We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

We’re excited to confirm that we recently transitioned our remaining ex AIA clients into the Resolution Life ecosystem. The newly transferred clients are being set up in the My Resolution Life portal, and we anticipate having their details available in mid-October.

As part of this transfer, we also introduced the MyQuote Annuities functionality in the My Resolution Life portal. You can use MyQuote Annuities for existing Resolution Life clients interested in annuities moving forward.

Unlike traditional investments (for example shares and managed funds), annuities offer a guaranteed rate of return. Once invested, these returns are immune to market and interest rate fluctuations, providing a guaranteed source of income.

By incorporating annuities into your clients’ retirement portfolio, you may reduce their exposure to investment risk. Plus, there may be potential tax and social security benefits when combining guaranteed annuities with other retirement income streams.

• Guaranteed income: Clients can rest easy knowing their investment and income are secure, regardless of market performance.

• Competitive rates: Competitively priced rates for your clients.

• Flexible terms and payment frequency: Choose a fixed investment term and choose your payment frequency from monthly, quarterly, half-yearly or yearly.

• Tax advantages: Payments are tax-free for clients over 60 when investing with super money, and tax offsets may be available for those between preservation age and 60.

• Estate planning: Options for nominated or reversionary beneficiaries.

• Access to funds: Clients can access either all or the residual value of their original investment, depending on their initial choice.

To learn more or to open an annuity with us, please contact Simon Felice our National Retirement Lead for Retail products, on 0416 037 066 or via email at simon.felice@resolutionlife.com.au.

As part of our ongoing commitment to providing you with up-to-date tools and resources, these annuity rates will be refreshed every Tuesday, giving you access to the most current information.

To access the rates, simply save this link to your favorites.

View this week’s annuity rates and if you’re providing rates to your clients, please ensure you check the latest information before providing details.

Simply log in to portal with your username and password. If you are having issues with logging in, refer to our help centre.

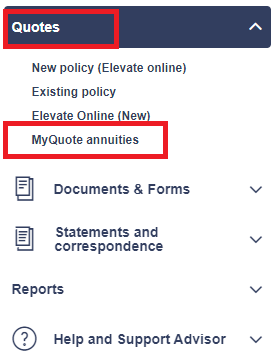

Once logged in, you can access MyQuote Annuities under the quotes tab on the left-hand side of the screen.

Once the client information is added (investor details, investment amount and type of investment), you can calculate the annuity quote.

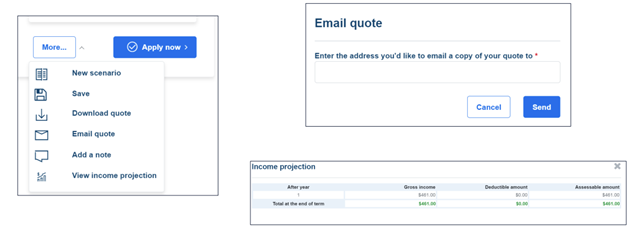

The tool will then provide you with the rate applied and income payment for the investment.

Additional features that can be accessed via the More button including the ability to save, download and email the quote and provide income projection for future income payments your clients will receive from the annuity.

To further assist you with the MyQuote Annuities tool you can follow the helpful guide steps.

We are pleased to announce that My Resolution Life portal has been updated with the following changes:

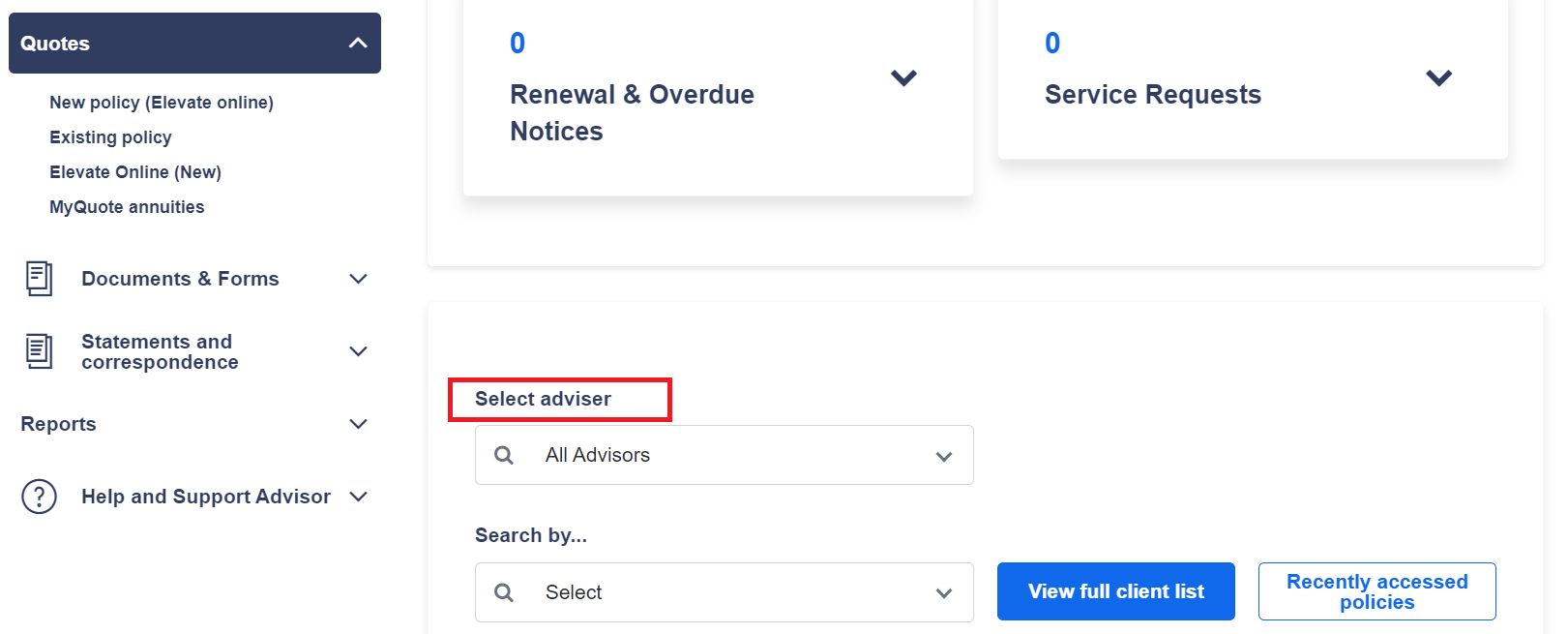

• We’ve enhanced the search functionality to streamline account management for your support staff

When searching for client details in the portal, your support staff can now log in once, Select adviser and can search for clients within their adviser group, making it easier to locate and manage different client requirements.

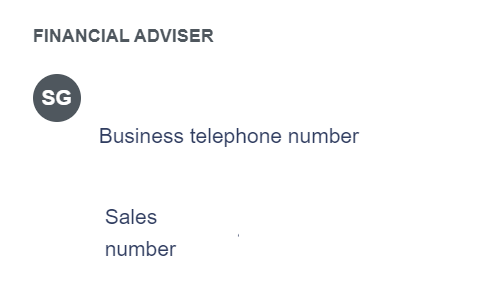

• Updated the financial adviser details

We’ve improved the adviser details displayed when viewing client information. Previously only the adviser’s name was shown. The portal now includes your contact number and sales number, making it easier to access important information without needing to download the customer list.

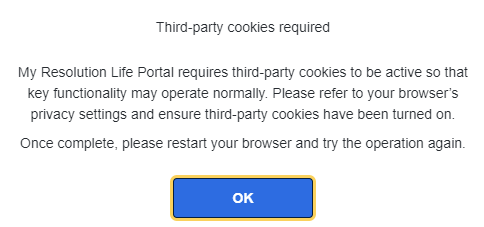

• How to resolve the third-party cookie issue

We have been advised that customers, advisers and support staff are receiving a pop up when logging into the portal or trying to register for portal.

Follow these steps to resolve the issue:

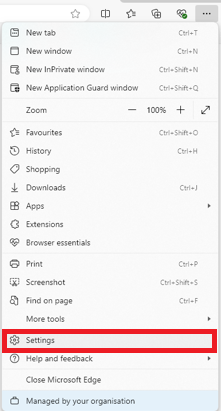

1. Open Edge: Click on the three dots in the upper right corner.

2. Go to Settings: Select “Settings” from the dropdown menu.

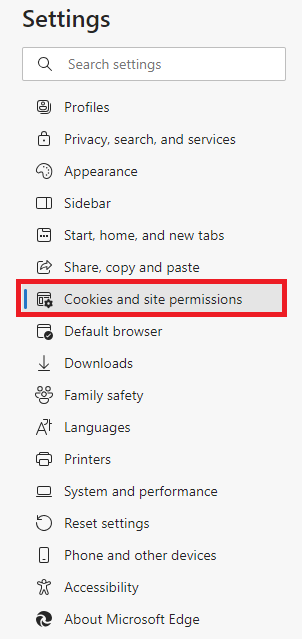

3. Cookies and Site Permissions: Scroll down to “Cookies and site permissions”.

4. Manage and Delete Cookies: Click on “Manage and delete cookies and site data”.

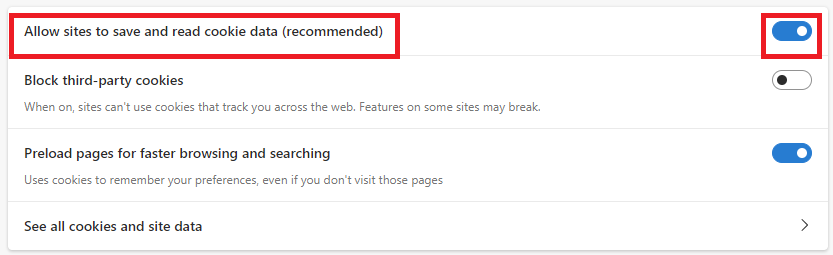

5. Allow Third-Party Cookies: Toggle the switch to "Allow sites to save and read cookie data (recommended).

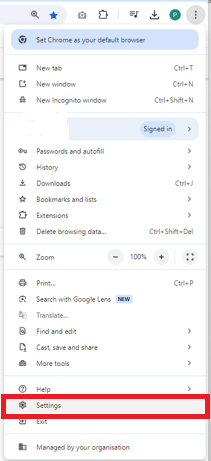

1. Open Chrome: Click on the three dots in the upper right corner.

2. Go to Settings: Select “Settings” from the dropdown menu.

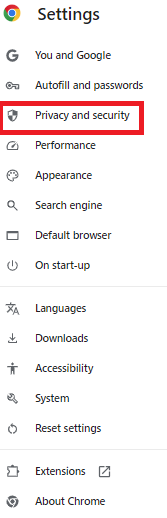

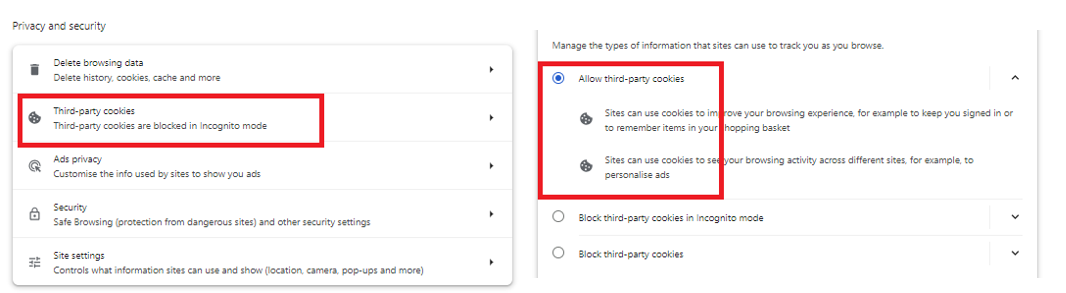

3. Privacy and Security: Click on “Privacy and security” in the left sidebar.

4. Cookies and Other Site Data: Select ‘Third-party cookies’.

5. Allow Third-Party Cookies: Choose “Allow third-party.

As part of our commitment to you, we have improved the way that you can view your forms. We have categorised the forms by product and alphabetised the list for you.

This enhancement is relevant to the following products:

• Elevate products

• FLP/Firstcare products

• Investment Growth Bond

• Annuities and

• Other forms such as online digital forms.

If you can’t find the form you’re looking for, we’ve added 3 alternative options for locating forms to help you, at the bottom of the page.

We are excited to announce the successful rollout of GreenID across Resolution Life. This is an easy-to-use solution for your clients to provide us with their certified identification (ID), to meet Australia’s anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

Going forward, this will be a time saver for your clients, as they will no longer need to:

• print off their identification

• locate an approved certifier to sign their documents and

• post these to us.

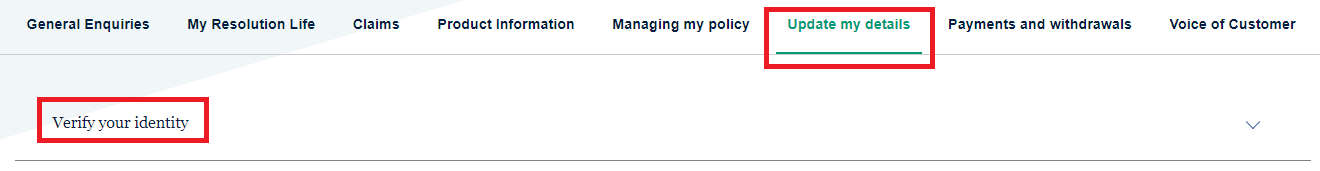

We have recently updated our FAQ page with information to assist your client with how to Verify their identity online. This information sits in the Update my details tab.

Following a review and simplification of fee structures and investment offerings, we’ve reduced the fees we charge for Super, Retirement Income and Investment products. Read the flyer Fee reductions for S&I products for more information.

The fee reductions were implemented for National Mutual Retirement Fund (NMRF) members, Super Retirement Fund (SRF) members and Resolution Life policyholders around the end of June 2024, with a small number of changes effective from their next policy anniversary. Members and policyholders will benefit from these fee reductions, depending on the product they hold.

The latest fees and costs information is available on the relevant product pages found under Superannuation, Retirement Income or Investment pages on the Products drop-down list.

Mr.S, a 53-year-old male, sustained a complicated fracture after falling 2 meters from a truck in May 2023. This injury sustained caused significant issues with walking, standing, kneeling, driving, and climbing ladders. As a result, the client was unable to perform his role as a self-employed builder/carpenter. This claim was managed by Naomi.

The client’s recovery was complicated by the lack of continuity in his medical care, as he was treated through the public health system and saw a different doctor at each visit. Without the continuum of care, it was difficult to establish his functional capacity and goals for returning to work.

To understand the client’s employment function, a Job Task Analysis (JTA) was arranged to obtain a comprehensive understanding of the functional requirements of his job. Being self-employed, the client had the flexibility with his hours and duties, and the JTA provided valuable insights into the specifics of what his pre-injury function, duties and hours were.

Following the assessment, the Claims Manager Naomi performed several functional calls and utilised motivational techniques that assisted the client to get a physiotherapy referral. She also educated him on the importance of medical updates, and she advised that he could see his GP for consistent care. As he progressed through the healing process, Naomi made a referral for a physiotherapy-based Work Conditioning program with Specialised Health to help regain some functional strength, balance, and range of motion in his foot.

As Mr. S saw improvement in his injury, his motivation to return to work increased. However, he was apprehensive about resuming heavy manual duties. We liaised with his GP, who supported a gradual return to work plan.

This story highlights the importance of empowering clients to take ownership of their treatment and recovery journey. By providing support and facilitating a rehabilitation assessment and Work Conditioning program, we helped Mr. S achieve a faster recovery. He was extremely grateful for the assistance provided by Naomi.

As mentioned in last month’s edition of Adviser Connect, we have added three new accordions to the Help Centre in the My Resolution Life portal, to help you when in the portal.

These accordions include steps to help advisers and licensees register for the portal and there’s a troubleshooting guide on what to do if you are having issues logging in.

If you have any issues or inquiries related to commission payments, please contact us at adviserremuneration@resolutionlife.com.au.

If you have any other adviser related inquiries such as your adviser ID, please contact us at adviserregisters@resolutionlife.com.au.

For more ways to connect with us, visit our contact us page for more information. To keep these email addresses handy, save them to your favorites.

Did you know your sales ID is also called your Commission Account Payment System (CAPS) number, Adviser Site User ID or Agency number.

This is the number that you’ll use when generating quotes using MyQuote in the portal.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.