We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

Our new Head of Relationship Management

Stacey joins Resolution Life in her new role as Head of Relationship Management, with a wealth of experience in sales, leadership and client engagement across the financial services sector. Most recently, she was the Head of Advice Sales at Midwinter Financial Services where she led the team, focusing on developing and implementing end-to-end software solutions for advice businesses, licensees and super funds.

Stacey is passionate about building strong, long-term partnerships and providing clients with tailored, innovative solutions to meet their evolving needs.

In her new role, Stacey will be responsible for overseeing relationship management strategies, driving growth through strategic partnerships, and delivering high-quality service to advice practices.

Outside of work, Stacey enjoys camping with her family and attending local a trivia night whenever possible.

If you would like to connect with Stacey, please contact her on +61 420 767 447 or via email at Stacey.nankivell@resolutionlife.com.au.

Our new Strategic Partnership Manager

Danica (Dani) joins Resolution Life from AIA where she was the Senior Relationship Manager within the Group Corporate sector, where she supported global brokers and international firms with their suite of insurances, as part of their Employee Benefit program.

Dani has extensive experience with leading financial institutions and has a deep understanding of the advice and life insurance sectors. This combined with Dani's unique blend of passion and approachability makes her a valuable addition to the Resolution Life team.

In her new role, Dani will leverage her skills to develop and strengthen our relationships with advisers and clients, ensuring their ongoing success with Resolution Life products and services.

Outside of this, Dani has a young family who enjoy coffee (babycinos) and croissants (almond) and long afternoons at the beach.

If you would like to connect with Dani, please contact her on +61 414 596 008 or via email at danica.nadalin@resolutionlife.com.au

As a leading in-force insurer, Resolution Life is continually trying to find new ways to support our advisers and customers, by providing product solutions as well as practical digital tools to make it easier for you to service your clients and meet their wealth protection needs.

In response to this, we are upgrading the existing Elevate suite of covers. This will:

• Ensure the Elevate covers remain market competitive and provide a suitable product solution for those customers without Income Protection cover

• Satisfy the affordability concerns of our customers, while continuing to meet their wealth protection needs

This is a demonstration of our commitment to both customers and advisers, by investing in contemporary product solutions, as well as delivering the tools and resources you need to easily manage your client relationships.

The Elevate suite of covers are being enhanced to include a NEW cover, known as Income Insurance Essentials Plan. Other key enhancements include:

• New Premium and Cover Pause Benefit

• New binding (non-lapsing) nominations (for superannuation arrangements where ETSL is the Trustee. Lapsing binding nominations will no longer be provided)

• Updated stepped and level premium labels (new policies only)

• New Trauma conditions and updates to existing definitions

• Increasing the entry age for Life Insurance Plans and decreasing entry age for Income Insurance Senior Plan

When the upgraded Income Insurance Essentials Plan is launched on 16 December 2024, the current Elevate Income Insurance Plan, Income Insurance SMSF Plan, Income Insurance Superannuation Plan and PremierLink Income Protection Plan option will be closed to new applications.

No new policies will be issued for these plans – this includes customers who already have these plans and want to do a cancel and replace to change ownership of the policy.

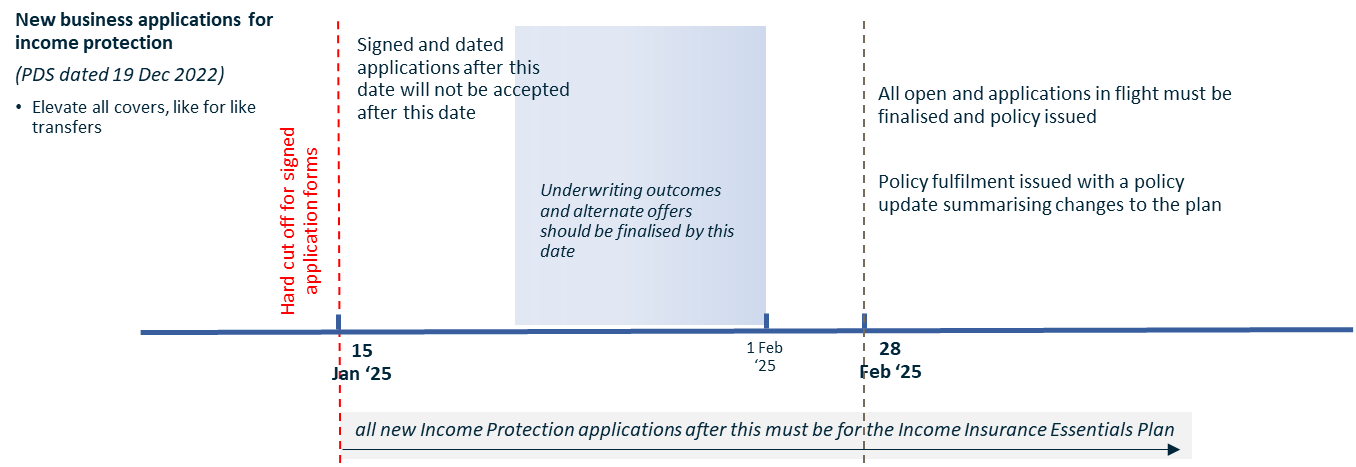

We will continue to accept inflight applications written under the PDS dated 19 December 2022 up until 15 January 2025. Any application submitted after this date must be written under the new PDS dated 16 December 2024.

| New business cut off dates [applicable to like for like transfers and for any continuation options] |  |

| New business policy fulfilment | Applications submitted with the PDS dated 19 December 2022 will be fulfilled with the new PDS dated 16 December 2024. We will inform those customers who applied under previous PDS but complete after 16th December 2024 in follow up communication explaining the product improvements. |

| Reopen old applications (U/W) | No old applications will be reopened after 1 February 2025, to allow sufficient time to allow time to communicate underwriting outcomes and/ or alternate offers to be accepted. |

| Binding nominations (ETSL only) | All nomination forms received after 30 November will be processed as ‘binding non lapsing’ regardless of the form completed/ requested. Customer who have completed the binding lapsing nomination form will be contacted to advise we are unable to proceed with their requests and will be asked to confirm they are happy to proceed with their nomination as binding non-lapsing. Commencing from 30 November, the ‘lapsing’ reminder and expiry notices will contain the ‘non-lapsing’ forms to reduce the number of ‘lapsing’ requests received after this date. |

| Elevate Online Quotes (EOL) | From 16 December 2024, a new Elevate On-line version will replace the existing version and have the new premium rates for the Income Insurance Essentials offer. There are no changes to premium rates for any lump sum covers. The previous version of EOL will no longer be available from 13 December 2024. Download any quotes required for applications well before this date. All unsaved quotes will be deleted as part of the implementation of the new version. |

In conjunction with the launch of the new Elevate insurance covers on 16 December 2024, the Elevate Online tool will be updated to reflect the new product enhancements. Further information on specific changes will be provided closer to launch date.

Along with the updates relating to the product enhancements, we will also be moving our quoting tool to a new in-house platform. As a result, any existing quotes and draft applications currently accessible in EOL will no longer be available from Friday 13 December 2024. Please ensure you download and save PDF copies of any quotes or draft applications you will require after this date to your personal drives.

Customer communications

Customers will be advised that improvements have been made to their Elevate Insurance policy in their next renewal notice. Details of these changes will also be available on the Resolution Life product updates webpage from the 16 December.

In conjunction with Elevate upgrade becoming available 16 December 2024, the following new collateral will be released: New PDS and TMDs, new underwriting guide, new application form, new personal statement form, new product summary flyers.

We will provide additional updates, either via direct communications, the monthly Adviser newsletter, or through your Adviser Support Managers and Partnership managers.

We will also be launching a dedicated online Adviser Hub, where you will be able to find all the information, online tools and support you need that relates to the upgraded Elevate Insurance This will be available to access at launch.

At Resolution Life we’re excited to announce that we have successfully onboarded all remaining ex-AIA transferred customers into My Resolution Life portal.

As part of our commitment to supporting you and your customers, for the first time, you and your customers now have online access to both Guaranteed Annuities Lifestream Guaranteed Income and Investment Growth Bonds (IGB).

Guaranteed Annuities and IGB

✔ Online access is being offered for the first time. You can now view your customers:

• Account balance

• Investment options

• Address and beneficiary details

• Payments and transactions and

• Statements and correspondence just to name a few.

Guaranteed Annuities

✔ Ability to complete MyQuote online for new annuities, with new features including:

• You can now save, download and email the quote and

• Provide income projections for your customers.

✔ As an adviser, you can complete the application form entirely online (MyApply) with features such as:

• Pre-emptive search fields

• Completion of tax residency status online

• Complete identity and verification checks online

• Digitally sign the application form and

• You can now submit the application electronically via email or post the application to Resolution Life.

Please note

• Self-managed super funds and companies are not eligible for portal access.

• Historical documentation will not be available within portal

To help you navigate My Resolution Life portal, visit our Help Centre for assistance.

From late November, we’ll be sending an SMS to customers 7 days before they are direct debited, if their payment frequency is quarterly, half-yearly and yearly. Sometimes customers may lapse due to missed payments, so this SMS will remind customers that:

• their policy payment is due soon, and

• they can call us to discuss their policy and payment options.

Customers will be sent an SMS if they:

• hold any of these products:

o Elevate Insurance

o Owner/Driver Income Protection

o Resolution Life Insurance

o Risk Protection Package

• have a premium payment due in the next 7 days, and

• pay yearly, half-yearly or quarterly.

Please note that customers won’t be contacted if they:

• have a monthly or fortnightly direct debit arrangement.

• have made a partial payment

• pay through other methods i.e. via a partial rollover from an external superfund

• have an expired benefit

• are on claim and premiums are waived.

For customers that have a direct debit arrangement with us:

We hope this will be a useful reminder for customers to help manage their policy payments on time.

For help, your clients can:

• Read more on flexible policy and payment options

• Make payments online or

• Call us to discuss their policy and payment options.

At Resolution Life, we're committed to continuously enhancing the adviser experience. Over the coming weeks, we’ll be simplifying our IVR options for you. By reducing the number of options available, we’re aiming to make it quicker for you to speak with someone.

Previously, the following products had dedicated options on the IVR menu:

• Guaranteed Super Account (GSA) and

• Retirement Security Plan (RSP)

After the change, these products will be managed by our Super and Investments team. To speak with them please call 133 731 and follow the prompts.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.