We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

At Resolution Life, our priority is to support our customers and their families in their time of need.

We understand that knowing the type of cover you have and how much you’re covered for is crucial. You can learn more about the types of cover we offer and what else you may need to consider when reviewing your insurance.

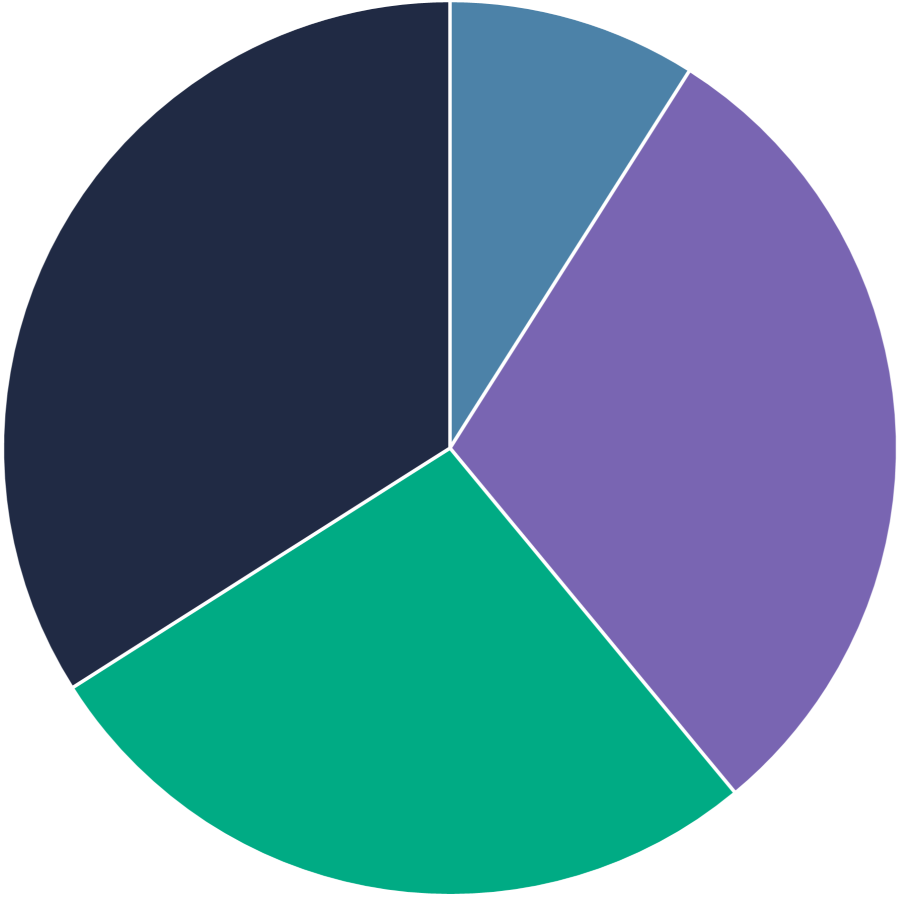

Income protection (34%)

Total and permanent disablement (TPD) (30%)

Death and terminal illness (27%)

Trauma (9%)

In 2024, Resolution Life paid out $257m to over 1,356 customers for life insurance claims, which equals $714,818 paid every day.

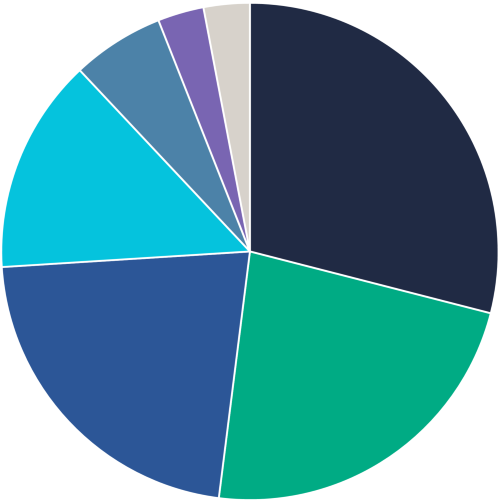

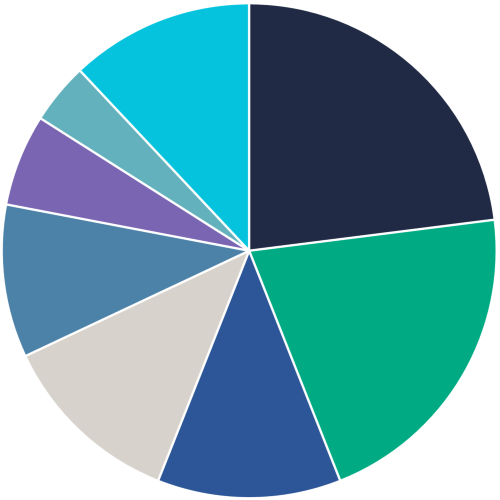

Cancer (29%)

Heart attack, stroke and other circulatory disease (23%)

Respiratory system disease (14%)

Accidents/Injuries (6%)

Digestive system disease (3%)

Infectious disease (3%)

Other (22%)

In 2024, this is the percentage of males and females with claims in the top six categories

Male | Female | ||

| Heart attack, stroke and other circulatory diseases | 25% | Cancer - other | 21% |

| Cancer - other | 17% | Heart attack, stroke and other circulatory diseases | 18% |

| Respiratory system disease | 15% | Respiratory system disease | 13% |

| Other | 12% | Other | 10% |

| Accidents/injuries | 6% | Nervous system disease | 5% |

| Cancer - bowel | 3% | Infectious disease | 5% |

In 2023, the top 2 leading causes of death registered in Australia were heart disease, dementia (including Alzheimer’s disease) and cardiovascular disease1

1 Causes of Death, Australia, 2023 | Australian Bureau of Statistics Causes of Death, Australia released 10/10/2024.

In 2024, Resolution Life paid out $283m to over 707 customers, which equals to $775,890 paid every day.

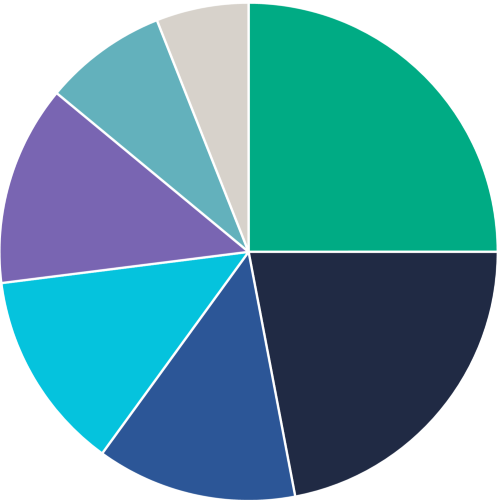

Mental health disorder (25%)

Musculoskeletal (22%)

Accidents / injuries (13%)

Nervous system disease (13%)

Cancer (8%)

Heart attack, stroke and other circulatory diseases (6%)

Other (13%)

In 2024, this is the percentage of males and females with claims in the top six categories

Male | Female | ||

| Mental health disorders | 24% | Mental health disorders | 26% |

| Musculoskeletal | 21% | Musculoskeletal | 24% |

| Accidents/injuries | 16% | Nervous system disease | 17% |

| Nervous system disease | 11% | Accidents/injuries | 10% |

| Heart attack, stroke and other circulatory diseases | 8% | Cancer | 5% |

| Cancer | 5% | Other | 4% |

In 2021, an estimated 42% of Australians over the age of 55 experienced high blood pressure or hypertension2. This statistic underscores the importance of regular health check-ups and proactive management to maintain cardiovascular health as we age.

2 Prevalence and impact of mental illness - Mental health - AIHW How many Australians have experienced mental illness? Sub heading Age and sex, figure 2: Types of serious illness by age and sex, 2009 to 2021.

In 2024, Resolution Life paid out $87m to over 286 customers for trauma insurance claims, which equals $239,230 paid every day.

Cancer (63%)

Heart attack, stroke and other circulatory diseases (23%)

Nervous system disease (6%)

Musculoskeletal (2%)

Accidents / injuries (1%)

Other (5%)

In 2024, this is the percentage of males and females with claims in the top six categories

Male | Female | ||

| Heart attack, stroke and other circulatory diseases | 32% | Cancer - breast | 45% |

| Cancer - other | 25% | Cancer - other | 21% |

| Cancer - prostate | 20% | Heart attack, stroke and other circulatory diseases | 8% |

| Cancer - bowel | 7% | Nervous system disease | 5% |

| Nervous system disease | 6% | Cancer - lung | 4% |

It’s estimated that 1 in 7 women and 1 in 550 men are diagnosed with breast cancer in their lifetime3. This statistic demonstrates the importance of regular screenings and early detection in order to provide the best chance of effective treatment and improve survival rates.

In 2024, Resolution Life paid out $326m to over 4,772 customers for income protection insurance claims, which equals $893,906 paid every day.

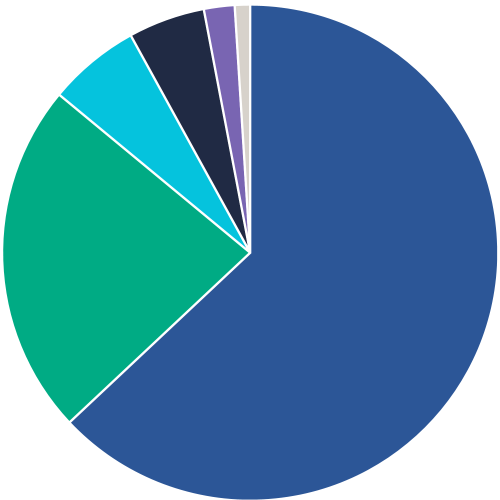

Mental health disorders (23%)

Musculoskeletal (21%)

Accidents/injuries (12%)

Cancer (12%)

Nervous system disease (10%)

Heart attack, stroke and other circulatory diseases (6%)

Fractures (4%)

Other (12%)

In 2024, this is the percentage of males and females with claims in the top six categories

Male | Female | ||

| Musculoskeletal | 22% | Mental health disorders | 29% |

| Mental health disorders | 21% | Musculoskeletal | 18% |

| Accidents/injuries | 14% | Nervous system disease | 11% |

| Nervous system disease | 9% | Cancer - breast | 8% |

| Heart attack, stroke and other circulatory diseases | 7% | Cancer - other | 6% |

| Cancer - other | 7% | Accidents/injuries | 6% |

In 2021, an estimated 15% of Australians over the age of 55 experienced depression or anxiety4. This statistic shows why mental health support and resources are important, especially for older Australians, to ensure their wellbeing and quality of life.

4 Prevalence and impact of mental illness - Mental health - AIHW How many Australians have experienced mental illness? Sub heading Age and sex.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.