We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

This month we have made the following update to the My Resolution Life portal.

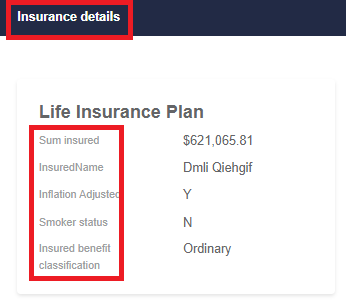

The Insurance details tab in the portal has been updated. You are now able to view your client’s risk benefits in one place.

To view this change, please search for the customer policy and access Customer View in My Resolution Life.

With the recent change to the My Resolution Life Privacy Policy, the Notice of Intent to claim online form has had the wording relating to the Privacy Policy updated. Your client will also need to tick the new checkbox.

By doing this, your clients will be confirming that they “provide express consent for Resolution Life to collect, store and share personal including sensitive information according to Resolution Life’s Privacy Policy. Further information can be found at Privacy – Resolution Life.”

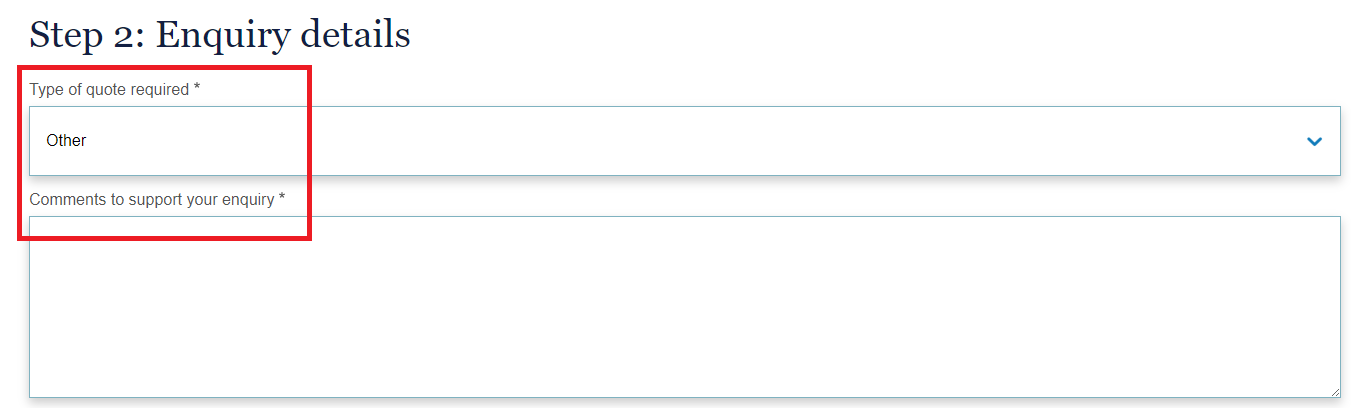

If your client has an existing Elevate Insurance Plan or a Firstcare-Lifetime Protection Plan (formally Flexible Lifetime Protection (FLP)), you can update your client’s occupation rating by using the Online Quotes enquiry form.

There are 2 steps that need to be followed:

1. Complete Step 1

2. In Step 2 select Other in Type of quote required

3. In Comments to support your enquiry, copy and answer the below questions with the appropriate answers into this field:

Update client occupation details for your client (all questions need to be answered)

a. What is your occupation title?

b. What industry do you work in?

c. How long have you been working in your current role?

d. Do you hold any professional/trade qualifications? If yes, please give details including the type of qualification and the name of the institution where the qualification was obtained.

e. In your main occupation, what percentage of time do you spend performing the following types of duties:

f. Describe details of specific duties performed:

i. Sedentary/Administrative: %

ii. Supervising manual work: %

iii. Light manual: %

iv. Heavy manual: %

v. Home duties (please include details of dependants including ages and any other relevant information): %

vi. Other (including hazardous duties, e.g. handling dangerous substances, working at heights/underground/offshore or refinery): %

Total duties = 100%

g. Do you have any other occupations or jobs?

a. If yes, please provide details including job title, duties, number of hours per week worked and annual income derived from your other occupations or jobs.

h. For proposed upgrades to AA rating only – please advise your annual income for the past 2 financial years.

i. Do you work in the mining industry?

a. If yes, please provide details:

i. Soft rock or hard rock?

ii. Do you work underground?

iii. Are you involved with the use of explosives?

4. Once these questions have been answered, just press submit.

5. Generally, you will receive this quote within 1-2 business days, but it may take longer if the quote is complex.

To finalise this request, your client will need to:

It’s important to remember that this request needs to be submitted to Resolution Life within 30 days of the date of the letter.

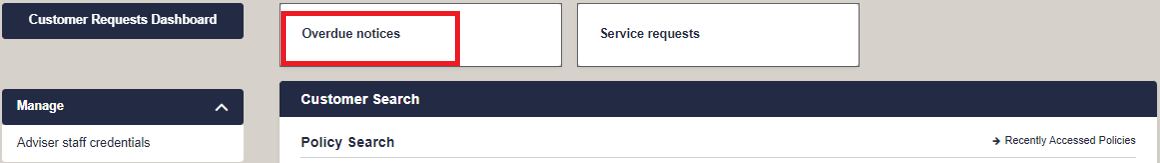

You recently received an email from us regarding the Overdue notices report, that is available within My Resolution Life.

This report has been created to help you manage your client’s insurance portfolio and assists you in identifying opportunities to service your clients who have:

When you log in to My Resolution Life, select Overdue notices tab on your dashboard.

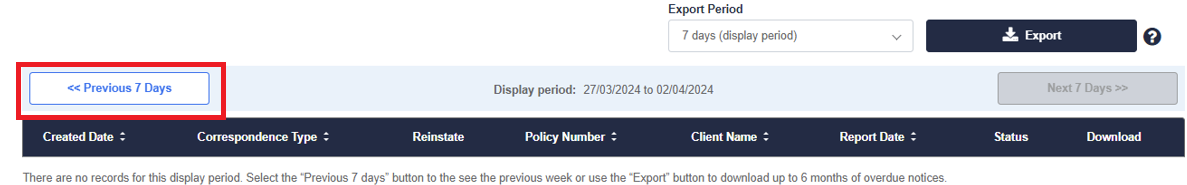

Please note that a report is created for a period of 7 days at a time. If you cannot view the report when you log in, please select the Previous 7 day report option.

The potential timing for a policy's cancellation depends on the type of payment your client makes to Resolution Life. You can view all relevant correspondence through the Customer view, accessible under Statements & Correspondence which is located on the left-hand side of the screen. The nature of the communications sent depends on the Communication Method your client has chosen. Every time correspondence is added to their profile, your client will be listed in the Overdue Notices report.

The timing of this correspondence may vary depending on the type of product they hold with us, however as a general example:

For policy's paid via Direct Debit:

For Direct payments to Resolution Life:

Over the coming weeks, you will start receiving regular emails from Resolution Life advising you of clients who have missed a payment, are at risk of lapsing or who have lapsed. You’ll only receive an email if your client(s) meets these criteria.

If you are having issues with accessing this report, start an online chat with us via the portal.

As part of a customer’s Whole of Life or Endowment (Conventional) policy, customers are entitled to receive profits earned on the value of the assets in the portfolio in the form of a bonus.

There are two types of bonuses available:

1. Annual bonus

2. End/Terminal bonus.

We are declaring higher Annual bonus rates for Super and Ordinary (non-Super) policies relative to the rates declared last year. These Annual bonus rates will apply on policy anniversary from 1 April 2024 for former-NMLA policies and from 1 May 2024 for former-AMP Life policies. The Annual bonus rates declared are 0.2% higher than those declared last year for former-AMP Life policies and 0.3% higher for former-NMLA policies.

For most policies, we are declaring unchanged End/Terminal bonus rates from 1 April 2024 (former-NMLA policies) and from 1 May 2024 (former-AMP Life policies) from the rates declared last year. For a small number of former-NMLA Super policies, we are declaring higher End/Terminal bonus rates relative to last year.

The Annual Statement will show the impact of this bonus declaration on the customer’s policy.

The bonus rate appendix for this article sets out Annual and End/Terminal bonus rates applicable for the different types of business and bonus scales.

Resolution Life has declared higher Annual bonus rates (an increase of 0.2%-0.3%) from the rates declared last year. This means policies will receive higher annual bonuses as a proportion of Sum Insured and existing Annual bonuses compared to last year. Annual bonuses will be credited to policies on their next policy anniversary. Once credited, it is a permanent (guaranteed) addition to their policy (unless bonuses are cashed, or the policy is altered).

The End/Terminal bonuses shown on Annual Statements represent the End/Terminal bonuses that would be received if a claim or maturity benefit was paid on the date the Annual Statement was produced. Unlike Annual bonuses, End/Terminal bonuses are not guaranteed.

For most policies, Resolution Life are declaring unchanged End/Terminal bonus rates effective from either 1 April or 1 May (there are some increases for a small number of former-NMLA Super policies). While End/Terminal bonus rates are unchanged for most policies, with the additional Annual bonuses credited to policies since the previous year, the End/Terminal bonuses shown on Annual Statements will be higher than the previous year.

Withdrawal benefits will also typically increase with the additional Annual bonuses and generally unchanged End/Terminal bonus rates. Withdrawal benefits for policies are shown on policyholders’ Annual Statements.

Please note: End/Terminal bonuses are not guaranteed which means that End/Terminal bonus rates can be increased or decreased at any time.

The bonus rate flyers are available on here.

The investment performance of the assets supporting these policies is an important factor in the levels of bonuses that can be declared. As market values fluctuate over time, we analyse investment performance since the last bonus declaration and update bonus rates to reflect the impacts of changes to investment markets and expected future earnings rates. Bonus rates are reviewed throughout the year, although changes normally occur from 1 April (former-NMLA) and 1 May (former-AMP Life).

When setting Annual bonus rates, Resolution Life considers both past returns and estimates of future investment returns, with the aim of declaring sustainable bonus rates over the longer term. Traditionally, movements in Annual bonus rates have trended directionally with historical movements in long-term bond yields. Long-term bond yields influence our expectations for future investment returns and impact the amounts we need to set aside to ensure we can meet our contractual obligations to our policyholders. While fluctuating during 2023, medium-to-long-term bond yields in Australia ended the year at largely similar levels to the start and remain considerably higher than the levels seen during the recent years of low interest rates.

End/Terminal bonuses are a way of passing on a greater level of capital appreciation, usually from growth-oriented assets such as equities (shares) and property. While there is some smoothing of returns, End/Terminal bonuses more closely reflect actual investment returns and, as such, can be more volatile than Annual bonuses.

Investment markets rallied late in 2023, with portfolio returns ending the year strongly to finish largely in line with expectations. Returns from growth-type assets were driven in particular by strong returns on overseas equities (shares), supplementing losses/lower returns from property and infrastructure assets.

We aim to set Annual and End/Terminal bonus rates that are supportable and fair to our policyholders over the lifetimes of their policies. Accordingly, we are declaring increases to Annual bonus rates (an additional 0.2% - 0.3%) and unchanged End/Terminal bonus rates for most policies relative to the rates declared last year (some increases for a small number of former-NMLA Super policies).

The bonuses for a customer’s policy are shown on their Annual Statement.

Annual bonuses are credited on each policy anniversary as guaranteed additions to the sum insured and previously accrued Annual bonuses. End/Terminal bonuses for former-AMP Life policies are based on accrued Annual bonuses and End/Terminal bonuses for former-NMLA policies are based on sum insured, accrued Annual bonuses and the number of years the policy is in force.

Annual and End/Terminal bonuses are only payable in full on claim or maturity.

Like interest on a bank account, Annual bonuses accumulate and compound over time. Annual bonuses that are yet to accrue are not guaranteed.

End/Terminal bonuses reflect the investment returns not already added as Annual bonuses and are not guaranteed. The risk that a fall in market values reduces or even erases past capital appreciation means that we cannot guarantee payment of End/Terminal bonuses in the future and End/Terminal bonus rates can rise and fall.

The amount that would be payable now on any policy is called the ‘Withdrawal benefit’.

Each Annual bonus added usually increases the Withdrawal benefit. If a policyholder does not wish to continue with their policy, a partial End/Terminal bonus may also be payable as part of the Withdrawal benefit, but this is not guaranteed. Consequently, where the End/Terminal bonus rates increase the Withdrawal benefit may increase. Conversely, reducing the End/Terminal bonus rates can result in Withdrawal benefits being lower.

As the full value of the sum insured and bonuses are only payable in full when the sum insured becomes payable (usually on claim or maturity), this means that the Withdrawal benefit for a policy is generally less than the amount received upon claim or maturity.

If bonus rates remain unchanged and premiums are paid on time as scheduled, Withdrawal benefits will typically increase as policies age.

Please call us on 133 731 or email askus@resolutionlife.com.au for more information.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.