We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

The most efficient way to manage your policy is to register for My Resolution Life portal.

Here you can:

If you are pre-registered and would like to access My Resolution Life portal, you will firstly need to set up a new password:

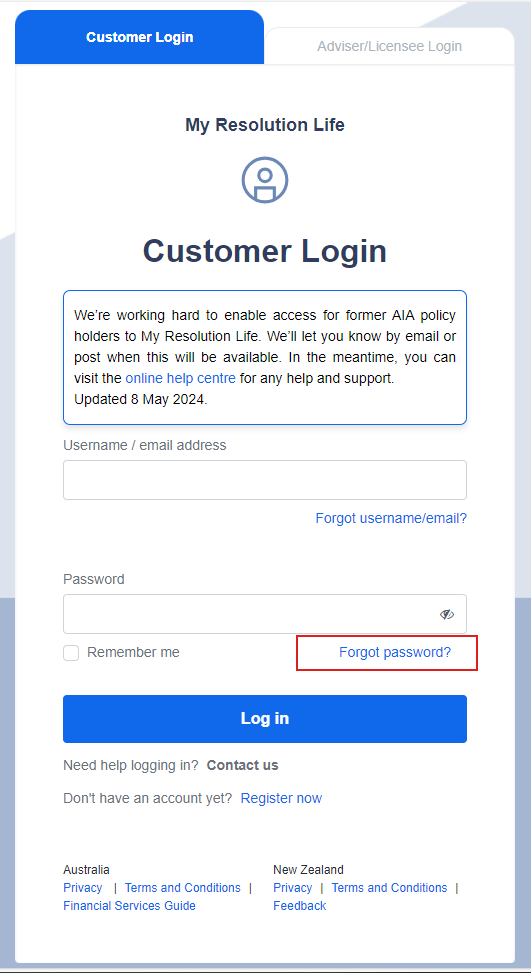

1. Visit My Resolution Life

2. On the login page, select Forgot password.

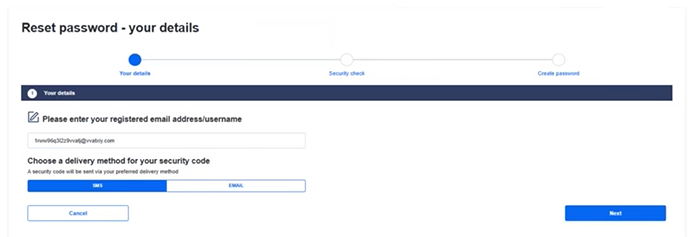

3. You will be redirected to Reset password page.

4. Enter the registered email/ username that we have contacted you on and then choose a delivery method for your security code. Click Next.

Note: The email and SMS options will only be available if we have your email address and mobile number on our records.

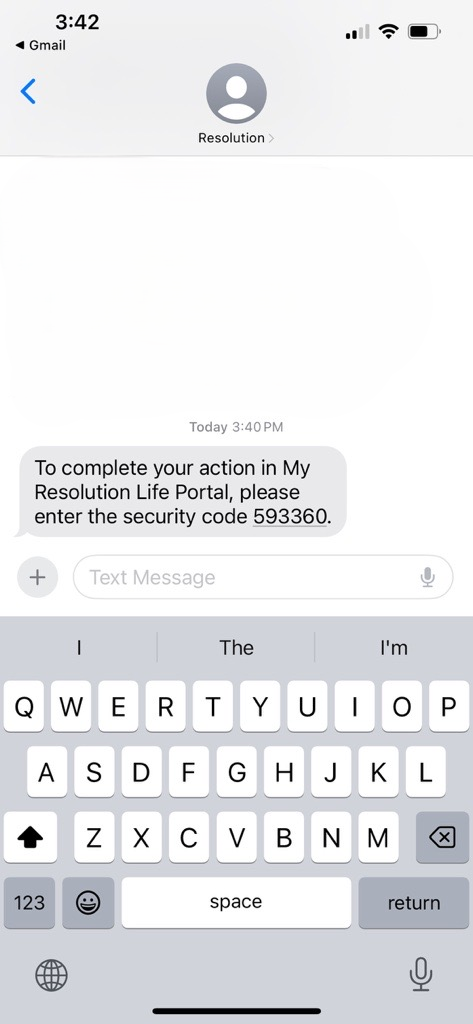

5. Check for the 6-digit security code we have sent.

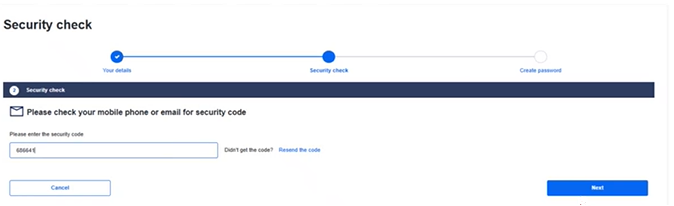

6. Enter the 6-digit security code and click Next.

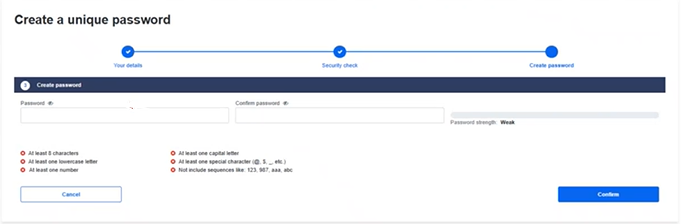

7. Create a unique password, ensuring all requirements are included. Click Confirm.

8. You will be sent back to the Customer Login page. Enter the username /email that we have contacted you on and the new password you have just created.

9. Select Log in.

10. You will then need to link your existing policy to your account. Click on Complete now.

11. Select Link policy.

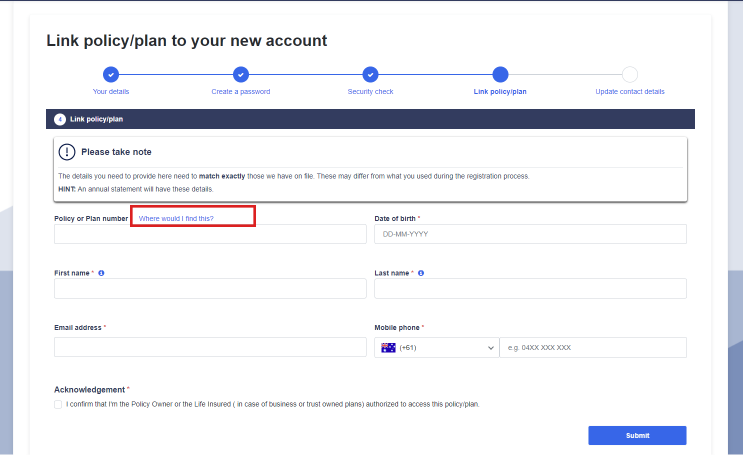

12. The first piece of information needed is the Policy or Plan number. This will be found on your latest annual statement.

If you click on Where would I find this? a diagram showing the exact location of the Policy or Plan number appears.

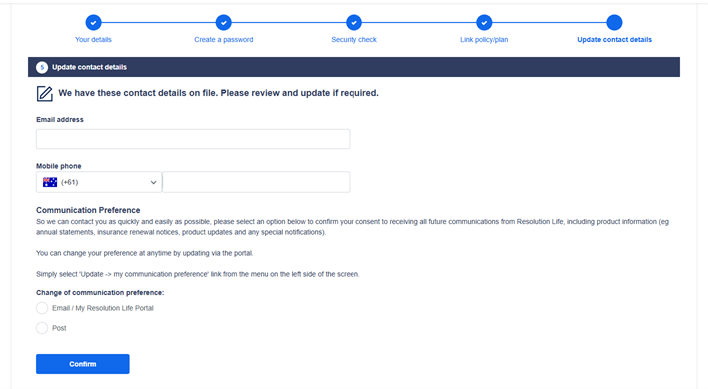

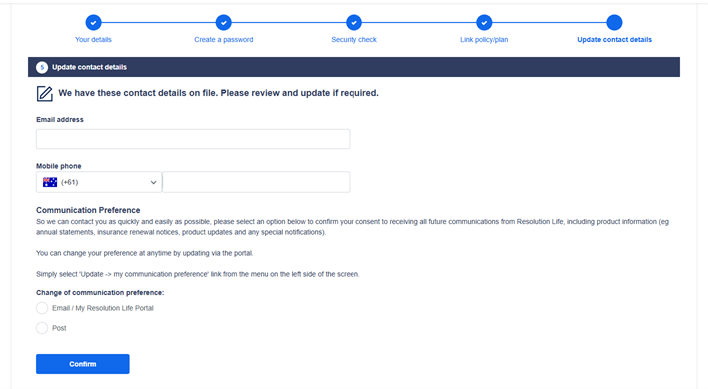

13. The final step is to update contact details. Select Continue to the next page.

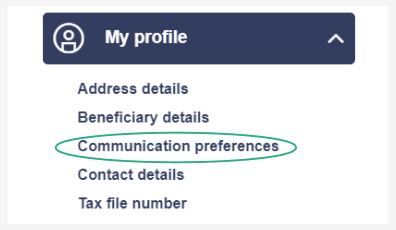

14. Review the contact details on file and update where required. Select your Communication Preference and click Confirm.

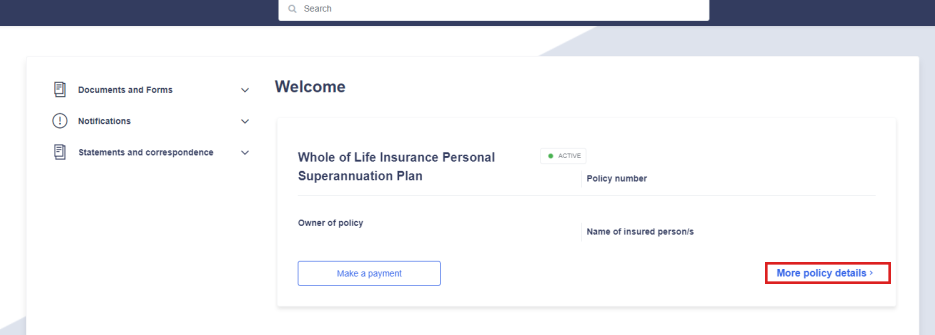

15. All done! Your online account is ready for you to access. Select View your dashboard.

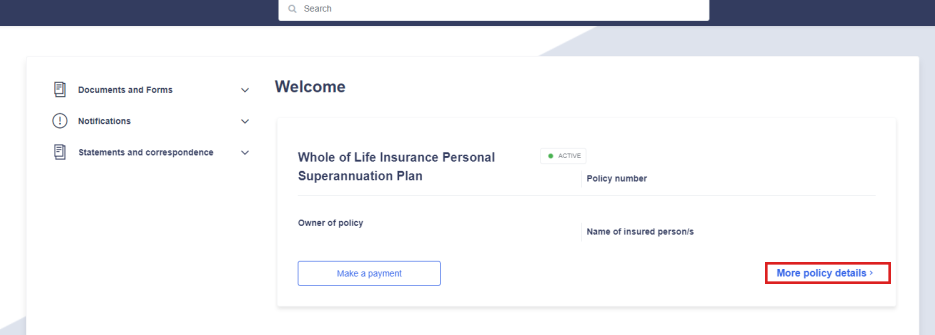

16. Your personalised dashboard shows your basic policy or plan information. Click through to More policy details to see further information.

If you are not pre-registered, you need to register first and then link your policy to your account.

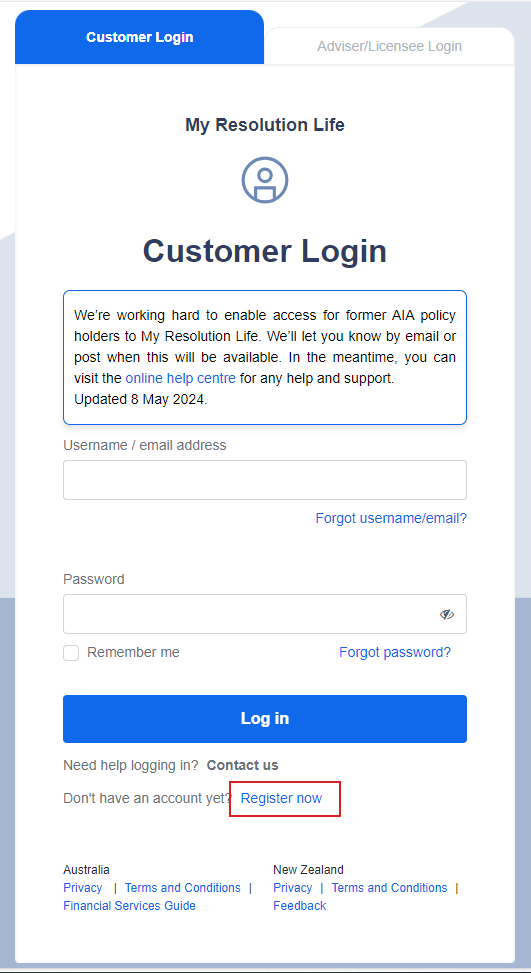

1. Visit My Resolution Life

2. Select Register now.

3. To begin this process, it is handy to have an annual statement on hand and also have the latest version of Chrome, Firefox, Edge or Safari installed on your computer.

Note- we are unable to register a business or trust account via portal.

4. Enter all your required personal details - ensure that they are the same as those we have on file and click Next.

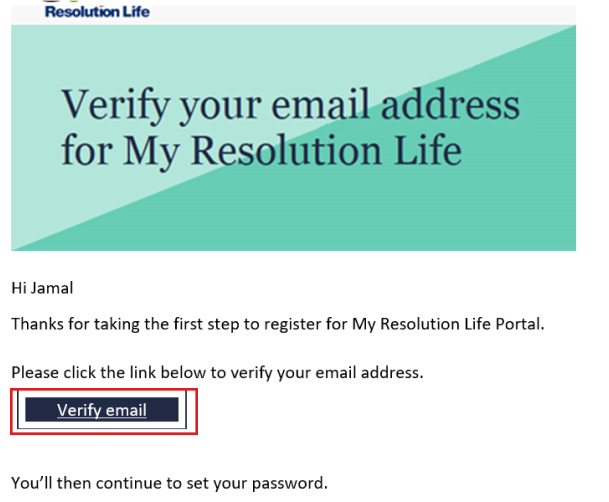

5. To verify your email, an email will be sent to your nominated address.

Note: Only one unique email address can be used for a My Resolution Life account, ie you cannot register the same email address for multiple portal accounts. If the email you receive says a user account with this email ID already exists, this means the email is already linked to a My Resolution Life portal account. You can either register using a different email address or click on 'Forgot Password' link and follow the steps to reset.

6. Click on the Verify email link.

7. You will then be directed to set a password

8. Once all password requirements are met, click Next.

9. Once registered, the next step is to link your policy or plan to your online account.

10. Select Go to login.

11. On the Customer login page, enter your username/ email address and the password you created during the registration process.

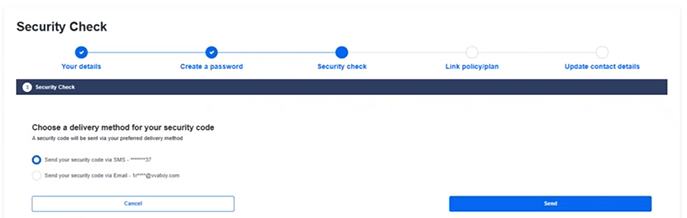

12. To ensure that it is you logging in for the first time, you will be sent a code via your preferred delivery method. Choose how you would like your security code to be sent and click Send.

Note: The email and SMS options will only be available if we have your email address and mobile number on our records.

13. Enter this 6-digit code sent and click Confirm.

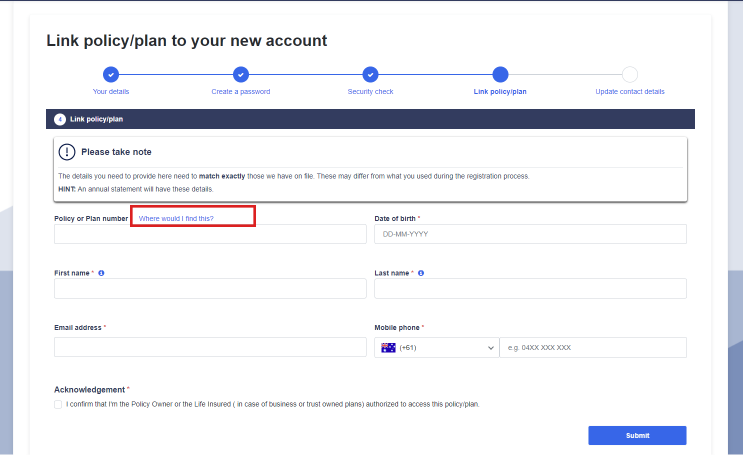

14. Next step is to link your policy. A past annual statement will have the details you will need to successfully complete this step.

15. Select Link policy.

16. The first piece of information needed is the Policy or Plan number. This will be found on your latest annual statement.

If you click on Where would I find this? a diagram showing the exact location of the Policy or Plan number appears.

17. The final step is to update contact details. Select Continue to the next page.

18. Review the contact details on file and update where required. Select your Communication Preference and click Confirm.

19. All done! Your online account is ready for you to access. Select View your dashboard.

20. Your personalised dashboard shows your basic policy or plan information. Click through to More policy details to see further information.

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am - 5pm (AEST) Monday-Friday

OR

Go to Contact us - Resolution Life

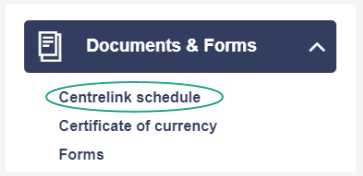

![]()

Website

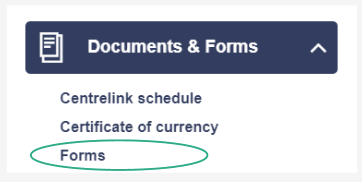

Go to Find a form to find the relevant form for your product

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am - 5pm (AEST) Monday-Friday

OR

Go to Contact us - Resolution Life

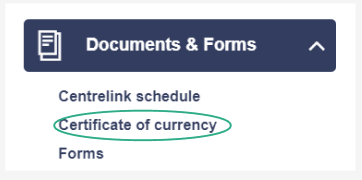

![]()

Website

Go to Find a form to find the relevant form for your product

Portal

![]()

Website

Go to Online enquiry, complete and submit the form for your product

Portal

![]()

Website

Go to Find a form to find the relevant form for your product

Portal

![]()

Website

Go to Find a form to find the relevant form for your product

Take a look at our FAQs

You can request a quote to adjust your existing insurance policy using the Cover adjustment tool. Use the tool to adjust the following products:

• Elevate Insurance

• Resolution Life Insurance

• Risk Protection Package

• Owner/Driver Income Protection

• Progressive Life Plan

Adjustments you can make when using the tool include:

• Viewing your current level of cover and premium details in My Resolution Life

• Reducing your cover amount to potentially lower your premiums

• Apply to increase your cover amount

• Changing your income protection waiting and benefit periods with ease

• Receive quotes in real time

To do this, Log in to My Resolution Life portal

1. From the dashboard → More policy details

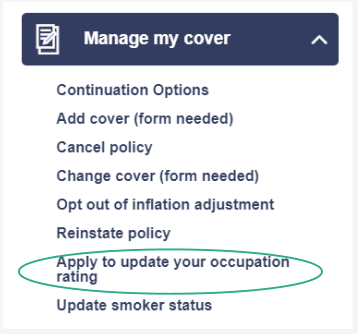

2. Select Manage my cover → Cover adjustment tool

You will then be guided through the steps to get a quote for your cover adjustment.

For any products not listed above, continue to use the relevant enquiry form which you can find in the left-hand menu under “Manage my cover”.

If you do not have a quote:

If you have not been issued with a quote in the last 30 days that accurately reflects your current occupation title and duties, you’ll need to submit a form or contact us to arrange one, before we can update your occupation rating. Alternatively, please reach out to your financial adviser to obtain one for you.

![]()

Website

Chat

For assistance with obtaining a quote, please Chat or Call us. For Chat operating hours and other contact details, please go to Contact us - Resolution Life

Call us

Call us on 133 731 during business hours

If you have a quote:

Once you have received your quote, you can continue the process of updating your occupation rating. This request needs to be submitted to us within 30 days of the date you received your quote.

Portal

![]()

Website

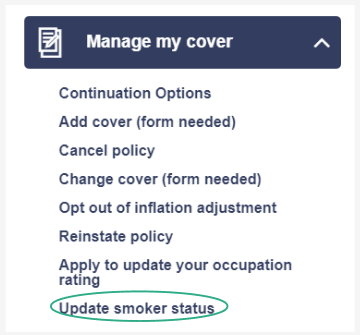

Portal

![]()

Website

Go to Find a form to find the relevant form for your product

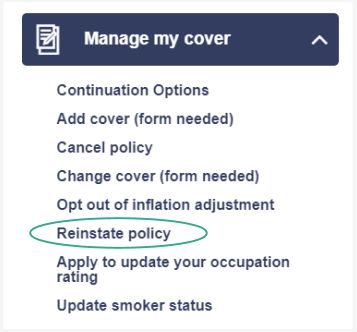

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Go to Find a form - Resolution Life to find the relevant form for your product, complete and submit the form

![]()

Website

For assistance with reinstating your policy, please speak with one of our agents via Chat (in the bottom right corner). You can view our Chat operating hours at Contact us - Resolution Life

OR

If your policy is within 90 days from the date that the policy lapsed, you can apply by completing the Reinstate policy form

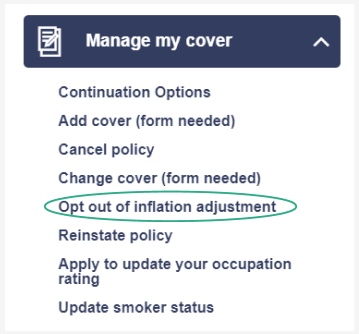

Portal

![]()

Website

For more information on how to opt out of inflation adjustment go to Inflation Adjustment

Take a look at our Product information FAQs

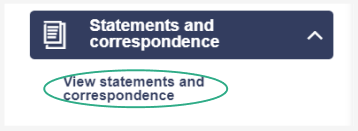

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am - 5pm (AEST) Monday-Friday

OR

Go to Contact us - Resolution Life

![]()

Website

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am - 5pm (AEST) Monday-Friday

OR

Go to Contact us - Resolution Life

![]()

Website

Go to Online enquiry complete and submit the form

Portal

![]()

Website

Go to Online enquiry complete and submit the form

Portal

![]()

Website

You can find relevant forms for your product at Find a form

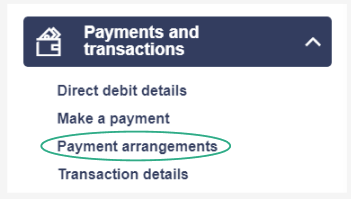

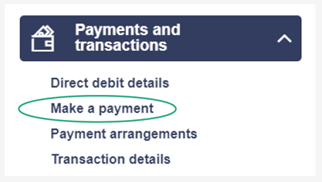

Portal

![]()

Website

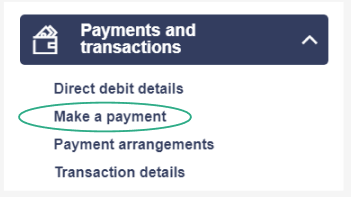

If you have a 15 or 20 digit Customer reference number or BPAY biller code and reference number please go to Make a payment

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, you can pay using BPAY, direct debit, EFT or credit card (based on your product). Check your latest statement or payment notice for details.

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Go to Find a form - Resolution Life to find the relevant form for your product, complete and submit the form

![]()

Website

If you would like to make any changes or set up your direct debit details, please go to Make a payment

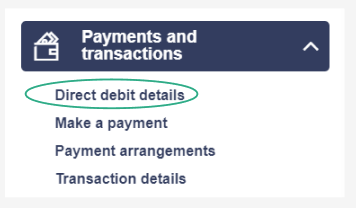

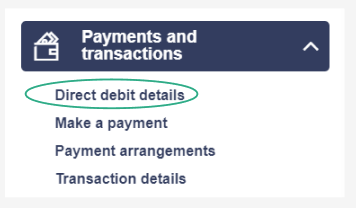

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am - 5pm (AEST) Monday-Friday

![]()

Website

To set up or change a direct debit please go to Make a payment - Resolution Life

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am - 5pm (AEST) Monday-Friday

![]()

Website

Go to Find a form to find the relevant form for your product

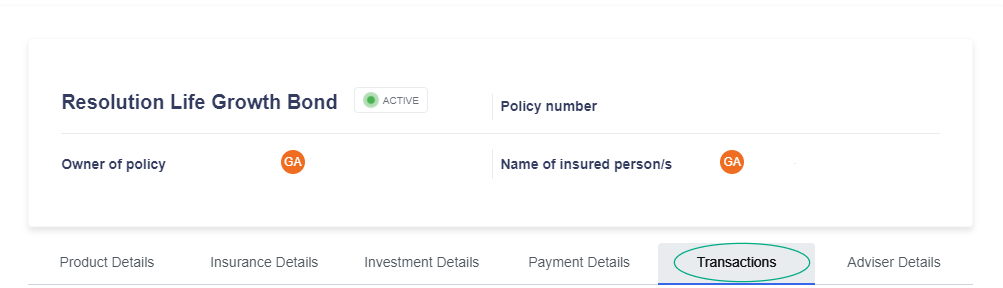

Portal

![]()

Website

For assistance with obtaining a transaction history please speak with one of our agents via Chat (in the bottom right corner).

You can view our Chat operating hours at Contact us - Resolution Life

Take a look at Payments and withdrawals FAQs

HIV status alone is unlikely to preclude an individual from obtaining life insurance. Due to medical advancements in the treatment of HIV, reduced infection rates, and improved understanding, eligibility for life insurance products has increased. At Resolution Life, we will assess HIV or AIDS like any other medical condition at the time of application. Consideration is given to HIV status, overall health, treatment compliance, lifestyle and medical history.

Please contact us if you have any questions or speak to your financial adviser.

For more information, please see the HIV and life insurance consumer fact sheet on the CALI website.

At the application stage, along with questions relating to your health and medical history, you will need to provide details about your HIV diagnosis, treatment, viral load, complications, related conditions, and test results, including any pending tests. A medical report may be requested from your treating doctor with your consent. Requests will include information on CD4 count, viral load levels, other relevant blood test results including results of recent tests and treatment. Questions will be asked in a sensitive manner, and we will not inquire about your sexual preferences or practices.

With the reduction in HIV infections and ongoing health improvements for people living with HIV, access to life insurance products for customers living with HIV is increasing. Depending on the product type, our underwriting guidelines, your general health, medical history and HIV status, policies may have restrictions applied such as loadings or exclusions, or shorter policy terms/durations. In some cases, we may not be able to offer you cover. This information will be communicated to you as part of the underwriting process. If you are an existing policyholder, we recommend you review your policy terms and conditions.

If you are diagnosed with HIV after your insurance policy has started, you do not need to notify us. If you do notify us, this will not affect your cover, the premium you pay, or your ability to claim in the future. Depending on your policy and options, you may be able to claim if you are diagnosed with HIV or if it affects your ability to work. You should check your policy terms and conditions to see if you may be eligible to make a claim, should you need to.

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am-5pm (AEST) Monday-Friday

OR

Go to Online enquiry, complete and submit the form

![]()

Website

For more information on how to make a contribution please visit Give your super a helping hand

![]()

Website

For more information on how to find lost or unclaimed super please visit Find your lost super

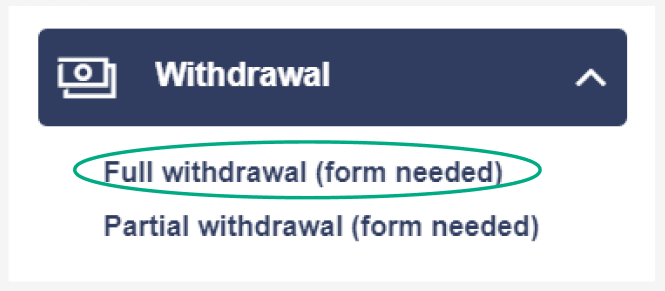

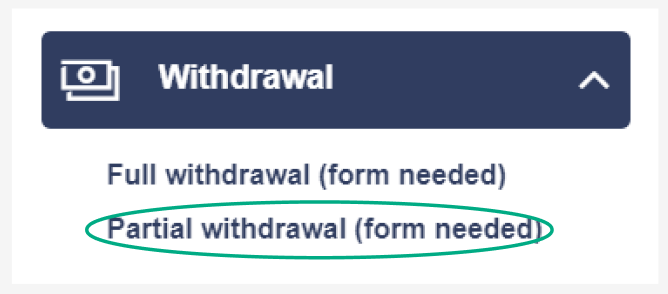

Portal

Full withdrawal

Partial withdrawal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am-5pm (AEST) Monday-Friday

OR

Go to Online enquiry, complete and submit the form

OR

Go to Find a form to find the relevant form for your product.

![]()

Website

For more information on maturities and withdrawals please visit Maturities and withdrawals

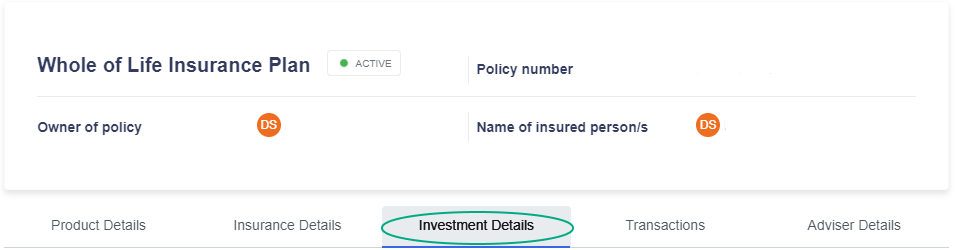

Portal

If you have recently transferred from another Superannuation & Investment life insurance business and do not have access to My Resolution Life portal, please:

Click Chat in the bottom right corner to be connected to an agent 9am-5pm (AEST) Monday-Friday

OR

Go to Online enquiry, complete and submit the form

![]()

Website

For assistance with finding your balance, please speak with one of our agents via Chat (in the bottom right corrner).

You can view our Chat operating hours at Contact us - Resolution Life

There are two main factors to consider when determining the value of your account balance:

1. The number of units you hold within your investment option(s), and

2. The unit price (for each investment option you hold).

How to work out your account balance:

Number of units x Unit price for each investment option = Value of your account balance*

Go to Unit Prices - Resolution Life for more information

* The value of your account balance may be subject to market fluctuations, fees and taxes upon withdrawal and is effective as at the date of the declared unit price. For the most accurate and up to date value of your account balance, please contact us.

Take a look at Payments and withdrawals FAQs

Financial advisers help people to achieve their goals in life by creating financial plans for managing money, building wealth and reducing debts. Many provide advice on investments like shares or property and on ways to protect your wealth and lifestyle through products like insurance. The Financial Advice Association Australia can help you find an adviser in your area.

• To change your servicing adviser, the plan owner/authorised trustee need to complete the Authority to change your servicing adviser request and send to adviserregisters@resolutionlife.com.au

• The request should include the plan owner’s/authorised trustee’s name, date of birth and address on the policy.

• Allow 5-7 business days for this request to be processed.

• The policy owner/authorised trustee, incoming and outgoing adviser will be informed of this change via email.

1. To remove your servicing adviser, the plan owner needs to send a written request to adviserregisters@resolutionlife.com.au

2. The request should include the plan owner’s name, date of birth and address on the policy

3. Allow 5-7 business days for this request to be processed.

4. The policy owner and outgoing adviser will be informed of this change via email.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.