We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here. Any references to Resolution Life Group on or available through this website are historical.

As you approach this significant financial milestone, we want to express our gratitude for your continual loyalty and trust. Your journey is important to us, and we are dedicated to help you through each step of the way.

Whether you’re planning for retirement or simply exploring the possibilities, here is some helpful information that may assist you in understanding the process and the options available to you. Rest assured that we will continue to help you at each stage.

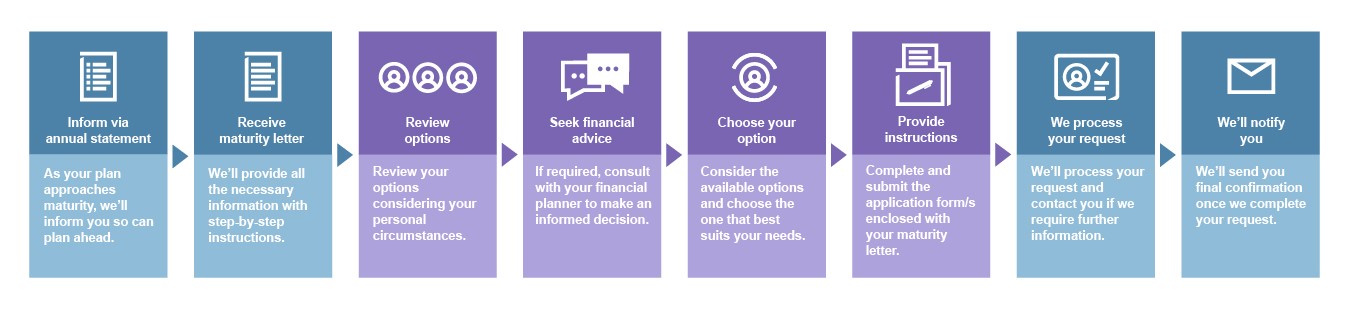

Here is what you can expect.

You don’t need to do anything until you receive the maturity letter, but you can check your current balance at any time in the My Resolution Life Portal.

When your plan/policy reaches maturity, you will be able to choose from one of the following options. (Note: your options will vary based on your product)

The maturity letter will provide clear information specific to your plan/policy and outline what you need to do when you choose any of these options.

1. Extend the plan: To maintain the consistency of your financial strategy, you can extend how long you keep your investment fund. How long you can extend it for will depend on the kind of product you hold.

2. Reinvest with us: If you hold another investment product with Resolution Life, you may be able to invest your matured funds into that investment plan. Your financial planner is best placed to help you to select a product that suits your needs.

3. Withdraw your funds: Your eligibility to withdraw your funds will depend on whether you hold your investment within a superannuation or a non-superannuation product. Check your eligibility to withdraw here.

It is important for you to carefully consider your unique financial circumstances and objectives. Your financial planner can help you choose the option that best suits your specific needs. If you do not have a financial planner listed on your policy/plan, you can contact the Financial Planning Association who will be able to assist further.

If you meet the eligibility criteria, you will need to complete a withdrawal form and provide us with certified identification. Please read the step-by-step guidance on what you need to do.

Please note that your balance is an indicative value only and may vary on your plan’s/policy’s maturity date.

We understand that life can bring some unexpected situations, and you may feel the need to access your funds before they mature. In some cases, you may have the option to withdraw your funds partially or fully, provided you meet certain eligibility criteria.

We want to make sure you’re fully informed - so it’s important to note that withdrawing your funds ahead of schedule could have financial implications. To understand the financial impact, we recommend you consult with a financial planner before making a decision.

Your eligibility to withdraw will depend on the type of plan/policy you have, specifically if you have invested in a superannuation or non-superannuation plan/policy.

To determine whether your funds are invested in a superannuation or non-superannuation plan/policy, please log in to the My Resolution Life portal or refer to your latest annual statement.

If your funds are invested in a non-superannuation plan/policy, you are eligible to withdraw your funds at any time in accordance with the terms and conditions of your policy document. To withdraw your funds, please click here for step by step guidance.

For funds invested in a superannuation plan/policy, access before retirement is restricted. However, there are circumstances where early access is allowed. These conditions include:

To qualify, you must provide:

If these conditions are met, you can access your super fund’s current balance as a lump sum. Any accrued benefits are tax-free if you have a terminal medical condition either at the time of the payment or within 90 days of receiving the payment.

Requirements for this condition may vary among super funds, so it’s advisable to check with us for confirmation.

Generally, your fund must be satisfied that you have a permanent physical or mental medical condition that is likely to prevent you from ever working again in a job you were qualified to do by education, training, or experience.

You may still be eligible even if you undertake other work such as light duties in a different role or casual work in a different field. If you meet this condition, you can withdraw your super as either a lump-sum payment or as regular (income stream) payments.

If you are facing severe financial hardship and wish to access your super, you’ll need to contact your super provider and understand their specific requirements for this circumstance.

Eligibility for accessing your super due to severe financial hardship depends on your age relative to your preservation age.

If you’re under preservation age plus 39 weeks:

To be eligible, you must meet the following conditions:

The minimum withdrawal amount before tax is $1,000 (or the remaining balance of your super after tax if you have less than $1,000) and a maximum withdrawal amount of $10,000.

You can only receive one payment in any consecutive 12-month period.

If you’ve reached preservation age plus 39 weeks:

To be eligible, you must fulfill these conditions:

There are no restrictions on the amount you can withdraw if you meet the age and the above two conditions.

The benefit is paid and taxed as a regular super lump sum i.e., if you are over 60 years old, it is generally tax free, but if you are under 60 years old, it is subject to taxation, which is generally between 17% - 22%.

In certain situations where you’re facing financial constraints and are unable to cover specific unpaid expenses, you may have the option to access your super funds on compassionate grounds. These circumstances include:

Applications for early release of super on compassionate grounds must be submitted to the Australian Taxation Office (ATO) for approval. Before applying, please contact us to confirm that we can make payments approved under this withdrawal request.

The super paid to you on compassionate grounds will be taxed as a normal super lump sum.

Additionally, you may be eligible for early access to your super if:

If you access your super account with less than $200, there is generally no tax payable on this amount.

To determine whether your funds are invested in a super fund, please refer to your most recent annual statement, or log in to My Resolution Life portal.

If you are eligible and would like to initiate an early withdrawal of your funds, please click here for step-by-step guidance.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.