We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

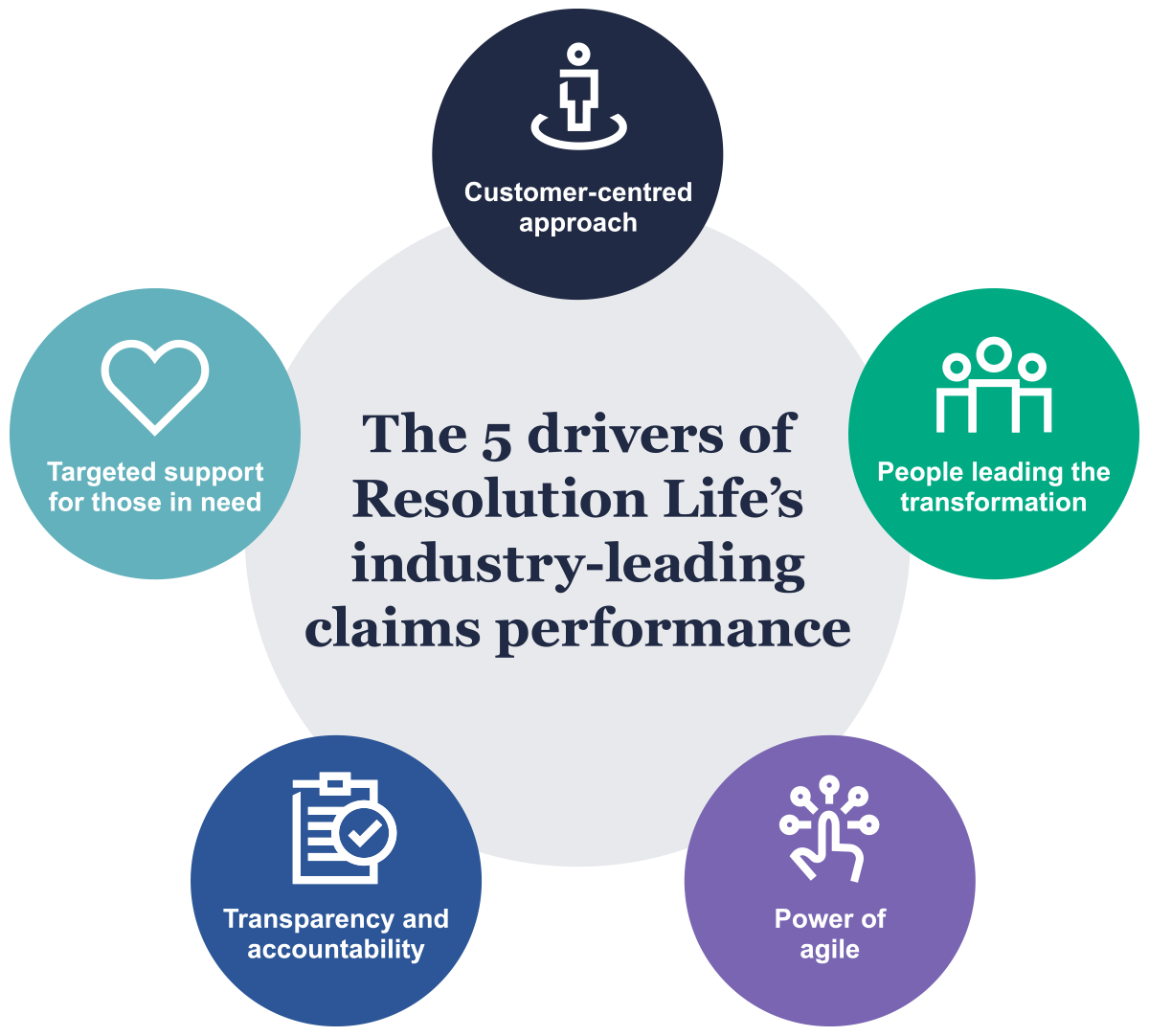

Resolution Life Australasia (Resolution Life) has transformed the way it manages claims over the past three years. It is now an industry leader in both turnaround times and acceptance rates.

Resolution Life has transformed its claims management over the past few years and is now one of the leaders in the Australian insurance industry for both turnaround times and acceptance rates for claims. This transformation has provided a better experience and outcome for customers.

During 2021 alone, it paid out $971 million in claims1 in Australia and $191 million in New Zealand2.

The four areas crucial to the transformation were:

The use of AI in the claims process will provide a better end-to-end experience for Resolution Life’s customers. This is because the innovative approach helps to accelerate claims assessment and payments by reducing manual administrative task. Therefore, the efficiencies that flow from using AI allows team members more time to concentrate on supporting customers and getting them the right help at the time they need it most.

Resolution Life Australasia is part of the Resolution Life Group. It has approximately $30 billion in assets under management and is a well-capitalised business with a dedicated focus on servicing its existing 1 million customers and providing them with competitive premiums, quality investment management, great customer service and efficient claims management.

Resolution Life Group is a global life insurance group focusing on the acquisition and management of portfolios of life insurance policies. Since 2003 Resolution Life Group has committed over US$18 billion of equity in the acquisition, reinsurance, consolidation and management of 28 life insurance companies. Resolution Life Group has operations in Bermuda, the U.K., the U.S., Australia, and New Zealand, assisting the restructuring of the primary life insurance industry globally. Resolution Life provides a safe and reliable partner for insurers as they restructure.

| Insurance type | Claims acceptance rate | Average handling time (months) | ||||

| Resolution Life | Resolution Life ranking | Industry average | Resolution Life | Resolution Life ranking | Industry average | |

| Death | 98.2% | 4/7 | 97.7% | 0.8 | 1/7 | 1.4 |

| TPD* | 92.2% | 1/7 | 84.4% | 5.6 | 1/7 | 7.3 |

| Trauma | 92.5% | 1/8 | 86.6% | 1.4 | 2/8 | 1.7 |

| IP* | 95.9% | 3/9 | 95.3% | 1.5 | Equal 3/9 | 1.6 |

*TPD - Total and Permanent Disability and IP – Income Protection

Data from the Australian Prudential Regulation Authority (APRA), to which all insurers report under federal law, shows that Resolution Life leads its sector on several important measures.

ASIC’s Moneysmart Insurance Comparison Tool takes annual APRA data and compares Australian insurers based on type of insurance3 and the outcomes that matter most to customers – how quickly a decision is made on a claim (handling time) and how many claims are paid out (claims acceptance rate).

According to the most recent update4, Resolution Life:

delivers fastest speed to assessment in three of seven insurance categories

delivers the highest acceptance rate in four of seven insurance categories

has a faster than industry average speed to assessment in six of seven categories

shows improved or steady speed to assessment in five of the seven categories

shows improved acceptance rates in all seven categories.

Resolution Life is committed to continuing to invest in its products and services to provide more effective and efficient experiences for its customers.

Resolution Life overhauled its processes to deliver better outcomes for customers, including more accurate benefit calculations, faster turnarounds, and more supportive relationships to get claimants back on their feet faster.

Resolution Life is customer-focussed and data-driven. Since 2017, a transformation process has been underway to improve customer service delivery through reduced administrative burdens.

At the time, highly trained staff were spending 60% of their time on administrative tasks such as entering and filing customer information and researching the policy terms and conditions rather than interacting with the customer during their time of need.

The solution was to restructure its teams and become an agile workplace. Instead of its people working in specialty-based silos within a hierarchical system, the insurer moved to self-managed, multi-disciplinary teams.

Now, each team at Resolution Life is self-contained, with all the skills and authority needed to manage its customers. For claims, the caseload of individual case managers, and portfolio of claims are held by the team.

The insurer trusts its people with full data transparency and has invested in AI technology to build its own custom claims management system – which currently is the only one of its kind in the insurance sector.

The technology is not used to make decisions. Rather, it reduces the necessary administration and speeds up analysis. This means staff can make informed decisions faster and can spend more time supporting the customers that need help.

When the transformation process began, the aim was to improve the insurer’s relationships with customers through greater human interaction and direct exchanges of information. That has continued as a phone-based approach reduces the administrative burden on staff by drastically decreasing the amount of paperwork that has to be created, sent, received and processed.

It also provides a less stressful and more reassuring experience for customers who can be facing enough challenges without also having to complete lengthy forms.

Resolution Life also trained staff in motivational interview techniques. Motivational interviewing is a guiding style of communication through which the interviewer collaborates with the interviewee to understand their circumstances and explore their options to navigate the best course.

This has changed the interactions with customers to be much more like having a conversation, rather than an interrogation. Resolution Life now uses paper-based processes only for more complex cases where substantial amounts of information is needed.

In their initial conversation with Resolution Life staff, customers are also taken through the claims process. This means they are given a greater understanding what is likely to happen and when.

The Resolution Life Lodgement team was contacted by a super fund (where Resolution life was the insurer) about Bryony, 69. She had put in a claim for terminal illness benefit. Bryony had been diagnosed with late-stage ovarian cancer and had been given only days to live.

The super fund was notified on the first of the month and completed all the documents that were required. The very next day they notified Resolution Life about Bryony and her claim.

The lodgement manager acted quickly to review the documents and ensure Resolution Life had everything required to create the claim. An urgent case was raised with a claims case manager, who was able to assess and pay the claim. It took Resolution Life four hours from receipt to lodge, assess and pay out Bryony’s claim.

*Real customer story, name protected for privacy.

Resolution Life invested heavily in creating a career pathway specific to claims so its people would feel confident in their skills and knew where their craft could take them.

It enhanced its ‘capability framework’ to better understand the capabilities of its people. This framework allows it to assess and balance the number and complexity of the claims each case manager looks after, as well as what’s in the overall team portfolio.

Caseloads and portfolios each require a mixture of high, medium and low complexity cases. The balance depends on the level of skill and number of hours available within the team. Because the capability framework allows Resolution Life to see this ‘at a glance’, it is both a useful management tool and a valuable barometer for training requirements.

All new starters are assigned a capability coach who introduces them to all elements of the claims management process. More experienced staff receive year-on-year training in their fields.

As of November 2022, 95% of Resolution Life’s claims staff have completed the core modules of the Australian and New Zealand Institute of Insurance and Finance’s (ANZIIF) Certificate IV in Life Insurance.

Between this training and ‘big picture’ data (the framework), claims case managers can benchmark their current skills against leaders in their craft and take ownership of their cases, professional development and careers.

Jehan started a claim in 2021 with a breast cancer diagnosis. One month after her claim was accepted, she was told she would need a left breast mastectomy.

Jehan’s Resolution Life case manager liaised with one of our recovery specialists to refer her to a rehabilitation provider that could help and support her post-operation recovery. Jehan’s case manager recognised that she would be more comfortable discussing her circumstances with a woman and arranged for Jehan’s case to be reallocated to a female case manager and for the rehabilitation provider to allocate a female specialist.

Jehan’s operation was successful, and the female rehabilitation specialist is helping with her recovery. Resolution Life has been supporting Jehan during this process and has worked with her to develop a plan for a gradual return to work. The plan includes a fatigue assistance program, funding for work-from-home equipment, and income protection benefits for the 18 months she spent preparing for, undergoing, and recovering from major surgery.

Jehan has let the insurer know that being supported by women has allowed her to be more open about her condition, functional limitations and fatigue. This, in turn, has allowed her support team to develop more effective strategies. Jehan will soon be able to begin a safe return to her career.

*Real customer story, name protected for privacy.

Resolution Life moved from a traditionally structured organisation to agile ways of working in 2020. Rather than being structured into field-based silos for claims, each self-managed team (SMT) hosts staff from various disciplines. An SMT is built to contain all the skills and authority it should need to move a claim through the claims process from beginning to end.

Each SMT has the expertise within it to cope with even the most complex of claims. Members of an SMT check progress and troubleshoot new issues at short daily meetings (called stand-ups). At fortnightly meetings (called showcases), SMTs share successes and discuss roadblocks. Progress, and lack of progress, is easy to track through integrating this agile working method with comprehensive workplace data that is available for everyone to see.

Each SMT is responsible for managing its own tasks and workflow and ensuring the team meets its objectives and key results. The effect is that team members keep each other accountable. It means they exchange constructive feedback. It also means every achievement is a success for the team. Ultimately, every person and every team have their eye on ‘output’ – achieving the best possible result for customers.

Liu is a 53-year-old who was assaulted towards the end of 2021. Resolution Life received a claim in mid-2022 for a head injury with post-traumatic stress disorder, depression and anxiety.

Liu received payments from Victims’ Services NSW due to the nature and severity of the attack. Per the offset clause of Liu’s policy, these payments needed to be offset from his total and permanent disability benefits. Although the Victim Support payments help Liu with the cost of counselling and medical services, his income protection plan is what allows him to live his life.

Resolution Life needed information from Victim Services NSW but did not have the authority to contact them directly and Liu’s condition makes it difficult for him to request information, organise forms and navigate red tape.

The agile workplace allowed Liu’s case manager to simplify the process and, in the end, all Liu needed to do was to provide a filtered bank statement showing his Victim Support payments. That gave Resolution Life what was needed to make him an initial income protection payment while the company requested information from Victim Services on his behalf.

Within two days of receiving all the information needed from Victim Services, Resolution Life was able to accept and fully pay out Liu’s claim. Liu’s case manager being able to directly approach the appropriate people within our business allowed his payment to be activated far more quickly than was previously possible.

*Real customer story, name protected for privacy.

When Resolution Life became an agile organisation, its leaders quickly realised that also meant becoming a transparent organisation while still adhering to customer privacy requirements.

Teams could not have full control over their portfolios without also having access to the claims data that guided and reported on caseload distribution, portfolio composition, staff member performance and training requirements.

Resolution Life developed a dashboard initially to help chapter leads and managers monitor team activity and the broader trends within the business. Teams could not access this information.

However, the nature of an agile workplace makes candid interaction necessary. Exposing the data increases the understanding people have of the context in which they work. This means they have a clearer view and improved ability to deliver the right help to customers at the right time. They become more accountable for their work and results.

As a result, Resolution Life gave claims staff access to the dashboard.

The dashboard, with its industry-leading design and functionality, is now a key component in how the SMTs function. It is updated daily and contains everything a team member may need to understand a claim.

Uniquely, the dashboard allows team members to manage claims with the assistance of data. It shows trends from statistics that inform how a team individualises its approach to each customer.

Henry is a 57-year-old self-employed tradie. He suffered atrial fibrillation in mid-2022 and Resolution Life received the claim two months later.

During the claims process, Henry’s assigned case manager required leave however, thanks to the dashboard, the case manager’s self-managed team was able to make sure no customer was left behind.

The claim was picked up, discussed, and allocated to a caretaker case manager, who referred it to a recovery specialist for an early intervention plan. The caretaker case manager was even able to make a recommendation to accept the claim as Resolution Life had all the information that was required. Even though the team had an unusual amount of work and fewer people than normal, Henry’s claim was paid within 14 days.

Even so, Resolution Life is still working with Henry, with his recovery specialist designing a work conditioning program to help him return to work when he is ready.

*Real customer story, name protected for privacy.

Sometimes, an insurance payout isn’t enough to get a person back on their feet, which is why Resolution Life has put a lot of effort into training people to understand customers’ unique circumstances.

Every case manager is trained to notice ‘red flags’ as early as their first interaction with a customer. For example, this could be a comment that suggests a customer may be struggling to afford groceries or find transport to a doctor. The customer may even confide that they’re not coping financially or emotionally.

Case managers use their training to reassure the customer, while also calling on a recovery specialist within their team to advise what the customer needs to alleviate their situation in the short term. The recovery specialist then develops a recovery management plan in collaboration with the customer that takes into account their unique circumstances and ideal outcomes.

Recovery specialists are trained to identify what will help a customer recover sooner, whether that’s a piece of equipment, a particular service, or even a voucher for groceries. In addition, Resolution Life has enabled its claims SMTs access to mental health specialists, as well as a chief medical officer. They also have access to psychiatrists and occupational physicians.

Lucy, 59, was diagnosed with L4/L5 spinal stenosis (a narrowing of the spinal canal) and bilateral severe facet arthropathy at the end of 2021. She had severe symptoms, which included continual pain, numbness and muscle spasms. She tried all more conservative methods of treatment but had to undergo back surgery within four months.

Lucy loved her job and was highly motivated to return as soon as possible. Soon after her surgery, Lucy’s assigned recovery specialist engaged medical professionals who could help Resolution Life and Lucy’s employer understand her condition. Within two months of major surgery, Lucy and her employer were beginning to work through a graded return to work plan. With steady support over six months, Lucy recovered. She returned to work full time in the role she loves within 10 months of her original diagnosis.

*Real customer story, name protected for privacy.

Resolution Life Australasia will continue to invest in its technology, digital and AI capabilities to meet the changing needs of its customers.

Resolution Life has begun rolling out a new claims management system that integrates AI.

Resolution Life has invested a significant sum to develop the new system, which was planned and developed according to customer needs at each step of their claim journey.

In order to develop a customer-focused product, Resolution Life analysed five years’ worth of claim data, focusing on the different conditions, scenarios and demographics that might affect a customer’s journey. Machine learning was then used to plot the different pathways to ‘best outcome’.

In practice, the claims management system uses optical character recognition (OCR), natural language processing (NLP), machine learning and automation to triage claims, assess them and calculate benefits. It can do this much faster and more accurately than a human can.

The claims system then provides recommendations to the case manager, who holds all decision-making power. The case manager then applies personal expertise and knowledge to ensure the customer truly receives the best outcome.

The new claims management system will significantly reduce the time Resolution Life team members spend on tasks such as researching and comparing terms and conditions and calculating benefits. It’s expected they will have up to 30% more time to talk with customers, understand their unique circumstances, and give them the right kind of support.

Resolution Life has invested in its people and systems to achieve one goal – improving outcomes for customers. Resolution Life expects further improvements in service delivery as more experts in claims management are created and the technology improves even further.

The data shows Resolution Life is already one of the fastest in the industry when it comes to deciding on claims.

“Our people are highly trained in motivational interviewing and claims assessment, which means we can learn what we need directly from customers, with minimal paperwork involved. Meanwhile, the systems we’ve put in place ensure the right staff receive the right cases, with the power to move those cases along the entire claims journey themselves.” – Dana Inglis, Chapter Area Lead, Claims Technical Services

Resolution Life will be using AI to speed up the administrative tasks associated with claims assessment, including what computers do best: calculations.

“With text recognition, natural language processing and machine learning, we’ve created the industry’s first advanced claims management system. It’s capable of trawling our extensive product library and comparing relevant sections against customer details to make suggestions to our claims managers about benefits payments, without being subject to human error.” – Maria Savvidis, Chapter Area Lead, Claims Management Services

Transforming its processes and using innovative technology mean people working at Resolution Life now have more time to deal with customers.

“Armed with their own extensive training and supported by a team of empowered experts – while AI takes care of more administrative and research tasks – Resolution Life staff will have more time to get our customers the support they need at a challenging time. For us, it’s about living our purpose to protect human spirit” – Maria Savvidis, Chapter Area Lead, Claims Management Services

1Resolution Life, Insurance Claims and Client Care, Accessed 1 November 2022.

2Resolution Life, Claims paid in 2021, Accessed 1 November 2022

3Resolution Life is included in seven categories: Death Retail, Death Group, Total Permanent Disability (TPD) Retail, TPD Group, Trauma Retail, Income Protection (IP) Retail, IP Group.

4Based on APRA data for the year July 2021 – June 2022

This article is dated November 2022. The information contained is general in nature and is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL no. 233671 (Resolution Life).

This information is not intended to represent or be a substitute for professional financial or tax (financial) advice. Before making a decision on whether to acquire, or continue to hold, a financial product, you should consider the relevant product disclosure statement (PDS) and whether the product is right for you. PDSs for Resolution Life products are available from Resolution Life at Resolution Life – Insurance, Super, Retirement and Investment - Resolution Life or by calling 133 731.

Resolution Life is part of the Resolution Life Group.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, Resolution Life does not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any financial decision. Except where liability cannot be excluded, Resolution Life does not accept any liability for any resulting loss or damage. The customer stories provided are based on true accounts but names have been changed for privacy.