We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

ASIC have recently updated their life insurance claims comparison tool with the latest statistics on claims performance across the industry. We’ve undergone a transformation in our claims process over the past few years so we’re excited to share with you the results for July 2021 – June 2022.

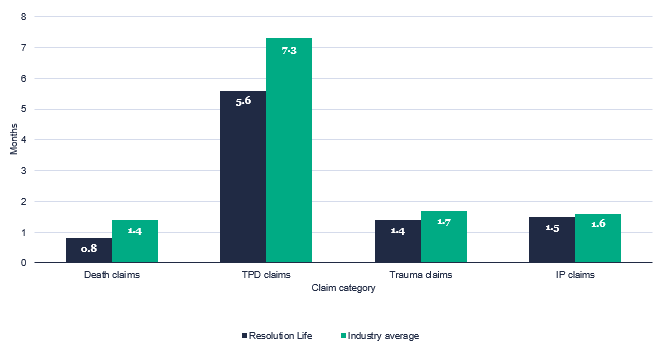

We deliver fastest speed to assessment in three of seven insurance categories

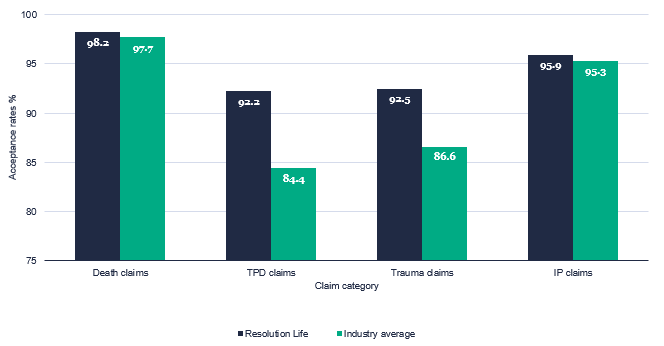

We deliver the highest acceptance rate in four of seven insurance categories

We have a faster than industry average speed to assessment in six of seven categories

We’ve shown improved or steady speed to assessment in five of the seven categories

We’ve shown improved acceptance rates in all seven categories.

Speed to assessment (retail categories)

Acceptance rates (retail categories)

Our performance over the last few years is testament to our focus on our customers and belief in continual improvements. The outcomes for the last financial year is evidence of the ongoing improvements we’ve made. We continually review our processes to deliver optimal better outcomes for customers, with faster turnarounds and fostering more supportive relationships to get customers back on their feet faster.

We’ll also continue to build on this momentum with further improvements in service delivery as more experts in claims management are created and the technology improves even further.

We’ll keep you updated in future newsletters.

You can read our 2021 claims paid brochure for more information on how we have helped our customers.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.