We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

As a leading in-force life insurance specialist, Resolution Life is continually finding new ways to support our advisers and clients. To demonstrate our commitment, we’re providing product solutions as well as practical digital tools, to make it easier for you to service your clients and meet their wealth protection needs, now and into the future.

We are upgrading Elevate, our on-sale Insurance product, which offers a full suite of wealth protection covers. We do accept new applications for Elevate for existing Resolution Life customers.

Ensuring Elevate continues to provide the most appropriate cover for your clients, means providing product features and benefits that consider premium affordability and allow flexibility to adapt a policy to meet the changing needs of your clients. Built with long term product sustainability in mind, our upgraded Elevate product suite is designed to balance those affordability and flexibility considerations.

Here’s how Elevate could make a real difference in your clients' lives:

• A new Income Insurance Essentials Plan, offering a contemporary income protection solution for clients who are a Resolution Life customer and don’t have income protection in place or have income protection, but wanting a more affordable solution.

• A new Premium and Cover Pause Benefit for all cover types, that allows clients to suspend their cover and premium for up to 12 months.

• Binding non-lapsing nomination for the Life Insurance Superannuation Plan. This replaces the current binding lapsing nomination and will reduce both adviser and client ongoing administration requirements and workload.

• New trauma conditions and updates to existing definitions.

• Reduced entry age to 60 for the Income Insurance Senior Plan, a simple income protection cover product for clients working longer and wanting to maintain cover until age 70.

• Increased maximum entry age to 75 for life cover, making it easier for your clients to transfer from legacy life cover policies into Elevate.

• Updated stepped and level premium labels, for new policies only.

Now that the new Income Insurance Essentials Plan has launched, the current Income Insurance Plan, Income Insurance Plus Plan, Income Insurance Premier Plan, Income Insurance SMSF Plan and Income Insurance Superannuation Plan will be closed to new applications.

No new policies will be issued for these ‘old’ plans (this includes clients who already have these plans and want to do a cancel and replace, to change ownership of the policy).

We will continue to accept and process inflight applications for these plans written under the PDS dated 19 December 2022 up until 15 January 2025. Any application submitted after this date must be under the new PDS, dated 16 December 2024.

Please note: Under the Income Insurance Essentials Plan, there are a limited number of options for Benefit Period and Waiting Period. For clients changing ownership or exercising continuation options, they may be unable to access the same Benefit Period or Waiting Period on the new policy.

For example, the age 65 benefit period is no longer available, meaning a 5-year benefit period will be the longest option available.

It is also important to note that as the new Income Insurance Essentials Plan has been developed in line with the APRA guidelines, with the available replacement ratio at 70% of income, which may mean a customer transferring into the product will be eligible for a lower monthly benefit.

Customers will be advised that product enhancements have been made to their Elevate Insurance policy in their next renewal notice. Details of these changes will also be available on the Resolution Life website from 16 December 2024 Product updates - Resolution Life.

In conjunction with Elevate upgrade becoming available 16 December 2024, the following new collateral will be released:

• New PDS and TMDs

• New underwriting guide

• New application form

• New personal statement form

• New product summary flyers

All this, as well as additional product information and comparisons, resources and online tools are available via a dedicated online Adviser Hub.

Since April, we’ve been sending regular weekly emails advising you of clients who have missed payments, and are at risk of lapsing or who have lapsed.

From early 2025, you’ll receive:

• an updated email that includes:

o a summary table showing the number of missed payment, pre-lapse and lapse notifications sent to customers and the value of annual premium at risk

o the number of customers that received Renewal notifications.

• this email is only sent if one or more of your clients received one of the relevant notifications that week.

New optimised email sample (107 kB)

We’re committed to supporting you and your clients with products and services that meet your needs. You can

• Learn more about the existing report

• Read more on flexible policy and payment options

• Make payments online.

If you have any issues with this email or report, or want to discuss client payment options, please chat with us online or contact your adviser support team.

Following a strategic review, we’re making changes to the objective and strategy of the investment option and to the product’s fees and costs, effective 1 February 2025. We’re making these changes with the aim of improving returns for members through higher crediting rates, while maintaining their low volatility and the capital guarantee that the rates will never be negative.

There will be changes to the investment strategy and fees and costs. The strategy changes include increased allocations to “growth” asset classes such as equities and property.

A revised investment objective, reductions to fees and an increase in Resolution Life’s share of the life policy participating profit allocation, are set out in the table below.

Before 1 February 2025 | From 1 February 2025 | |||

Investment objective & strategy | To provide returns over the longer term exceeding those from cash, with security of capital. Resolution Life guarantees returns will not be negative. The investment strategy for the GSA is to invest in a group superannuation policy that has limited exposure to growth assets, such as equities/shares and property. Changes to investment allocations, including the use of derivatives, can be made according to the outlook for the various investment sectors and the nature of the investment. | To provide returns (after investment fees, costs and superannuation tax) exceeding inflation over the longer term, but with lower volatility of returns than would be expected of an investment option with the same exposure to fixed interest, cash, shares and property. The investment strategy is to invest in a diversified portfolio with a core of fixed interest and cash, and with exposure to shares and property, to enhance returns. Changes to investment allocations, including the use of derivatives, can be made according to the outlook for the various investment sectors and the nature of the investment. This is a crediting rate option. Assurance: members are protected from capital losses – Resolution Life guarantees that crediting rates will not be negative. | ||

Additional information | Participating policies are administered in accordance with the Life Insurance Act 1995 and the Insurance Contracts Act 1984. Under these Acts, an annual profit is determined for each class of participating policies, and these are shared between the policy owner and the life company (Resolution Life). At least 80% of that profit must be allocated to the participating policy owner(s). Currently for GSA, 92.5% of the annual profit is allocated to the policy owner and 7.5% is allocated to Resolution Life. | Participating policies are administered in accordance with the Life Insurance Act 1995 and the Insurance Contracts Act 1984. Under these Acts, an annual profit is determined for each class of participating policies and these are shared between the policy owner and the life company (Resolution Life). At least 80% of that profit must be allocated to the participating policy owner(s). Currently for GSA, 80% of the annual profit is allocated to the policy owner and 20% is allocated to Resolution Life. | ||

Asset Classes: | Strategic asset allocation % | Asset allocation range % | Strategic asset allocation % | Asset allocation range % |

Fixed interest and cash | 88 | 90-100 | 70 | 50-90 |

Shares and alternative investments | 8 | 0-20 | 20 | 10-30 |

Property and infrastructure | 4 | 0-10 | 10 | 0-20 |

| Fees and Costs: | ||||

| Administration fees and costs | Account Balances ($) | % pa | Account Balances ($) | % pa |

$0 - $9,999.99 | 1.15 | $0 - $9,999.99 | 1.05 | |

$10,000 - $49,999.99 | 0.73 | $10,000 - $49,999.99 | 0.63 | |

$50,000 + | 0.50 | $50,000 + | 0.40 | |

Investment fees and costs | Investment fees and costs estimated to be 0.72% pa. | Investment fees and costs estimated to be 0.69% pa. | ||

These changes mean there will be an increase in the crediting rate applied to the account balance from 1 February 2025. The crediting rate will depend on the account balance. Please note, crediting rates may increase or decrease at any time without notice but will never be negative.

Customers will see the changes reflected in GSA’s disclosure documents from 1 February 2025 as well as the Investment report and Fees & costs document. To view the current disclosure documents, select GSA from the Superannuation category at resolutionlife.com.au/performance.

GSA customers will be notified of the changes.

Every year we update the estimated indirect investment costs for each of our investment options, based on the underlying costs incurred over the last financial year. These underlying costs are deducted from the underlying assets of the investment portfolios and are reflected in the investment option's unit price or crediting rate.

When updating the estimated indirect investment costs, we make an assessment for each investment option as to whether the costs have changed significantly from the previous year. For most investment options, there have been no significant changes to the indirect investment costs. For a number of options (listed below), there has been a significant increase in the indirect investment costs over the last financial year. Customers who have been impacted by these changes will receive a letter from us shortly, providing them with more information.

| NMRF Product | Investment Option | Previous Indirect Inv Cost (% pa) | New Indirect Inv Cost (% pa) |

| MultiFund Flexible Income Plan | International Bond | 0.19% | 0.43% |

| MultiFund Flexible Income Plan | Listed Property 2 | 0.15% | 0.35% |

| MultiFund Flexible Income Plan | International Bond 2 | 0.40% | 0.76% |

| MultiFund Superannuation Bond | Listed Property 2 | 0.14% | 0.54% |

| Retirement Bond | Diversified Fixed Interest | 0.08% | 0.19% |

| Retirement Bond | International Shares | 0.01% | 0.13% |

| RLA Allocated Pension Plan | Australian Equities 3 | 0.08% | 0.23% |

| RLA Allocated Pension Plan | Wholesale Global Equity Fund | 0.00% | 0.15% |

| RLA Personal Super Plan | Diversified Fixed Interest | 0.08% | 0.19% |

| RLA Personal Super Plan | Australian Equities 3 | 0.10% | 0.24% |

| RLA Personal Super Plan | Wholesale Global Equity Fund | 0.02% | 0.16% |

| RLA Personal Super Plan | Specialist Australian Share | 0.27% | 0.42% |

For additional information on indirect investment costs, the latest fees and costs information for products and the current investment options, please visit resolutionlife.com.au/performance, select the product from the drop-down box available in the Superannuation or Retirement categories, and select the ‘Fees & costs’ and/or the ‘Investment report’ tabs.

We're committed to empowering and supporting our advisers. Over the past year, Resolution Life has made significant progress in improving service standards. By streamlining processes and investing in new technology, we've achieved faster response times and more efficient operations.

We're proud of this progress and remain committed to delivering exceptional support to you and your business. To demonstrate our transparency, we've outlined our key performance indicators and the improvements we've achieved over the past year below.

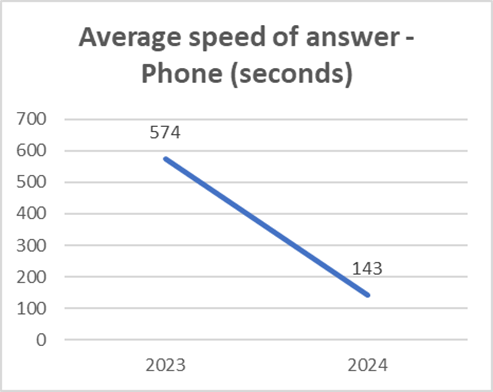

We've reduced wait times by 75% by increasing our team size and investing in their training. This means you can get the help you need faster, so you can get back to what matters most.

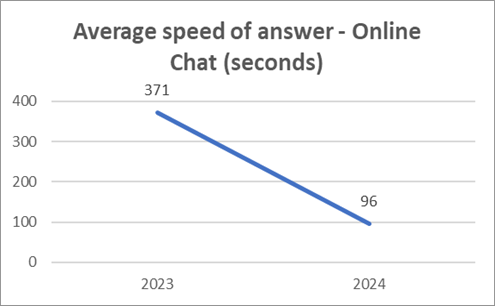

We've also significantly improved our online chat service, reducing wait times by 74%. This achievement was made possible through strategic investments in technology and the expansion of our dedicated support teams.

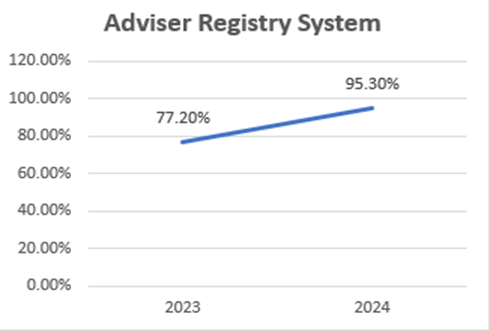

We've successfully cleared any backlogs associated with customer transfers and are now processing 95.3% of all tickets within the SLA, a 18.1% improvement.

We've also focused on improving our administration processes. By allocating additional resources and investing in our teams’ skills and training. We've significantly outperformed our 2024 targets; we’ve processed 93.7% of financial transactions within SLA. This is 8.7% above the target of 85%. This all means faster turnaround times and improved efficiency for your business.

| Year | Financial transactions |

| 2023 | 86.4% Financials (3 days) |

| 2024 | 93.7% Financials (3 days) |

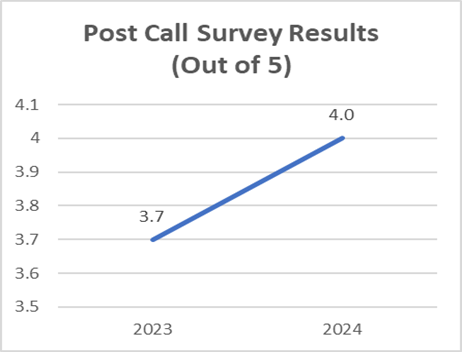

This commitment to service is reflected in our improved call survey results. We're pleased to see increased engagement from our advisers in our feedback surveys. Your feedback is invaluable in helping us shape the future of our business.

Resolution Life has identified that between 26th September and 30th October, 2024, a number of renewal notices were issued to customers in Australia and New Zealand, containing an amount which had been adjusted for inflation incorrectly.

Customers who received a renewal premium ‘without inflation’ were affected by this issue. To resolve this, we have sent impacted customers a notification addressing the inaccuracy. This letter will clarify that a recent inflation adjustment notice contained an inaccuracy in the calculated ‘without inflation’ premium. Renewal notices are sent to customers 60 days prior to any new premium being deducted. Customers who wish to know the accurate ‘without inflation’ premium can contact us directly. Attached is a sample communication sent to affected customers

Sample Elevate Renewal Letter (83 kB)

Please note customers who have received a ‘with inflation’ premium is correct. No action is required for customers who wish to proceed with the inflation adjustment.

A new PDS will be available on our website from 16 December 2024. Paper applications from the current PDS will continue to be accepted during the transitional period from 16 December - 13 January 2025, provided the application form is signed and dated prior to 16 December 2024.

As the holiday season approaches, we want to ensure a smooth experience for our advisers during this busy time. With many businesses adjusting their operating hours during the holiday period, we wanted to let you know ours, so that you can plan ahead.

At Resolution Life, we're committed to providing advisers with the support they need. Our contact centre, administration teams and click-to-chat service will be open during the holidays, as outlined below:

Dates

23rd Dec – 9am – 3pm (AEDT)

24th Dec – 9am – 3pm (AEDT)

25th Dec – Closed – Christmas

26th Dec – Closed – Boxing Day

27th Dec – Closed

30th Dec – 9am – 5pm (AEDT)

31st Dec – 9am – 5pm (AEDT)

1st Jan – Closed – New Years Day

2nd Jan – 9am – 5pm (AEDT)

3rd Jan – 9am – 5pm (AEDT)

Note: Some of our additional support initiatives to help customers manage their insurance policies will be paused between 20 December 2024 and will recommence from 6 January 2025.

You can self-serve and view your policy/plan information online. Just login to My Resolution Life Portal.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.