We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

We reported in our July issue of Adviser Connect that we had made progress during the second quarter of this year, and with planned adjustments during July, we anticipated moving our service standards to where we want them to be.

We’re pleased to share that our service standards for August are looking strong across both our call centre and operations.

This year, our call centre initiated a collaborative framework to coordinate our engagement specialists based on call type and complexity. This approach not only enhances our ability to handle call and chat volumes but also ensures that calls are routed to the appropriate knowledge base.

In July, we moved some of our up-skilled staff from the Simple Insurance tier (or queue) to bolster the support provided to complex insurance and super & investments queries. This has improved our call wait times - for the first two weeks of August, our performance was below or close to our target average wait time of 3 minutes.

August 2023 (first two weeks) – Average wait time for calls - across Australasia

|

Service Tier |

Average wait time (minutes) |

|

Simple Insurance |

2 minutes and 12 seconds |

|

Complex Insurance |

3 minutes and 33 seconds |

|

Super & Investments |

2 minutes and 30 seconds |

*Combined for both advisers and customers

In addition to the making improvements to our call centre, we’ve focused on streamlining our administrative processes and implementing automation to improve our speed and capacity.

Transaction Backlog - August saw us clear our insurance transactions backlog. We’ve reduced the backlog for super & investments by 65% since the start of 2023 and are on track to clear it by the end of the quarter.

New transaction processing - We’re happy to report that we met our service standard (85%*) for most transaction types during the first two weeks of August. The only exception was non-financial transactions for super & investments – but that’s improving, and we should reach our target during this quarter.

August 2023 (first two weeks) – Transaction Services Standards – across Australasia

|

Transaction Type |

Service Standards* |

|

|

Insurance |

Super & Investments |

|

|

Financial |

86% |

86% |

|

Non-financial |

86% |

74% |

*Service Standard – percentage of transaction processed within days: Financial, 3 Days; Non-financial, 5 Days.

As you know, on 1 July 2023, Resolution Life Australasia Limited (Resolution Life) began its next phase of strategic growth when it acquired AIA Australia Limited's (AIAA) Superannuation and Investment life insurance business.

Information for former AIAA policyholders and advisers is now available at resolutionlife.com.au/aia.

From 1 July 2023, the Lifestream Guaranteed Income Annuities and Investment Growth Bond are issued by Resolution Life and are now available for you and your customers.

Providing specialist retirement and investment support to you, we’d like to introduce you to our Retirement Business Development Managers:

Find out more about our products online, and if you’d like to access our weekly Annuity rates information, please go to our website, click on the ‘view this week’s annuity rates’ link and bookmark the link for easy future access.

Both Simon and Vijay would welcome the opportunity to meet and discuss any opportunity in relation to these products. If you would like more information, please reach out via the website at resolutionlife.com.au/aia or contact Simon and Vijay directly:

|

|

|

NSW/ACT/SA/WA/NT Simon Felice |

QLD/VIC/TAS Vijay Mathew |

We’ve rounded up the latest changes we’ve made to My Resolution Life below.

Some of the changes below will require you to search for the customer policy and access Customer View in My Resolution Life. If you need help with searching for your customers, visit the My Resolution Life help centre.

|

What’s different? |

Where will you or customers see this in My Resolution Life? |

|

When you or customers update their address, the following fields must now be completed before hitting submit:

This ensures we have all the details we need from you or customers to efficiently update the address on record.

|

To update the customer’s address: 1. Login to My Resolution Life, and search for the customer policy to access Customer View. 2. Once in Customer View, on the left-hand side menu, select My profile > Address details. 3. Simply complete the form and all mandatory fields and select Update.

|

|

When viewing a customer’s policy information, the customer names are now displayed against the benefits in the Insurance details section. This will make it easier for you and customers to know which benefit applies to which person on a policy, especially when there is more than one life insured.

|

1. Login to My Resolution Life, and search for the customer policy to access Customer View. 2. Once in Customer View, scroll down and click on Insurance details to expand the tab. You’ll have the below view, as an example:

|

|

You can now view a list of the policies you recently accessed, without having to search for them again. |

1. Once you have logged in to My Resolution Life, under Customer Search, select Recently Accessed Policies.

2. You’ll be taken to a page with a list of policies you previously accessed:

|

|

When updating beneficiary details in My Resolution Life for certain policies, a pop-up now appears to clarify that previous updates to beneficiary details will not be reflected in the portal. Please note, this does not impact you or your customers’ ability to update beneficiary details. Complete the form as per usual, and it will be submitted to us to action. |

To update beneficiary details for a customer’s policy: 1. Login to My Resolution Life, and search for the customer policy to access Customer View. 2. Once in Customer View, on the left-hand side menu, select My profile > Beneficiary details. 3. The new pop-up will appear. Simply select OK and follow the prompts to proceed with updating the beneficiary details.

|

|

When submitting the Contact Us form in the portal, you’ll immediately see an error notification if we cannot accept the file type that you’ve attached to your request. Ensuring you attach acceptable file types to your request helps us in processing your request efficiently. Please note, we can only accept the following file types: .jpg, .tiff, .PNG or PDF. For security purposes, we can’t accept .docx or .doc. |

To access the Contact Us form: 1. Login to My Resolution Life, and search for the customer policy to access Customer View. 2. Once in Customer View, on the left-hand side menu, select Help and Support > General enquiry. If you complete the form and attach an unacceptable file type, you’ll see this error message:

|

The following policies are impacted by the beneficiary details update.

Accidental Death Benefit

Annual Renewable Term Plan

Business Whole of Life Plan

Defined Period Lifestyle Protection Plan

Defined Period Premier Lifestyle Protection Plan

Endowment Plan

Flexible Security Plan

Investment Only Lifestyle Protection Plan

Investment Only Premier Lifestyle Protection Plan

Level Life Insurance Plan

Level Life Insurance Superannuation Plan

Non Participating Plan

Open Ended Lifestyle Protection Plan

Open Ended Premier Lifestyle Protection Plan

Open Ended Premier Plus Lifestyle Protection Plan

Permanent Life Plan

Premier Plus Lifestyle Protection Plan

Retirement Security Plan

Stand-Alone Trauma Plan

Step Term Insurance

Stepped Life Insurance Plan

Stepped Life Insurance Superannuation Plan

Superannuation Annual Renewable Term Plan

Term Insurance Level Premium

Term Joint Life Insurance

Term Life Insurance Plan

Term Life Insurance-Decreasing Sum Insured

Whole of Life Plan

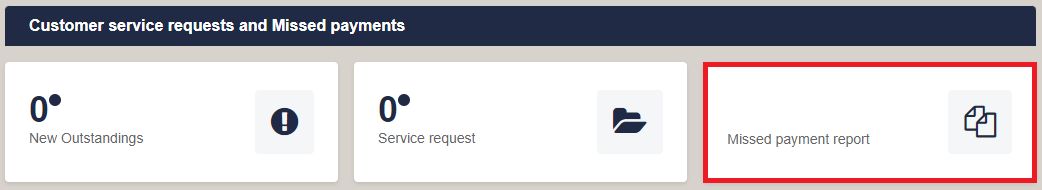

We have addressed the display and download issues that some advisers were having with the missed payment report in My Resolution Life. You can now access and download missed payment reporting online again. We apologise for the inconvenience this has caused.

Login to My Resolution Life and click on Missed payment report from your dashboard.

Your staff can access this report too. If you haven’t yet set up access for your staff, see instructions in the My Resolution Life help centre here.

During 2022, Resolution Life reduced the fees we charge for several Super, Retirement and Investment products following a review and simplification of fee structures and investment offerings. We have recently finalised a further series of fee reductions for the S&I products that are set out in these tables.

Impacted National Mutual Retirement Fund (NMRF) members and Resolution Life policyholders will benefit from these fee reductions, which were all implemented by the end of June 2023. Note that only the products and investment options listed have been impacted.

The latest fees and costs information for S&I products is available on the relevant product pages found under the Super, Retirement, and Investment pages.

We recently undertook a review of our strategic asset allocation investments, resulting in updates to some of our investment options.

The below changes are effective from 1 July 2023. We are currently writing to customers who are impacted by these changes.

We've made updates to help simplify our investment options menu and reduce the ongoing costs of managing these portfolios. The diversified portfolios have been consolidated into 6 risk profiles, each with their own objective, standard risk measure (SRM), benchmarks and ranges. Click here to view a flyer detailing all the changes.

We have changed the way we manage some investment options, moving them from passive to moderately active investment management. While these investments will still be largely tied to matching the returns of a particular index, this change will allow us to make some additional investment movements from time to time.

As a result of this change, we have updated the name for the following investment options:

|

Current name |

Updated name |

|

Australian Share Index |

Australian Share 5 |

|

International Share Index |

International Share 3 |

|

Wholesale Global Equity Index Fund |

Wholesale Global Equity Fund |

|

Wholesale Global Equity Index Fund Mature |

Wholesale Global Equity Fund Mature |

In addition, we have updated the objective and strategy for the following investment options:

As part of managing your investments, we regularly monitor the options and underlying managers and make appropriate changes. We were advised that the underlying investment portfolios for your investment option were to be closed. We’ve automatically reinvested the funds into a similar investment with a similar risk/return profile.

We have updated the name, objective and strategy for the following investment options:

|

Current name |

Updated name |

|

Multi-manager Australian Equities |

Australian Equities 2 |

|

Multi-manager Australian Equities Mature |

Australian Equities 2 Mature |

|

Multi-manager International Equities |

Specialist International Share |

|

Multi-manager International Equities Mature |

Specialist International Share Mature |

Please refer to the current Investment Report for the updated objective and strategy.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.