We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

Please refer to our Find a form page, where you can locate various forms by clicking on the drop box.

We're here to help so if you can't find the form you are looking for or if you have any questions about your insurance

At Resolution Life we are committed to helping you and doing what's right by our customers. We care about what you think and welcome your compliments, complaints and suggestions. If you are unhappy with any part of your experience, we want you to tell us. For information on how to lodge a complaint and the process, please click here.

To authorise Resolution Life to provide information to a third party, please complete the Authority to release information form

If your policy has lapsed, or in other words, cancelled due to non-payment of premiums you may be able to reinstate your policy within the first 90 days by completing the online application form below:

Application for reinstatement within 90 days from lapse date form

Please contact us if you’d like to discuss your options with us or contact your adviser.

Verbal authorities are recorded over the phone and are kept on file. This allows Resolution Life to make changes to your policy as agreed and/or to ensure Resolution Life have disclosed information in accordance with life insurance regulations. A verbal authority can only be given, amended and or cancelled by the Policy Owner.

A Power of Attorney is a legal document where you nominate a person or trustee organisation to manage your financial affairs, in case you’re unable to do so due to for example if you are travelling or due to sickness. You still have control of your affairs, and you can revoke your Power of Attorney at any time.

To add a Power of Attorney you must be over the age of 18.

Please send an original certified copy of your Power of Attorney along with an original certified proof of identity such as a driver's license or passport to GPO BOX 5441, SYDNEY NSW 2001.

We understand your circumstances may change, and we welcome a conversation about your needs.

Any premium pause options can be located on your policy document.

If you do not have your policy document or would like to discuss your premium pause options, please contact us.

Please send your third party authority to askus@resolutionlife.com.au or to GPO BOX 5441, SYDNEY NSW 2001.

Please ensure your third party authority form is signed and dated within six months of sending and includes the following

If you think you might have lost or unclaimed super, please go to the Australian Taxation Office who can assist you in locating your lost super or unclaimed super.

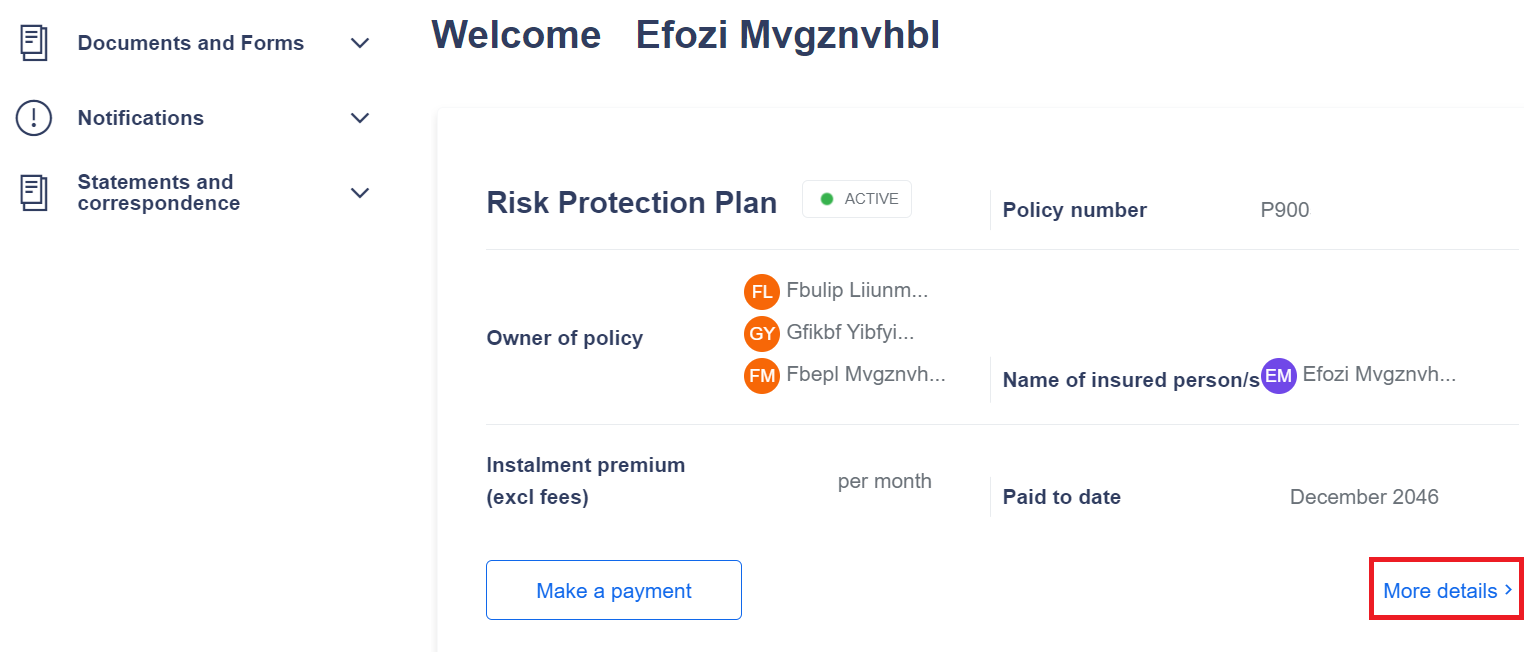

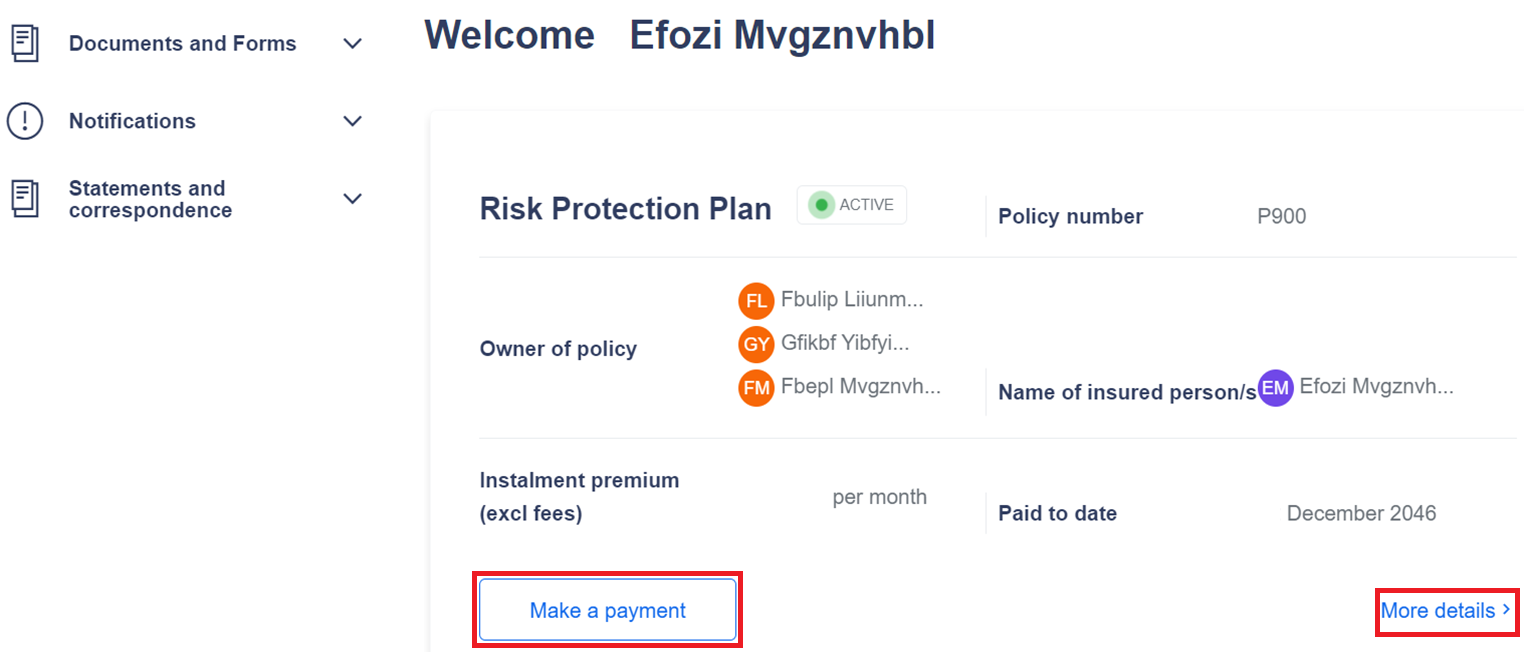

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

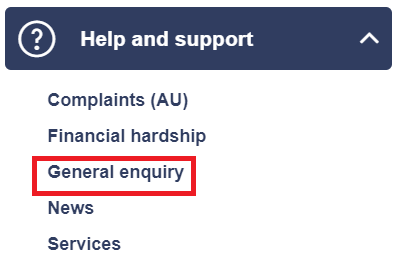

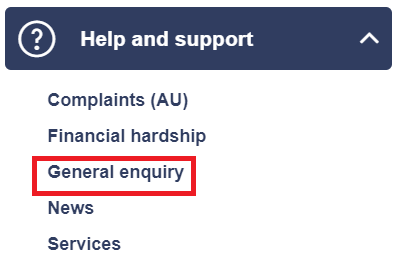

From the policy dashboard, select Help and support → General enquiry from the left-hand side.

To assist you with your enquiry, you have the option of having your personal details prefilled into the form.

Complete the form and write your enquiry in the box provided. If you have any supporting documents you want to attach, you can do this by dragging or uploading the file in the field available on the online form. Once the online form has been completed click Submit.

Your enquiry will then be submitted to Resolution Life to process, and someone will be in touch with you.

If you would like your enquiry looked at sooner chat directly with one of our consultants by clicking the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

Note: If you hold more than 1 policy with Resolution Life, you will need to update each policy individually with your updated details.

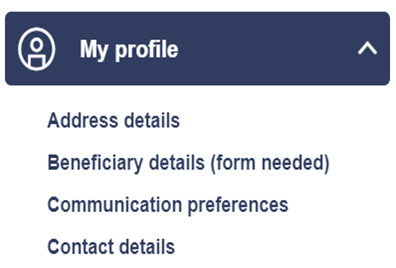

Your contact details (phone, email, address, and communication preference) can all be updated online by selecting the relevant option in the navigation menu.

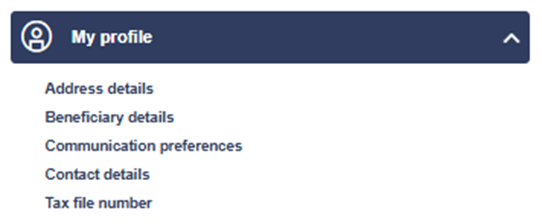

From the policy dashboard, to update your personal details, select My profile from the left-hand side and select the relevant option.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

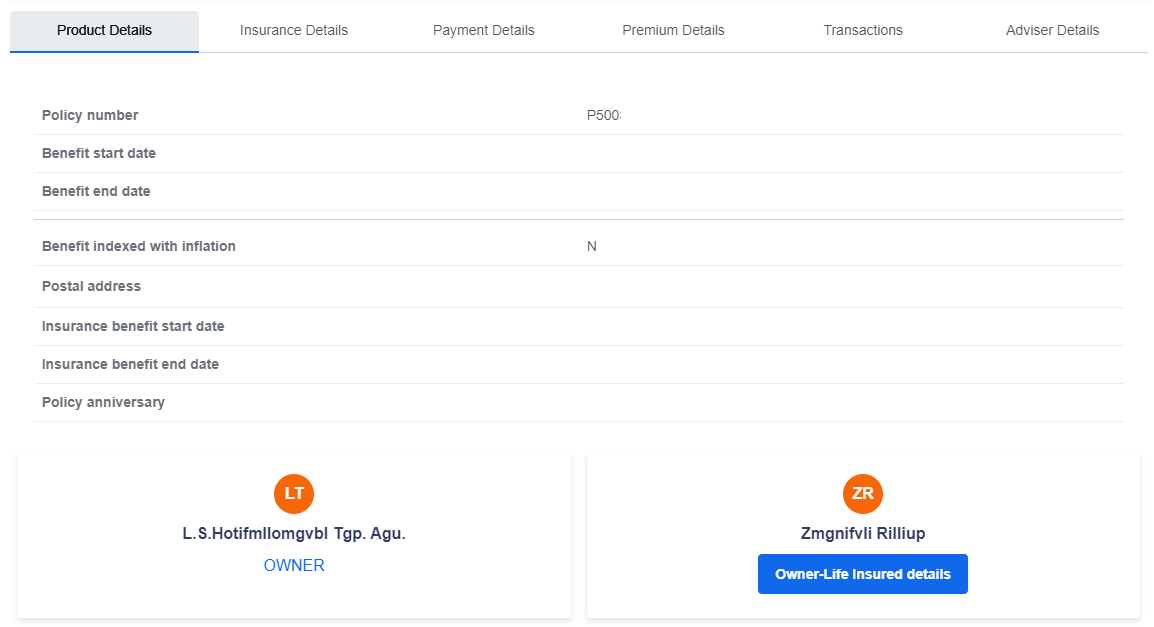

The information that is displayed is a high-level review of your policy with us. It will show you the name of your product, policy number, Owner of the policy, name of insured person/s, Instalment premium and Paid to date details.

From this screen you can also Make a payment to your policy or select More details.

By selecting More details on the right-hand side of the screen, this will take you to the policy dashboard, where you will be able to view more detailed information regarding your Product details, Insurance details, Payment details, Premium Details, Transaction and Adviser Details. You are also able to view Policy owner details listed on your account.

There are two ways that you can update your payment details with us, either through direct debit or by changing your payment arrangement.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

Direct debit

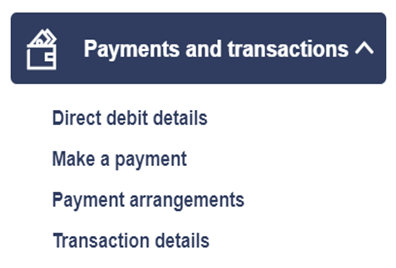

If you want to update or set up a direct debit, you can do this by selecting Payments and transactions → Direct debit details from the left-hand side.

Changing your payment arrangement

Any other payment related changes such as change of payment frequency or removal of a direct debit can be done by selecting Payments and transactions → Payment arrangements from the left-hand side and complete the form. Your enquiry will then be submitted to Resolution Life to process.

Making a payment

To make a one-off payment, select Make a payment from the left-hand and complete the online form. Your payment will then be submitted to Resolution Life to be processed.

If you are unsure of what payment option to use, chat directly with one of our consultants by clicking the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

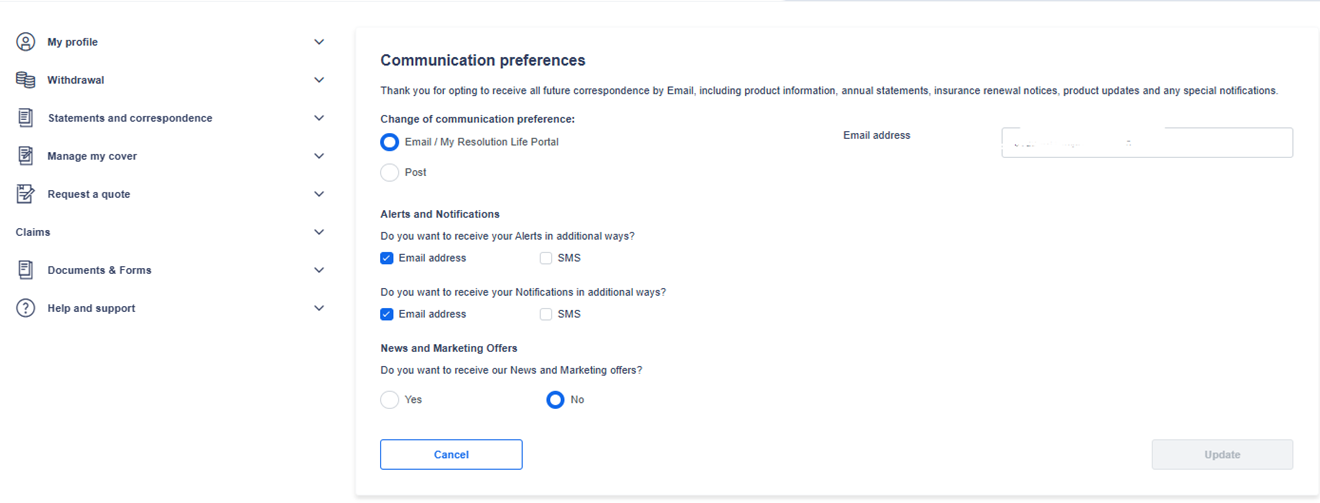

Select My Profile from the left-hand side and click Communication preferences

Under Change of communication preference, select how you’d like to receive your policy correspondence. Once all relevant fields are completed, press Update.

If you can’t find what you are looking for you can speak to your financial adviser.

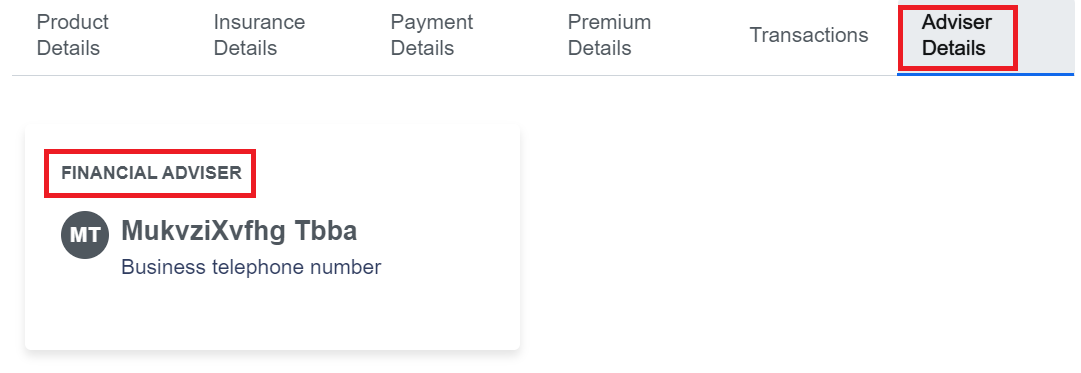

After logging in, you’ll land on your dashboard (the page that displays after you log in).

You need to select the policy you are enquiring about and select More details on the right-hand side of the screen.

Once the policy details have appeared, you will click on the tab called Adviser Details for their details.

You can also submit an online enquiry to Resolution Life from the policy dashboard, by select Help and support → General enquiry from the left-hand side.

Complete the form and write your enquiry in the box provided. If you have any supporting documents, you want to attach you can do this by dragging or uploading the file in the field available on the online form. Once the online form has been completed click Submit.

Your enquiry will then be submitted to Resolution Life to process, and someone will be in touch with you.

If you would like your enquiry looked at sooner chat directly with us by clicking the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

You can start the claim process simply by completing the form online.

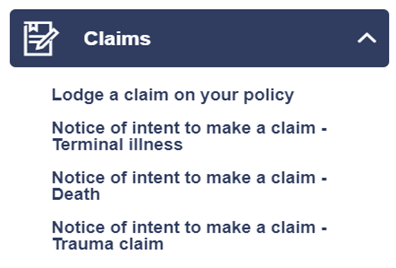

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen underneath the policy that you are looking to make a claim on.

When the policy details appear select Claims from the left-hand side and select the type of claim.

Your claim will then be submitted to Resolution Life to review, and someone will be in touch with you.

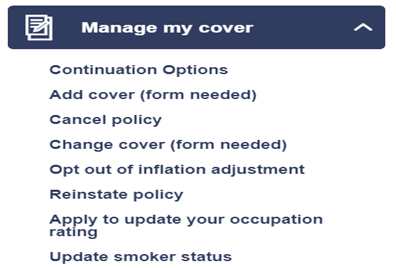

Most details can be updated online.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

When the policy details appear select Manage my cover on the left-hand side and select the relevant option.

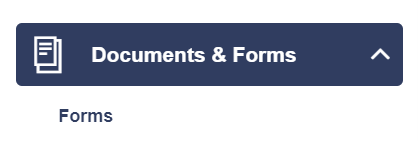

After logging in, you’ll land on your dashboard (the page that displays after you log in).

You can find a form by selecting More details on your policy details on the right-hand side of the screen.

From the policy dashboard select Documents and forms → Forms from the left-hand side.

Alternatively, you can select Help and support → General enquiry from the navigation menu and complete the form. Your enquiry will then be submitted to Resolution Life to process, and someone will be in touch with you.

You can also skip the wait by chatting directly with one of our consultants. Please click the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

Once Resolution Life has received all the relevant information and required documents your request will be reviewed within 5 to 7 business days. If your request cannot be finalised for any reason someone will be in touch with you.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

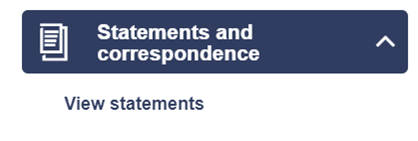

You can view your statements and correspondence by selecting More details on your policy details on the right-hand side of the screen.

From the policy dashboard, select Statements and correspondence → View statements and correspondence. A list of your statements and correspondence, will appear. Select from the list and download to view.

Yes, you can. After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on your policy details on the right-hand side of the screen.

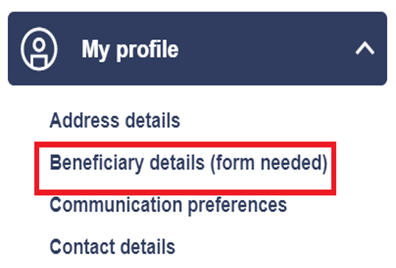

From the policy dashboard, select My profile → Beneficiary details to update your details.

If you want to update a binding beneficiary you will need to download and complete a binding beneficiary form, have this witnessed and send to Resolution Life.

Please chat directly with one of our consultants by clicking the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

Yes, you can. You can complete the Authority to release information form and submit.

If the condition you claim for is excluded from the policy, then we will not be able to fulfil your claim. This is why it helps to completely understand what conditions you’re claimed for under your policy when you’re setting it up.

To find out if you are eligible to claim against your policy please contact us, or depending on how you bought your policy, you can contact your financial adviser, super fund or employer to find out more.

We're here to help, to answer a hypothetical claim question, or if you have any questions relating to your insurance

Once we’ve received your claim forms, a Claims Manager will contact you to discuss your claim and answer any questions you have. We feel it’s important that you always speak to the same person, so we will assign you a dedicated Claims Manager to help you throughout the process.

To lodge or submit additional disability claim documents, please send them to the following address:

Resolution Life

GPO BOX 5441

SYDNEY NSW 2001

To lodge or submit additional death claim documents, please send them to the following address:

Resolution Life

GPO BOX 5441

SYDNEY NSW 2001

Your next claim payment is due based on the terms and conditions of your policy and chosen payment cycle you can find this information on the last payment advice you received or you can contact us.

Payment statements are sent at the end of each financial year, so if you did not receive a previous statement please contact us. All future statements will be automatically uploaded to the ATO so you will no longer receive a paper copy of this statement.

If you are unsure on the policy type you have with Resolution Life, please refer to your latest annual statement which you can obtain from My Resolution Life. If you have a financial adviser, they will be able to assist you further in understanding your policy or account.

An Australian Business Number (ABN) is a unique 11-digit number that identifies a business to the government and community.

A Unique Superannuation Identifier (USI) assists in identifying the superannuation product. When rolling over from one superannuation fund to another, you’ll often be asked to provide the Unique Superannuation Identifier (USI) of either the paying or receiving fund.

You can find the USI for your product on your annual statement. You can also find the USI for your product in our website under Super products.

Your financial adviser contact details are generally located on your annual statement. If you have a financial adviser, they will be able to assist you further in understanding your policy or account.

Your annual statement is generally sent to you after the financial year or on the anniversary date of your policy commencement. This statement contains important information such as your sum insured or withdrawal value of your policy. You can retrieve your latest annual statement and any previous statements on My Resolution Life. Once you have logged in, refer to the Statements & Correspondence section on the left hand side.

From 1 July 2022 super members no longer need to meet the federal government’s work test before their fund can accept personal super contributions. This test required members to be gainfully employed for at least 40 hours in a consecutive 30-day period during a financial year in order to be eligible. However, you may still need to meet the work test if you intend to claim a tax deduction for a personal contribution.

In a few cases we’ve needed to ask members to confirm whether or not they met the work test in financial year 2021-22, and we’ve written to those members telling them how to do this.

We're here to help. If you’re unsure if you need to provide your work test status to us, or if you have any questions about your super, please:

Loans can be taken against the value of your Resolution Life conventional policy also known as Whole of Life or Endowment policies. Variable interest rates are applied to the loan amount. If you would like further information on how you can apply for a loan, please contact us.

Generally, you can apply for a loan of up to 70% of your policy value. Policies under the superannuation class of business are not able to have a loan taken. To apply for a loan against your Whole of Life or Endowment policy, please contact us.

We're here to help, to check to see if your payments are up to date, or if you have any questions about your insurance

The waiting period is the period of time that you must wait before your benefit can be paid. Benefits are not payable during the waiting period. Depending on what you chose when you set up your policy, your waiting period could be as short as 2 weeks or as long as 2 years.

You can find the waiting period applicable to your income protection policy by referring to your latest annual statement. If you do not have your annual statement, you can access this by logging into My Resolution Life. Once you have logged in, select statements and correspondence on the left hand side.

The benefit period is the period of duration that a benefit payment will be made, unless you return to work. This may vary depending on the type of benefit you have chosen.

You can find the benefit period applicable to your income protection policy by referring to your latest annual statement. If you do not have your annual statement, you can access this by logging into My Resolution Life. Once you have logged in, select statements and correspondence on the left hand side.

The sum insured is the amount of benefit you are covered for in the event of an accident, illness, or in the unfortunate circumstance that you pass. The type of benefit payable will depend on the type of policy you have with us. You can locate your latest sum insured by referring to your annual statement which you can obtain by logging into My Resolution Life. Once you have logged in, select statements and correspondence on the left hand side.

Your Product name can be found on the policy schedule you would have received as part of your welcome pack when you took out your policy out.

We're here to help

If you have any questions about your insurance

Your Policy Document would have been included as part of your welcome pack which you would have received when you took your policy out.

We're here to help, if for some reason you can’t find your policy document or you have any questions about your insurance

To claim a tax deduction on personal contributions made to your superannuation account, please complete the notice of intent form. You may request a form from us directly by contacting us or complete the Notice of intent to claim or vary a deduction for personal super contributions form which you can obtain from the Australian Tax Office website. Once completed, please email your completed form to askus@resolutionlife.com.au or by post to GPO BOX 5441, SYDNEY NSW 2001.

To view the balance or value of your policy, please log into your My Resolution Life account here.

If the cost of your policy is a concern, you may be able to alter it so it aligns with your budget while maintaining coverage.

To discuss cancelling your policy, contact your financial adviser or call our Customer Solutions team directly on 133731 option 4 extension 50012.

For options on how your insurance policy may be changed to meet your affordability and changing needs, find out more here

You may be able to decrease your insurance cover.

To discuss your options to decrease your insurance cover you can contact your financial adviser or call our Customer Solutions team on 133 731 option 4 extension 50012.

You may be able to increase your insurance cover.

To discuss your options to increase your insurance cover you can contact your financial adviser or contact us.

To be eligible to change your smoker status, you must not have smoked or used the following within the previous 12 months:

– smoked tobacco or any other substance

– used e-cigarettes, or

– used nicotine replacement products.

Note: You can apply for non-smoker rates after 12 months, however non-smoker rates may not be available to you if you’ve suffered from a smoking related medical condition.

You can alter your smoking status by completing the Non-smoker declaration form which you can access here.

You can nominate beneficiaries by completing the beneficiary nomination form which you can obtain here.

It is important to note that not all policies will be able to have a beneficiary nomination applied to the account. For more information, please contact us or email us on askus@resolutionlife.com.au

We're here to help, to change or remove your adviser, or to discuss changes to your adviser

We understand your circumstances may change, and we welcome a conversation about your needs. So, to remove or update the policy owner please contact us to discuss your options.

To keep up with the cost of living we increase the sum insured on some insurance products, without the need for medical or other details. As your cover increases so does your premium.

We call this an inflation increase and it's your choice whether to accept or opt out of the increase.

You can learn more about inflation adjustments and opt out the increase for one year or permanently in My Resolution Life, just search for ‘inflation adjustment’.

You may be able to remove benefits from your policy. You can contact us to discuss your options with our Life Insurance Specialists. Alternatively, you can contact your financial advisor to organise this on your behalf.

We're here to help, to obtain an insurance quote, or if you have any questions about your insurance

Verifying your identity just got easier!

Resolution Life now uses GreenID, a simple solution for you to provide certified identification. Learn more at Verify your identity online

To update your name, please complete the change of personal details form which you can access here.

To amend your date of birth, please complete the change of personal details form which you can access here.

To update your contact details, please log into My Resolution Life. Once you have logged in, select My profile → Contact details from the navigation menu.

To update your address, please log into My Resolution Life. Once you have logged in, select My profile → Address details from the navigation menu.

To update your communication preferences, please log into My Resolution Life. Once you have logged in, select My profile → Communication preferences from the navigation menu.

We do not offer AMEX as a payment option.

To update your payment frequency, please log into My Resolution Life. Once you have logged in, select Payments and transactions → Payment arrangements from the navigation menu and complete the form. Your enquiry will then be submitted to Resolution Life to process within 5-7 business days.

Depending on your product, you can also make one-off payments. Please select Payments and transactions → Make a payment. If this option does not exist, please chat directly with one of our consultants by clicking the chat icon at the bottom right of the page.

There are 2 ways that you can update payment details, it depends on the product you have and what you want to update.

To update or set up a direct debit, you can do this by selecting Payments and transactions → Banking account details from the navigation menu

Any other payment related changes such as change of payment frequency or removal of a direct debit can be done by selecting My Profile → Payment arrangements from the navigation menu and complete the form. Your enquiry will then be submitted to Resolution Life to process within 5-7 business days.

Depending on your product, you can also make one-off payments. Please select Payments and transactions → Make a payment. If this option does not exist, please chat directly with one of our consultants by clicking the chat icon at the bottom right of the page.

There are many different options for you to make your payment which include BPAY and Direct Debit, or Card payment online or over the phone, however some policies may not accept all payment options. Please refer to your latest payment notice.

If you do not have your latest payment notice, you can access this by logging into your My Resolution Life account. Once you have logged in, please navigate to the statements and correspondence section on the left hand side.

The most effective method to rollover your super is request a rollover from the Australian Tax Office using MyGOV. If you require further assistance, you can contact the Australian Tax Office superannuation department on 13 10 20.

Alternatively, you can download the Completing the request to transfer superannuation benefits from an external fund to Resolution Life form.

You can obtain a rollover or withdrawal form by accessing our find a form page which you can find here.

It is important to note that any withdrawals from your superannuation account are subject to the condition of release criteria.

Generally, you can only access your preserved super when you meet one of the following conditions of release:

– you retire after reaching your preservation age—refer to the relevant preservation age table for details.

– you cease employment at age 60 or over

– you reach age 65

– you’re the holder of an expired or cancelled temporary resident visa and you have permanently departed Australia

(this option is limited to certain visa categories and isn’t available to New Zealand citizens)

We recommend speaking with a financial advisor before you decide to rollover or withdraw your superannuation. If you don’t have a financial advisor please contact us.

Paying your policy or account by BPAY is dependant on the policy type you currently hold with Resolution Life. BPAY details are generally located at the bottom of your most recent payment notice. For more information, please contact us.

To cancel your direct debit, please log into My Resolution Life. Once you have logged in, select Payments and transactions → Payment arrangements from the navigation menu and complete the form. Your enquiry will be then be submitted to Resolution Life to process within 5-7 business days.

You can obtain a withdrawal form by accessing our find a form page which you can find here.

It is important to note that any withdrawals from your superannuation account are subject to the condition of release criteria.

Generally, you can only access your preserved super when you meet one of the following conditions of release:

– you retire after reaching your preservation age—refer to the relevant preservation age table for details.

– you cease employment at age 60 or over

– you reach age 65

– you’re the holder of an expired or cancelled temporary resident visa and you have permanently departed Australia

(this option is limited to certain visa categories and isn’t available to New Zealand citizens)

We're here to help, to discuss accessing your super if you're overseas, or If you have any questions about your superannuation

Exit fees may be applicable to your policy for information on this please refer to your Product Document or Product Disclosure Statement which you would have received as part of your welcome pack when you took your policy out.

We're here to help, if for some reason you can’t find your Product Disclosure Statement or you have any questions about your policy

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.