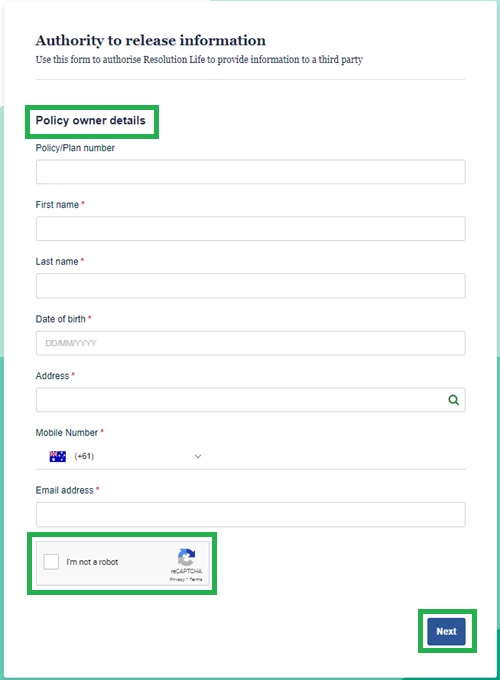

1.) Provide Resolution Life with your customer’s details ensuring that all fields marked with an asterisk have been filled in.

2.) Select ‘reCAPTCHA’

3.) Select ‘Next’

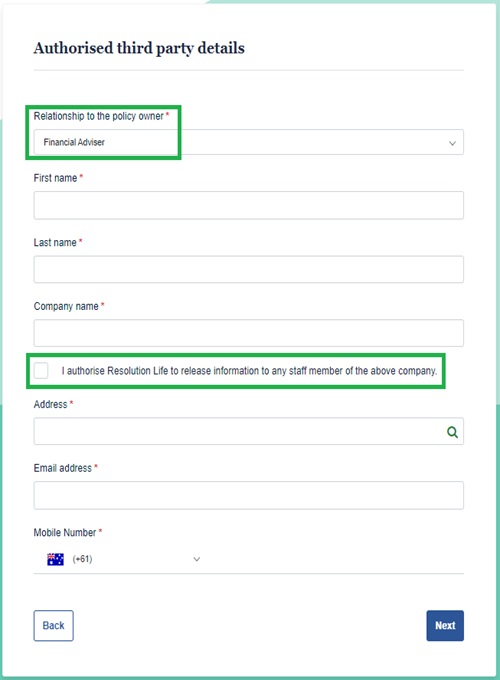

4.) Select Financial Adviser option from drop down

5.) Select 'Next'

6.) Provide Resolution Life with your details. If support staff will be assisting with this customer, do ensure you tick the box for I authorise Resolution Life to release information to any staff member of the above company.

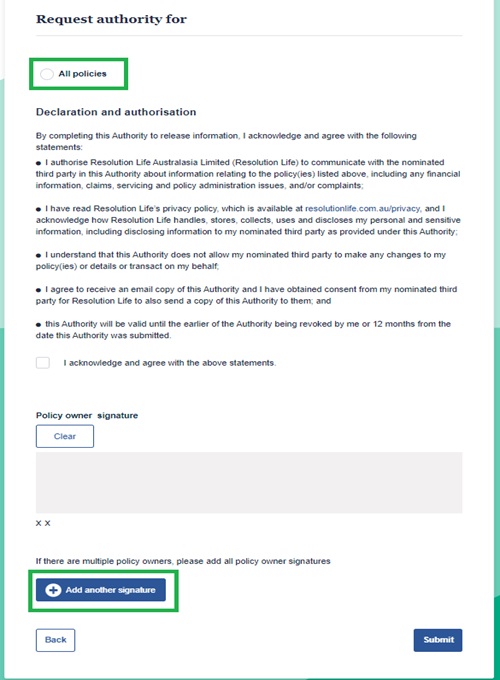

7.) Select if authority is valid for all policies or only for the one provided

8.) It is important to ensure that your customer has read the Declaration and authorisation statement prior to selecting the disclaimer checkbox. This ensures the customer is fully informed and aware of the information they are providing

9.) Your customer will need to digitally sign this request. If there is more than 1 owner, the Add another signature tab will be selected to allow them to also sign this request.

10.) Select ‘Done’

11.) Select ‘Submit

Important things to note:

We are pleased to announce that the my Resolution Life portal has been enhanced over the last 6 weeks with a range of new features.

These include:

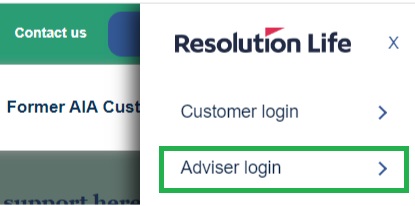

We are pleased to inform you that, following your feedback, we have resolved the issue with the My Resolution Life portal link from the public website. This means that when you click on the link, you will now be directed to the Adviser/Licensee Login page, instead of the Customer Login page.

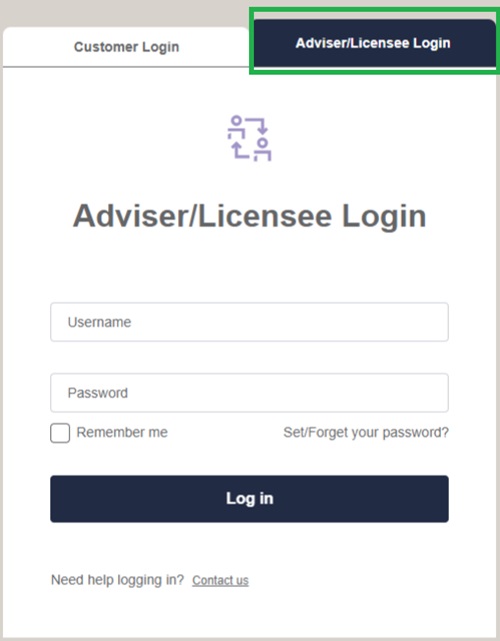

If you are still having difficulties with registering to the Adviser portal, the following steps may be of assistance.

1.) Navigate to the Adviser login tab

2.) Click ‘Set/Forget your password?’

3.) Enter your username

4.) Follow the instructions and change your password

5.) Click ‘Update’

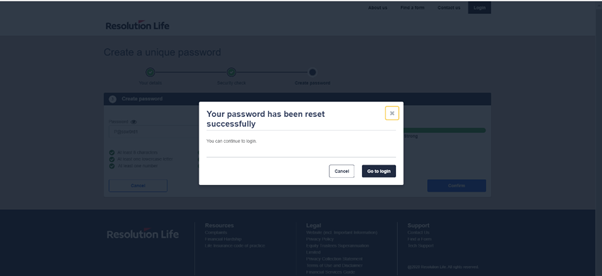

6.) A pop up will appear advising that ‘Your password has been reset successfully’.

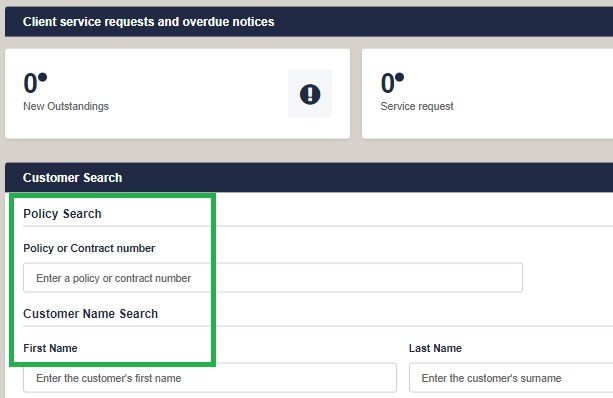

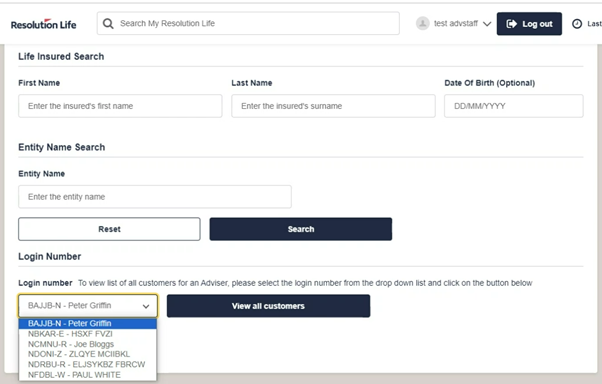

The my Resolution Life portal now offers you the ability to search for their records using either their first name, last name, or an exact match by using their first and last name or their date of birth.

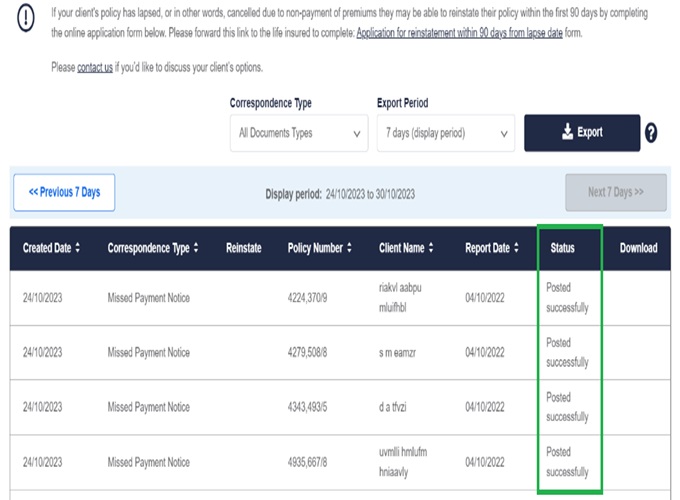

The Overdue Notices have been updated, making it easier to check the delivery status of the customer’s notice. i.e. to confirm if the notice was successfully delivered to the customer. If the delivery status is unsuccessful then the customer has not received the notice and needs to be made aware that they have an outstanding payment and their address details needs to be updated.

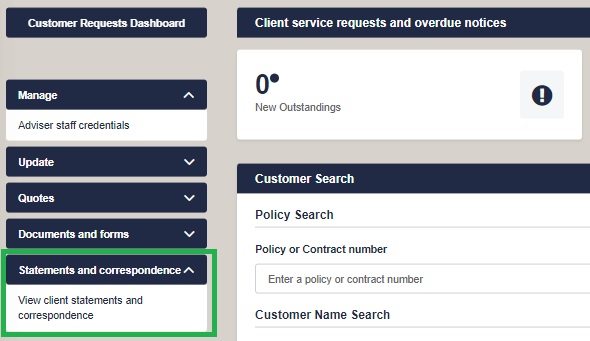

You now have the ability to view documents for closed policies,. This enhancement to self service capabilities is accessible from the main dashboard, in the left side menu titled ‘Statements and Correspondence’. Here, you can retrieve documents for a single policy, including for closed policies. Note: the adviser needs to manually enter the policy number.

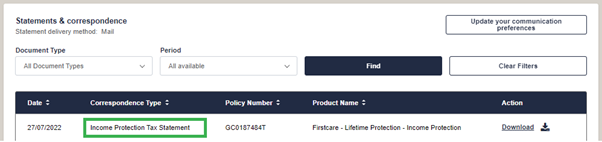

We have recently updated the correspondence type tab to include the naming convention of Income Tax statements. This should make it easier to identify and download the relevant document when required.

Talisman Products now have the correct full insured benefit displayed on the My Resolution Life portal. If you have any questions or concerns regarding this, please don't hesitate to reach out to us through the Online enquiry form.

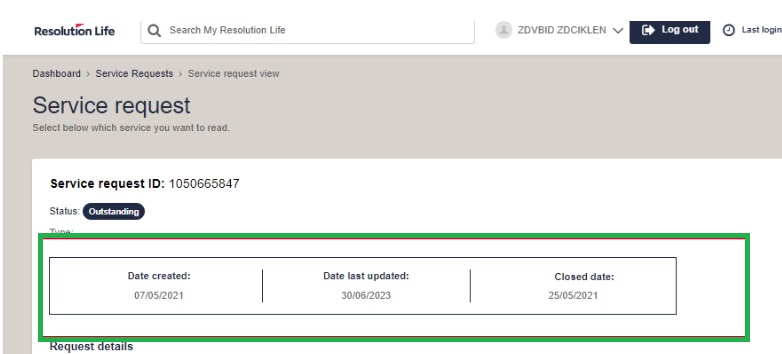

We have removed the Estimated completion date from the Service request, as these dates were not accurate.

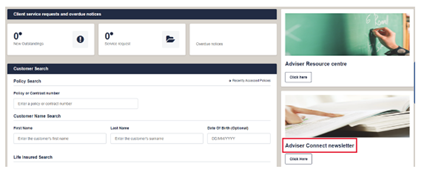

This is the new view:

We are pleased to announce that the adviser portal now displays both your adviser sales ID and your name. This provides a more user-friendly experience for you and allows you and your staff to easily identify adviser jobs when logging in.

To make it easier for you to stay up to date on the latest news and business updates, we have added a link to the Adviser Connect homepage on the right-hand side of the portal dashboard. This link provides direct access to past newsletters, allowing you to quickly and easily catch up on the latest news and business updates. You can use this link to stay up to date on the most recent information.

Did you know that Resolution Life offer a market leading and award-winning Investment Growth Bond (‘Bond’)? The Bond is a versatile tool that’s designed to provide a myriad of benefits, that can cater to a wide range of customers.

In this article, we’ll show you how this product may benefit those customers looking to invest on behalf of their children or grandchildren.

Investment bonds, also called insurance bonds are a tax-paid product that suits a wide range of needs and different situations. Investment bonds combine features of a managed fund and a life insurance policy, with the added benefit of the investment bond provider paying 30 per cent tax on any earnings in the bond rather than an individual paying tax on earnings at their marginal tax rate.

Like a managed fund, customers can select from single-sector and multi-sector investment options that invest in assets such as shares, fixed income, property and cash.

Investment bonds are easy to establish and if the client has satisfied the 125% rule (where each year’s contributions do not exceed 125% of the previous year’s contributions) and held the investment for 10 years (‘10 year period’), any withdrawals made will not attract personal income tax or capital gains tax. In addition, the ownership of the investment can also be transferred at any time without capital gains tax implications. There is also no obligation to withdraw after the 10 year period.

One of the important features of the Bond are our guarantees, which add an extra layer of security for your clients and their loved ones.

Investment Option Guarantees are available on four of our nine investment options and are designed to provide certainty around the minimum value of a customer’s holding in an investment option. This makes the Bond an excellent option for those customers looking to invest on behalf of their children or grandchildren, providing exposure to growth assets along with security in their investment portfolio.

Death Benefit Guarantees are another compelling aspect of the Bond, which provide certainty on the minimum amount that will be paid on death of the last surviving life insured.

If your clients are looking for an investment product to save for their children or grand children’s future, this product caters for them. Children as young as 10 can invest with parental consent and an adult can establish a Child Advancement Policy on behalf of a child under the age of 16. The Bond can then transfer to the child at a nominated age, up to 25 years.

Flexibility is a crucial factor for many customers, and the Bond allows switches between investment options at any time, without incurring fees or attracting personal capital gains tax. This flexibility enables your clients to adapt to changing financial circumstances, market conditions, or their evolving investment goals seamlessly.

To deter adults from investing in children’s names to minimise tax, high tax rates apply (up to 66 percent) on children’s unearned income from investments and family trust distributions.

For the Bond, earnings in the life company are taxed at a maximum rate of 30%. So additionally, if the adult is in a tax bracket above 30 per cent, it may be more tax effective to invest specifically in our Bond (owned by the adult investor) as potential tax offset entitlements may reduce some tax liabilities from other income.

Investing on behalf of children is a significant aspect of financial planning for many families. The Bond offers four options when investing on behalf of a child:

1.) Adult as the owner and child as the life insured: in this scenario, the adult is the policy owner, while the child is the life insured. At a time determined by the adult, ownership can be transferred to the child for no consideration (i.e. as a gift), without any tax consequences, while also retaining the tax paid status.

2.) Adult as the life insured and policy owner and child as the beneficiary: here, the adult is both the policy owner and the life insured, with the child (or children) as the nominated beneficiary. Should the policy owner die, the Bond proceeds would be paid to the nominated beneficiary tax free.

3.) Investing as a Family Trust: for those who prefer the structure and benefits of a family trust, this is an option. The family trust can be the policy owner, and the children can be the lives insured.

4.) Child Advancement Policy: are designed for anyone, such as a parent, grandparent, other family member or friend, who would like to invest for a child’s future financial needs and are subject to specific rules. One popular feature is that the client can nominate the vesting age (the age at which ownership automatically transfers to the child), which can be set at any age between 10 and 25 years of age.

The Bond has won the AFA Investment Bond of the Year award 15 years running, from 2008 through to 2022. We’re also proud winners of the 2022 AFA Investment Bond Excellence Award.

There are additional features and information included in the attached paper. You’ll find more information on tax treatments, contribution rules, minimum initial investments and options specific to investing for children.

Contact your dedicated Retirement Business Development Manager who can answer your questions or provide additional information for you.

For new business enquiries, please contact Simon and Vijay directly, or visit the website at resolutionlife.com.au/aia/igb

|

|

|

NSW/ACT/SA/WA/NT Simon Felice |

QLD/VIC/TAS Vijay Mathew |

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.