We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

We are pleased to announce the following updates:

• Resolution Life website:

A product update was released, effective March 2024, advising that Resolution Life has changed the name, underlying manager, asset allocations, objectives and strategies for some of our investment options.

The unit price page has been updated to reflect the updated investment option names.

• My Resolution Life portal:

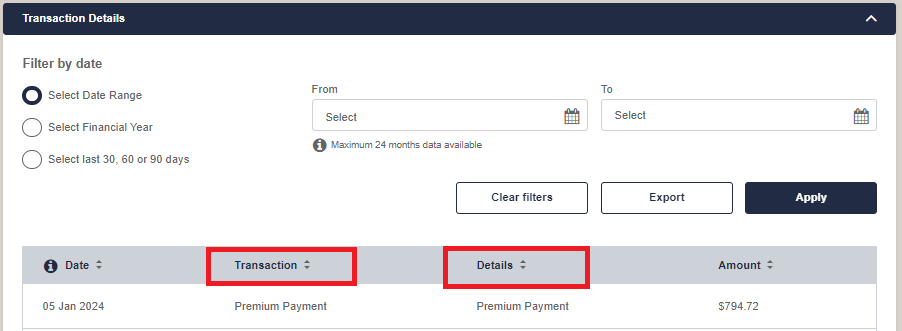

The Transaction Details in Customer view have been improved to provide more comprehensive information about the transaction type noted in your clients account with Resolution Life.

• Email communications:

Effective 18 July 2024, when emails are sent to your clients advising:

• Unsuccessful reinstatements and

• Continuation options,

you as the adviser will also receive a copy of this email correspondence.

At Resolution Life, we’re committed to improving how your clients interact with us. As part of our ongoing transformation journey, we are excited to introduce a new digital form that complements our existing suite.

This form offers a convenient alternative to paper forms, making it easier than ever for your clients to manage their direct debit agreements.

Key features:

• Streamlined process: the new form simplifies the setup and updates the existing direct debit agreements. Clients can complete the process efficiently, saving time and effort.

• Easy access: for your clients who either can’t or prefer not to register for My Resolution Life.

• Digital validation and messaging: the form validates your clients’ BSB number and delivers relevant messaging aligned with your direct debit service agreement.

• End-to-end digital experience: this enhancement eliminates the need for hard copy printing and sending us paper copies of the form, offering a seamless digital journey from start to finish.

Important note:

This form can only be used to debit money out of your client bank account or your credit/debit card.

The form adapts based on your clients entered policy number.

If you have any questions or need further clarification, you can chat with us directly via the chat function in the bottom right-hand side of the screen.

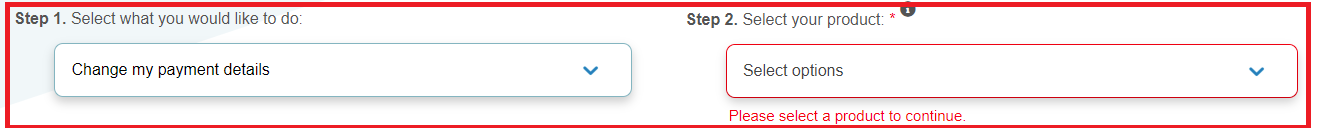

This form can be easily accessed via Find a form, by using the search criteria of Change my payment details and your product name.

The form type will appear as the Digital version.

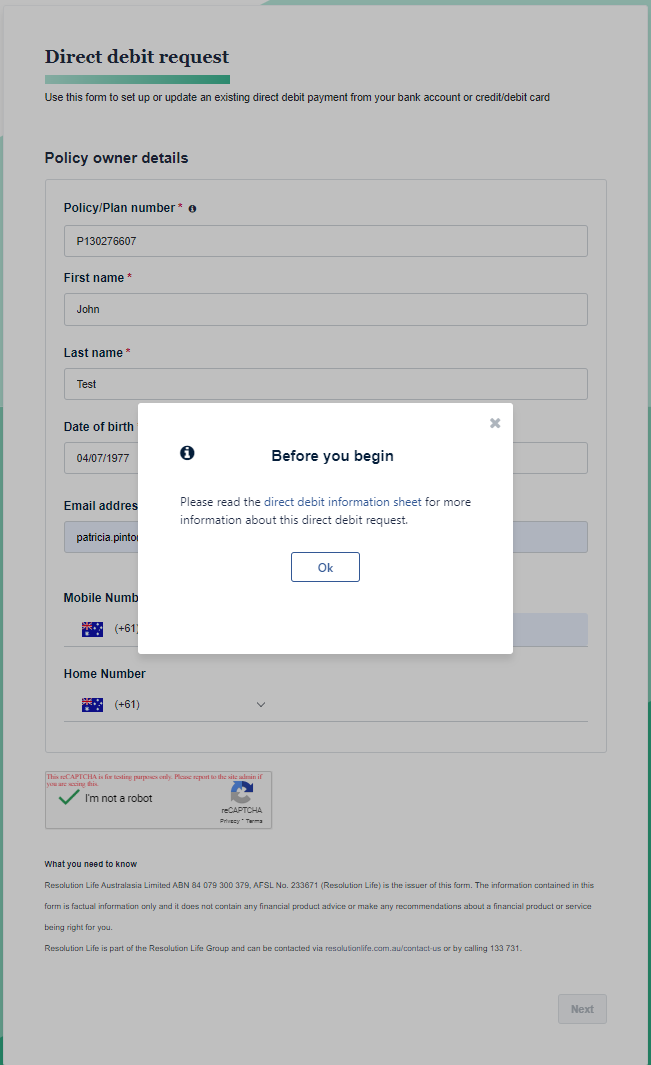

1. Complete all Policy owner fields:

A pop up will appear, providing your client with the direct debit service agreement which is relevant to their product.

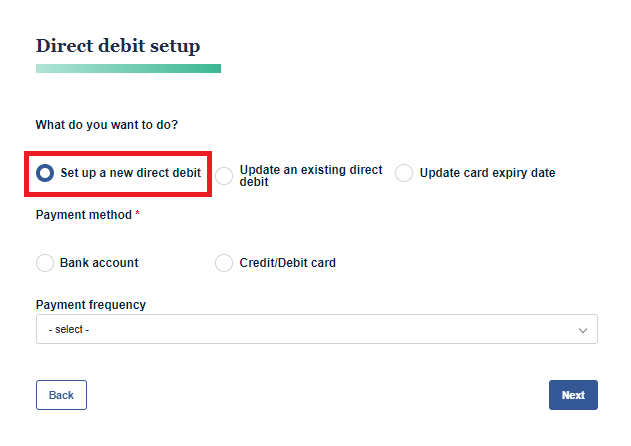

2. To set up a new direct debit:

• Choose Set up a new direct debit.

• Select the payment method.

• Specify the payment frequency.

• For superannuation or investment policies, please provide the start date for the direct debit and payment amount.

• Your clients BSB number is digitally validated when entered.

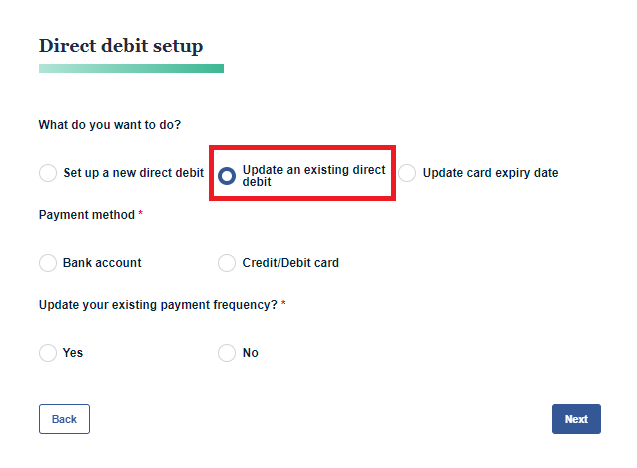

3. To update an existing direct debit:

• Select Update an existing direct debit.

• Choose the payment method.

• Change the payment frequency (if needed).

• For superannuation or investment payments, please provide the payment amount to be debited.

• Your clients BSB number is digitally validated when entered.

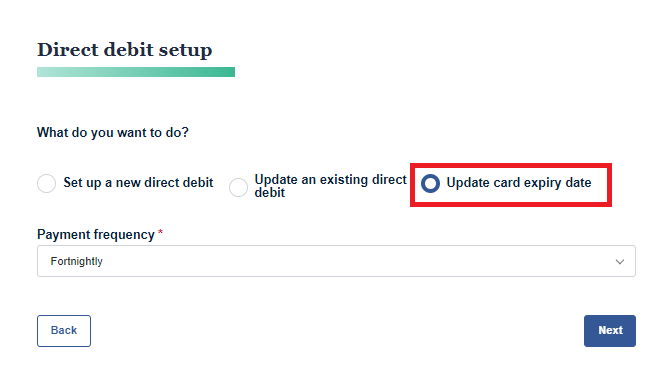

4. Updating debit/credit card expiry:

• Select Update card expiry date.

• This option is only available for policies that already have an existing credit/debit card set up.

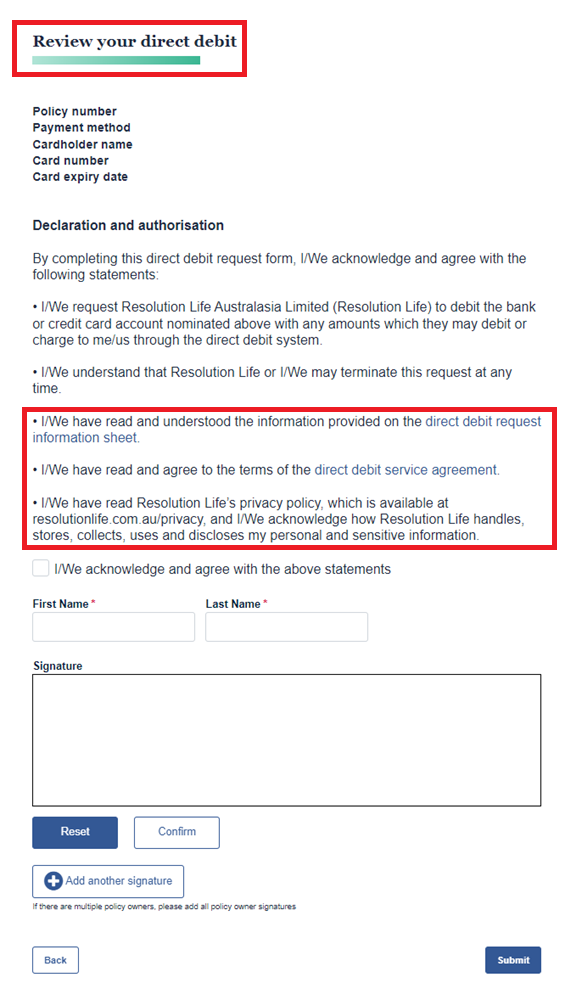

5. Confirmation:

• Ensure that your client has reviewed the Review your direct debit page to ensure that their details are correct.

• It is important that your client has read the declaration and ticked the acknowledgment box.

• If there are multiple account holders, select Add another signature.

• Once all the details are confirmed, please Submit.

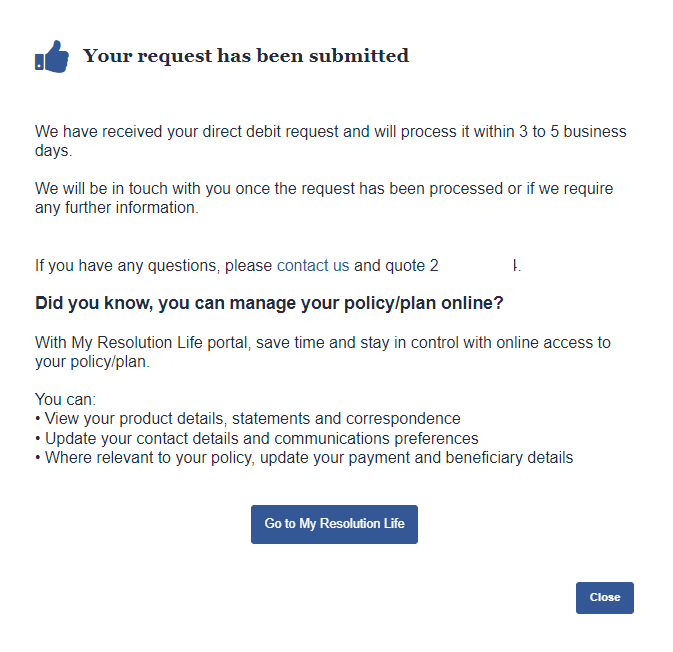

6. Confirmation receipt:

• If an email address was supplied, then an email confirmation will be sent to your client.

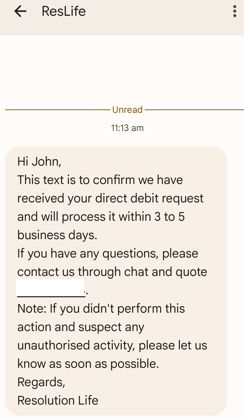

• If a mobile number was supplied, then a text message will be sent to your client from ResLife.

• If no email address or mobile number is provided, then confirmation will not be sent out to your client, but the request will be recorded against their policy with us.

• Your clients request will be processed within 3-5 business days.

Attached is a more detailed step-by-step user guide for the Digital direct debit form.

• Accelerator Personal Superannuation Plan

• Accelerator Savings Plan

• Children's Endowment and Whole of Life

• Children's Investment Linked Insurance Bond

• CrisisCare Insurance

• Elevate Insurance

• Endowment

• Endowment NMLA

• Firstcare - Lifetime Protection

• Flexible Security Plan

• Flexipol Plan

• Flexipol Superannuation

• Goldline Personal Superannuation Plan

• Goldline Savings and Protection Plan

• Insurance

• Investment Account Regular Premium Plan

• Investment Account Regular Premium Super Plan

• Investment Linked Children's Plan

• Investment Linked Insurance Bond

• Investment Linked Personal Superannuation Bond

• Investment Linked Plan

• Investment Linked Superannuation Plan

• Loan Cover

• Personal Superannuation Plan

• Provider Personal Retirement Plan

• Provider Protection and Savings Plan

• Provider Top Up Retirement Plan

• Resolution Life Growth Bond

• Retirement Bond

• Retirement Security Plan

• Risk Protection Plan

• RLA Personal Super Plan

• Term Insurance

• Term Life Insurance

• Whole of Life

• Whole of Life NMLA

• Yearly Renewable Term Plan

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.