We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

At the start of the year, Resolution Life made a commitment to putting more focus into supporting you and our joint customers, as we acknowledged our service standards were not where they needed to be.

Throughout the year, we implemented numerous initiatives to help with this, such as:

These initiatives have helped Resolution Life finish on a positive note for the year.

We saw improvements across the board. Average speed of answer for both phone and online Chat improved. We also saw improved results for adviser registry management requests (e.g. reallocating customers across advisers) and our administration processing SLA’s. These results have contributed to our call survey results finishing on a high.

We are committed to continuing to provide you with a quality level of service.

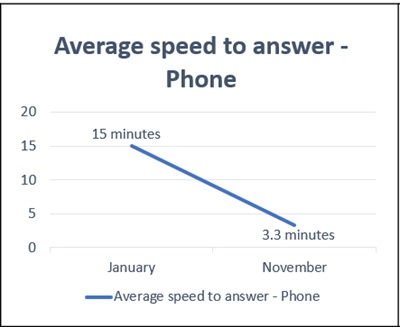

We are pleased to inform you that our call centre's average speed of answer (ASA) has decreased by 78%. This means that customers and you are able to get through quicker.

The ASA decreased from ~15 minutes in January to around 3 minutes and 3 seconds as of 30 November.

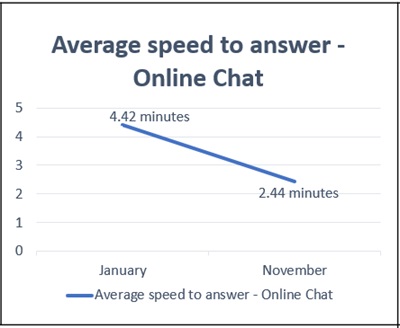

Our online Chat saw a decrease in its average speed to answer (ASA). In January, it took us an average of 4.42 minutes to respond to a query.

By 30 November, this decreased to approximately 2 minute and 44 seconds, representing an 45% decrease.

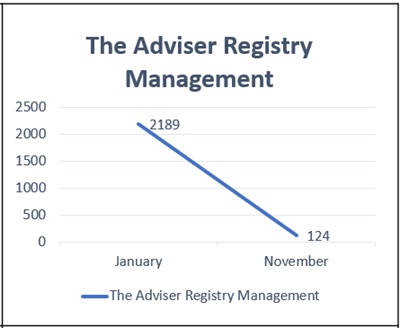

The Resolution Life Adviser Registry System was introduced last year. Although there has been a backlog in moving customers across advisers within the registry, we have been working hard to address this through automation and improved processes. In January, we had 2,189 items in progress, representing 1,890 overdue hours in effort.

As of 30 November, we have reduced the number of items in progress to 112 and have eliminated overdue hours. This represents a 94% reduction in items in progress.

In January, we processed 68% of financial transactions within 3 business days and 72% of non-financial transactions within 5 business days. Our SLA was 85% for both.

We’ve since been able to improve our service standards, and as of 30 November, we are now processing 83% of financial transactions within 3 business days and 78% of non-financial transactions within 5 business days.

| Month | Financial Transactions | Non-Financial transactions |

| January | 68% Financials (3 days) | 72% Non-Financials (5 days) |

| November | 83% Financials (3 days) | 78% Non-Financials (5 days) |

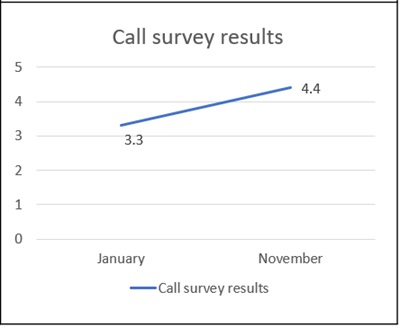

I am happy to share that our call survey results have improved since January. In January, our average score was 3.3 out of 5.

On 30 November, that score increased to 4.4 out of 5, which is a 25% increase.

In August, we consulted with a number of advisers and their support staff to gain their feedback on the My Resolution Life portal and how it could be enhanced. Their feedback was extremely useful in guiding our efforts to make the portal more user-friendly. We also sought an independent review, which confirmed that our planned enhancements are in accordance with industry best practices.

We understand the significance of having simple access to the information you need to establish strong client relationships. With this in mind, we’re dedicated to creating a portal dashboard that meets the requirements of both you and your support staff.

We’ve applied several key principles that will guide our design and development process:

We’ve been continuously improving our portal with a variety of new features, and in 2024 we plan to relaunch My Resolution Life with a refreshed look and user experience. We’ll continue to keep you informed as we roll-out new features and experience.

It certainly has been a packed-full year for My Resolution Life portal. We’re constantly striving to improve our services and customer experience and look forward to continuing to work with you in the future.

During 2023, we’ve had 32 IT releases and implemented over 100 enhancements to both the adviser and customer portals. Furthermore, we’ve made several continuous improvements to the adviser dashboard, such as the ability to quickly access key information, improved navigation and search capabilities, customisable views, and enhanced reporting.

Some of the significant portal updates are around:

How information in the portal is accessed:

Updates to how customer correspondence is accessed/used:

Easier for information entry via online forms:

Changes and new additions to the Premium Calculation tool:

For our customers we have:

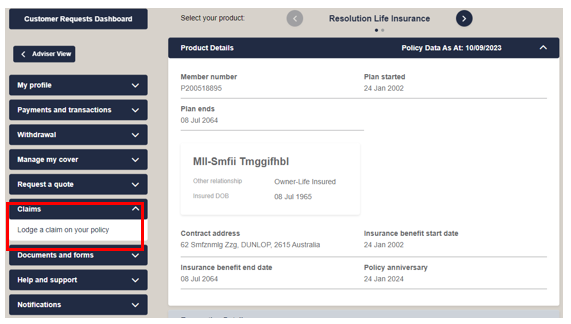

We’ve updated My Resolution Life portal to enable initial claim requests online via the customer dashboard.

After you have selected the claim, you wish to make, you'll then be guided through the 5 easy steps to complete the initial claim request.

These steps are as follows:

1. Make a claim – details of the claimant.

2. Confirm with us with the policy details are for the claim

3. Provide us with the deceased’s details

4. Confirm details on where the correspondence need to be sent to

5. Finalising claims details

Once you have submitted the initial claim request, a confirmation page will be displayed. This will also provide an immediate timeframe and a reference number for the claim. This information will also be emailed out to the initiator of the claim.

Once the initial claim request is received by our claims team, a claims pack will be sent out to your customer.

You will be able to view the details of the submitted claim in the dashboard and download if required. You will also be able to see when correspondence has been sent out to the customer via the statements and correspondence tab.

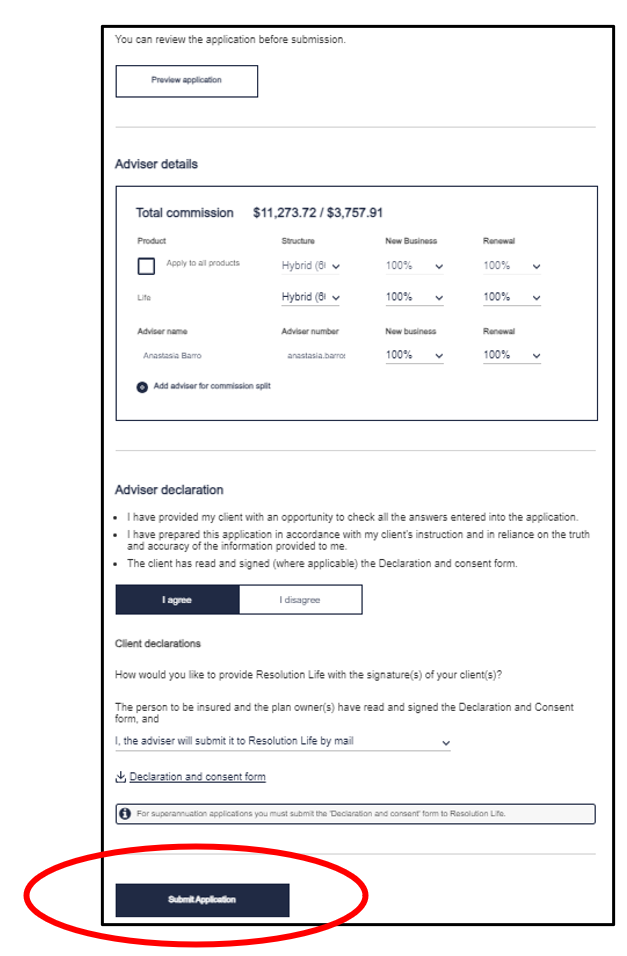

From the 13th of December 2023, you will be able to submit applications for Elevate Insurance via Elevate Online (EOL). The ‘Submit Application’ button has been enabled within the Review and submit section of EOL (as per screen shot below).

Note: The personal statement has not been enabled – so if you are submitting an application for a ‘New plan’ which requires a personal statement, you must continue to provide that to us via post or email to insurance@resolutionlife.com.au.

More information

For more information on EOL, refer to the Resolution Life Portal.

What you need to know

For Professional Financial Advisers Only – Not for distribution or disclosure to retail or wholesale clients.

Equity Trustees Superannuation Limited ABN 50 055 641 757, AFSL No. 229757, RSE Licence No. L0001458 (Trustee) as trustee of the National Mutual Retirement Fund ABN 76 746 741 299 (Fund) is the issuer of the Life Insurance Superannuation Plan, TPD Insurance Superannuation Plan and Income Insurance Superannuation Plan. Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life) is the issuer of life insurance policies to the Trustee for these products. The Trustee, as owner of the life insurance policies, will receive the applicable benefit from Resolution Life, and in turn provides the benefit to eligible Fund members. All other insurance products under Elevate Insurance are issued by Resolution Life directly.

The information contained in this document is only for professional financial advisers acting in that capacity and does not contain any financial product advice.

Resolution Life can be contacted via resolutionlife.com.au/contact-us or by calling 133 731.

Resolution Life Australasia (Resolution Life) is proud to have taken the initiative to assist our joint customers in getting the most out of their policies. We reviewed our withdrawal benefit/surrender value calculations and due to changing market conditions, were able to provide a sustainable increase to conventional surrender values, improving returns to existing customers who hold Whole of Life or Endowment policies. An additional payment was made to customers who have recently surrendered their policies, providing an enhanced return and more equitable payout figure for most of our conventional policy holders.

We began informing approximately 270,000 existing customers, across both Australia and New Zealand, from April 2023 that their gross withdrawal benefit/surrender value was increasing. To balance the equity of this change for recently surrendered customers, we wrote to approximately 19,000 customers in July, who had surrendered their policy prior to maturity (since 2020) and have made successful payments to more than 95% of ordinary policy holders and 100% of super policy holders.

This decision was made to provide better value to our customers based on past earnings and investment gains. Resolution Life was not obliged to make this increase or make an additional payment but chose to do this to benefit our customers.

For most customers that are still current with us, these changes mean that they will now have a higher gross withdrawal benefit/gross surrender value.

Feedback from our customers has been positive, as for many these additional funds were a lifesaver given the current economic climate. We are proud to have taken this initiative and hope that it will help our customers in the long run.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.