We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Chat to one of our friendly staff in real time via click to chat in the My Resolution Life portal.

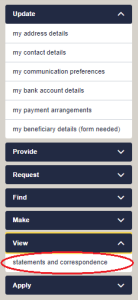

You can now request your Certificate of Currency & Centrelink Schedule through the portal to fulfil your EOFY tax obligations. A copy of these documents will be sent to you once the request is processed by our teams. These documents will be saved in My Resolution Life portal for future reference and can be downloaded from ‘Statements and Correspondence’ section. login or register to submit a request.

You would have received communication regarding your IP tax statements in August 2022. There are a small number of policies which may be experiencing a delay, this is currently being resolved and all letters will have been sent by the end of October 2022.

Here are some helpful links to information you may want to consider this end of financial year.

Maximum super contribution base | Australian Taxation Office (ato.gov.au) - The maximum super contribution base is used to determine the most an employer is legally required to pay employees as part of the super guarantee.

Super income stream tax tables | Australian Taxation Office (ato.gov.au) - A super income stream is when you withdraw your super as regular payments over a period of time. If you're aged 60 or over, this income is usually tax-free. If you're under 60, you may pay tax on your super income stream.

Transfer balance cap | Australian Taxation Office (ato.gov.au) - The transfer balance cap is the amount of super you can transfer tax-free over a lifetime to retirement income streams, including pensions.

Eligibility to claim a deduction | Australian Taxation Office (ato.gov.au) - You may be able to claim a tax deduction for personal super contributions that you made to your super fund from your after-tax income.

Super lump sum tax table | Australian Taxation Office (ato.gov.au) - If you withdraw your super as a lump sum, it may be taxable. The amount of tax payable generally depends on your age at the time you withdraw the funds and the components of your super.

Key super rates and thresholds | Australian Taxation Office (ato.gov.au) - Rates and thresholds apply to contributions and benefits, employment termination payments, super guarantee and co-contributions.

Super | Australian Taxation Office (ato.gov.au) - Handy information about super to help you understand some choices you can make today to help shape your lifestyle in retirement.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.