We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

We’re pleased to share that our service standards for August and the first half of September were strong across both our call centre and operations.

This year, the Resolution Life call centre created a cooperative system that classifies our engagement specialists according to call type and complexity. We established three tiers (or queues) that not only helps us manage call volumes, but also ensures that calls are sent to the right area of expertise. It also helps us to train our staff quickly and allows us to adjust engagement specialists across the service tiers when needed.

For a period of six weeks, beginning on 1 August and ending on 15 September our performance was either below or nearly at our goal average wait time of three minutes.

1 August to 15 September 2023 – Average wait time for calls - across Australasia

|

Service Tier |

Average wait time (minutes) |

|

Simple Insurance |

2 minutes and 33 seconds |

|

Complex Insurance |

3 minutes and 9 seconds |

|

Super & Investments |

3 minutes and 10 seconds |

*Combined for both advisers and customers

In addition to the making improvements to our call centre, we’ve focused on streamlining our administrative processes and implementing automation to improve our speed and capacity.

New transaction processing - During the six-week period between 1 August and 15 September, the majority of our transaction types beat the service standard (85%*) - the only exception being non-financial transactions for super & investments, but this is gradually improving.

The reported period saw a high number of transactions, with 21,917 in the insurance space and 32,240 for super & investments.

1 August to 15 September 2023 – Transaction Services Standards – across Australasia

|

Transaction Type |

Service Standards* |

|

|

Insurance |

Super & Investments |

|

|

Financial |

90% |

88% |

|

Non-financial |

91% |

78% |

*Service Standard – percentage of transaction processed within days: Financial, 3 Days; Non-financial, 5 Days.

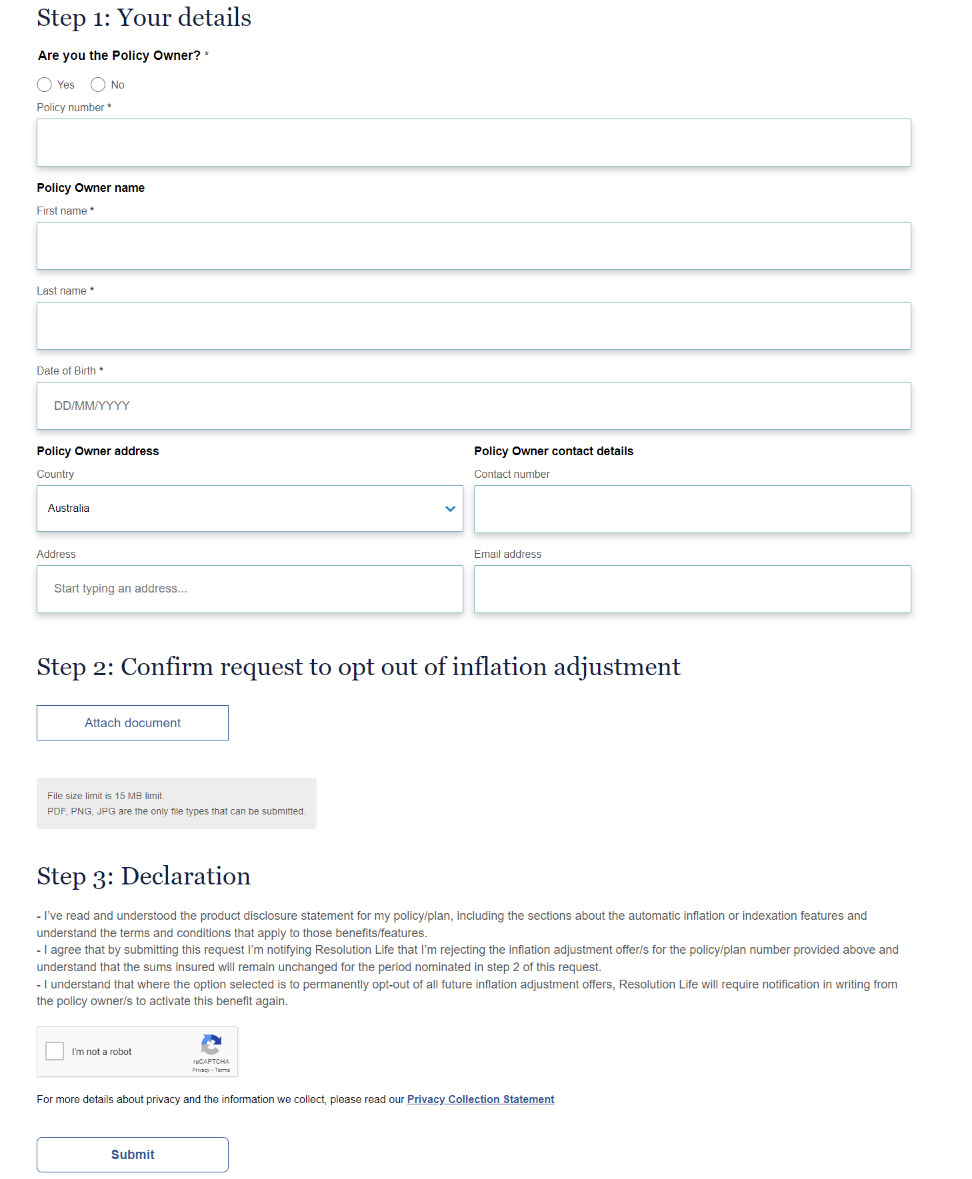

Customers now have the opportunity to opt out of inflation adjustment on their insurance related products (excluding SMSF and Company owned policies) with the launch of the Opt out of Inflation Adjustment webform. The webform is accessible outside the My Resolution Life portal using this link.

This webform gives customers the choice to opt out for one year or permanently.

To submit the request, customers should complete the form and submit. Upon submission, a confirmation screen will appear and an email confirmation will be sent to the customer.

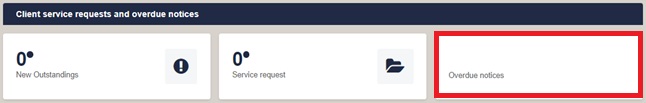

You can now access the Missed payments report, which has been renamed Overdue Notices, on My Resolution Life.

Simply log in to My Resolution Life and click on the ‘Overdue Notices’ option from your dashboard.

You will now be able to view renewal/missed payments correspondence for a single policy for a 7-day period with the ability to move between previous 7-days and next 7-days. This correspondence (document) retrieval can be used for current policies.

Your staff can access this report too. If you haven’t yet set up access for your staff, from your dashboard menu on the left of the Adviser view home screen, select the drop-down icon on Manage, then select Adviser staff credentials.

Click here for further step by step instructions on how to request access for your staff.

Save time waiting on the phone and access our premium calculator through My Resolution Life today.

We have launched a new feature in the My Resolution Life portal that will allow you to produce or submit a quote digitally on behalf of your customers that have Risk Protection Package, Elevate Insurance or Resolution Life policies via the premium calculator. You can also request a quote to decrease the cover sum insured and/or change the Income Protection (IP) waiting period and benefit for all Risk Protection Package, Elevate Insurance or Resolution Life policies that have Death, TPD, Trauma or IP for customers in Australia.

Simply follow the prompts to generate a quote for your customer. You can then submit the request to make the change to the policy online on behalf of the customer, with applicable consents.

Learn more about the premium calculator here.

1. Log in to My Resolution Life.

2. Search for the customer on the home dashboard and click on the customer from the search results to enter Customer View.

3. On the left-hand side menu, select Request a quote > Policy Alteration.

4. Click on the check box for ‘Change of Waiting period/Benefit period’ option as required.

5. You’ll be presented with the premium calculator. Simply follow the prompts to generate a quote.

Your staff can access the premium calculator by following the above steps too.

If you need guidance with the above, such as logging in, how to search for your customers and granting your staff access to the portal, visit the My Resolution Life help centre.

We hope you find this update useful in assisting customers.

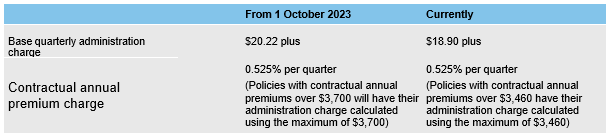

Effective 1 October 2023, the fees and charges for Goldline and Provider products have been reviewed and increased in line with movements in the Consumer Price Index (CPI).

![]()

Please contact the Mature Products team for more information.

Our annuity products are a secure investment offering a guaranteed rate of return for a fixed term of your customers choosing.

Unlike traditional investments such as shares and managed funds, annuities offer a guaranteed rate of return, which once locked in, are not affected by market and interest rate fluctuations, so they can be relied on as a regular source of income.

By diversifying a retirement income stream and including an annuity for your customers, not only is there less exposure to investment risk, but there may be tax and social security benefits, when using a combination of guaranteed annuities, account-based income streams and other income streams.

Some of the benefits our Lifestream Guaranteed Annuities offer:

To help you and your customers choose a quality annuity provider that can meet their needs, deliver a competitive rate of return and make good on their promises, it's important to consider:

Contact your dedicated Retirement Business Development Manager who can arrange this for you – this will include bonus quotes for larger investments.

Both Simon and Vijay would welcome the opportunity to help you and your customers with any annuity opportunity. If you would like more information, visit resolutionlife.com.au/aia or contact Simon and Vijay directly:

|

|

|

NSW/ACT/SA/WA/NT Simon Felice |

QLD/VIC/TAS Vijay Mathew |

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.