We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

We understand it’s been a period of economic uncertainty. And during these periods, insurance affordability may be top of mind for our customers.

We want our customers to be able adjust their policy to suit their situation when they need to. Along with online options to easily opt out of inflation adjustment, we also have our premium calculator available on My Resolution Life .

Since launch, advisers who have used the premium calculator have told us that the calculator is easy to use and a valuable tool for conversations with customers thinking about insurance affordability.

1Feature currently not available for policies renewing within the next 2 months from the quotation date.

1Feature currently not available for policies renewing within the next 2 months from the quotation date.

2Policy renewal (anniversary) date within the next 2 months from the quotation date.

We have more updates planned for the premium calculator. Keep an eye out in your inbox for our monthly Adviser Connect newsletter for future updates.

Currently, the premium calculator is available for the following (excluding premier or flexi-link policies):

We plan to expand the premium calculator across all products in the future.

1. Log in to My Resolution Life. Haven’t used My Resolution Life before? Learn more here.

2. Search for the customer on the home dashboard and click on the customer from the search results to enter into Customer View.

3. On the left-hand side menu, select Request a quote, then Decrease premium calculation.

4. Simply follow the prompts to generate a quote.

For more information on how to use our premium calculator and how to enable your staff to access My Resolution Life so they can use it too, visit the My Resolution Life help centre.

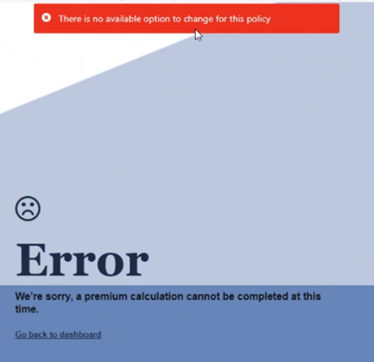

Currently, the premium calculator is only available for certain products. If you’re using the premium calculator for an ineligible policy, you may see the following error messages:

| Message | Reason for the message |

|---|---|

|

The policy is not eligible for a decrease premium. |

|

If the policy:

|

You can chat with us online by clicking Chat in the bottom right corner.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.