We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

Last month, you could use the insurance premium calculator to help customers looking to decrease their sum insured on standalone policies with primary benefits (TPD/Death/Trauma) only.

Since launch, we’ve focused on expanding the functionality of the tool. You can now use the insurance premium calculator for policies that have:

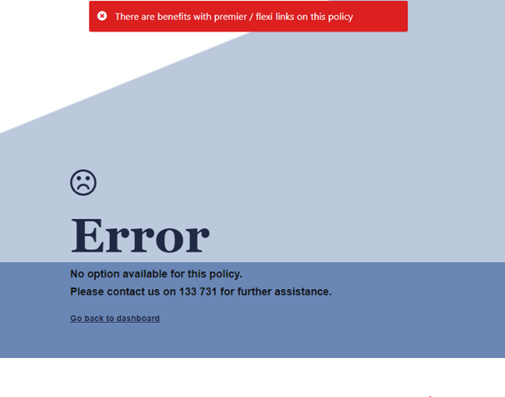

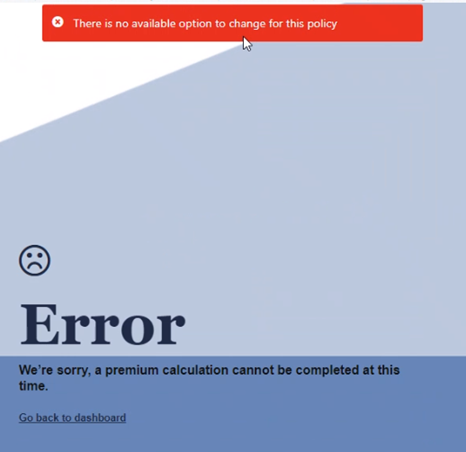

Please note if the policy does not meet the above criteria, you may see the following errors displayed.

| Message | Reason for the message |

|---|---|

| The policy is a premier or flexi-link policy. |

| The policy is not relevant for a decrease premium. |

For instructions on how to use our insurance premium calculator, see last month’s article.

We’re continuing to enhance the insurance premium calculator. We want to ensure it is a tool that you can use across different policies and help you keep fully informed about the changes the customer wants to make to their policy.

You can expect the following updates to the insurance premium calculator in the coming months:

We’ll keep you updated on the above through future editions of the adviser newsletter.

If you have any feedback you’d like to share about your experience with the current features of the insurance premium calculator, please reach out to your Relationship Manager.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.