We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

At Resolution Life we know that our service standards aren’t what we want them to be. We appreciate your patience as we continue to invest in our systems and people to sustainably improve our service to you and your clients. We expect to continue to progressively improve each week through the actions we are taking and expect to be delivering consistently by the end of August.

We are absolutely committed to working in partnership with you to retain our joint customers.

In this month's article, we'll look at our operations backlog, call centre and registry management.

In terms of our operational back log, at the end of March 2023 we had around 3,000 hours of overdue work (backlog) across all work queues which had accumulated due to a range of separation challenges and system fixes. By early May 2023, this amount had reduced by over 30% and there remains a sharp focus on clearing this by the end of July. We have seen SLA processing time return to near target levels of 85% within 3 days (financial) and 5 days (non-financial) and we continue to increase resourcing to achieve this outcome consistently throughout Q3 and beyond.

As noted in the April newsletter, we have recently reorganised our call centre engagement specialists into tiers based on call type and complexity in order to better leverage team experience and increase the speed of our onboarding processes. This change has started to show results with our 'Simple enquiries'and ‘Complex S&I’ now achieving an average speed of answer (ASA) of 269 seconds. This is 50% of our callers. However we know that our ‘Complex Insurance’ wait times are significantly higher and unacceptable. Whilst we still have a way to go, we are seeing the change is working and the new recruits that have joined have been making an impact. We’re continuing to hire more staff into the call centre across Australia and New Zealand, with 10 additional staff joining in May and another group joining in June.

We know the backlog in our register management team is causing frustration. Additional resources have been assigned to the registry management team whilst we are implementing systems upgrades to be able to more easily process bulk transfers. We’ll provide further updates in our next newsletter.

We’re committed to providing a quality service to our advisers and customers – and everyone at Resolution Life is dedicated to this cause. We look forward to continuing to work with you and sharing our progress.

It is that time of year again – end of financial year (EOFY)! My Resolution Life portal can help you support customers through this busy period.

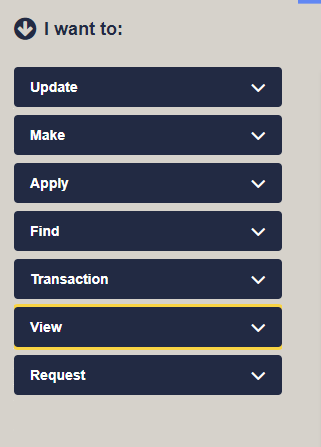

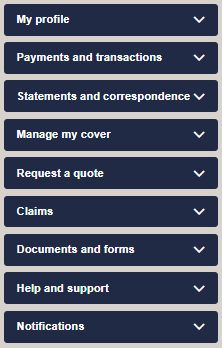

Through My Resolution Life portal, you can complete a range of EOFY activities such as:

We know you experienced delays with last year's income protection tax statements. We’re currently assessing delivery times for this year’s income protection tax statements and will keep you updated about this in the June newsletter. These will be available to download from My Resolution Life when they are sent to the customer.

If you need help with using My Resolution Life this EOFY, see our guides in the My Resolution Life help centre.

|

Date |

Action needed |

More information |

|

Early June |

No action from you or customers – customers will receive our EOFY marketing campaign. |

See We’re contacting your customers below for more information. |

|

23 June 2023 |

We encourage you to submit contribution forms and payments by this date to ensure it counts within the 2022-2023 financial year. |

It’s important to not leave this to the last minute, as most super funds can take 3-5 business days to process payments and application forms. Otherwise, the customer’s contributions will likely count towards the next financial year. |

We’re also running a marketing campaign to inform customers about EOFY and provide them with some extra educational content.

All customers who have opted in for marketing and have a valid email address with us will receive an email in early June.

You can read the educational content we’re sharing with customers below:

We’re always looking for ways to improve the customer experience with My Resolution Life, so we’ve recently made updates to the navigation menu of the My Resolution Life portal for customers.

We’ve heard feedback from customers that the original navigation menu was difficult to navigate, so we’ve simplified it and made it more intuitive. The new navigation menu should make it easier for customers to find the information they need in the portal.

| Our old menu for customers | Our new menu for customers |

|---|---|

|

|

You’ll see this new menu whenever you’re in Customer view in My Resolution Life. For information on how to access Customer view in My Resolution Life (which shows you what the customer can see when they log in to My Resolution Life), see the My Resolution Life help centre.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.