We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Life insurance is often viewed as a safeguard, a financial safety net, that ensures our loved ones are taken care of in unforeseen circumstances. Given the current economic climate and cost of living pressures many are under, tough decisions sometimes need to be made on some expenses.

When it comes to cutting expenses, insurance may seem ‘expendable’. However, before you make a decision, it’s important to remember that one of the primary reasons you may have acquired life insurance originally is to provide financial stability for yourself and your loved ones. If affordability and maintaining your life insurance is an issue, did you know you have options available to help maintain your policy and protect your loved ones’ future?

In this article, we review why it’s important to regularly review your life insurance and highlight some of the options available to make sure your cover remains affordable and meets your needs.

Your life insurance product may allow you to adjust it to fit your needs, while retaining your financial safety net. We also recommend speaking to your financial adviser regarding your specific cover needs. You can arrange a quote to find out how much your insurance cover will cost if you make any changes – read more on this later in the article.

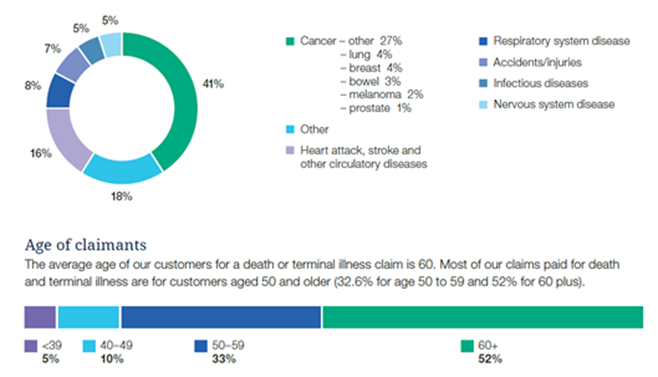

Cancer is the most common condition for claiming on life insurance in Australia, and these claims account for approximately 40% of all death and terminal illness claims (noting the graph below refers to death and terminal illness claims for our Elevate product). Heart attack, stroke and circulatory diseases are the next most common conditions, accounting for just over 15% of all our death and terminal illness claims.

The older you get, the more likely you are to claim as well, with more than 50% of customers claiming being over 50 years of age.

It’s always important to review your insurance. Life is dynamic and as your circumstances change, so may your need for cover. Have your circumstances changed recently? Have you got married, divorced, retired, started a business or paid off your mortgage? Depending on your personal situation, and what stage of life you’re at, it’s worthwhile reviewing your cover to ensure that it still meets your needs.

If you’re thinking of cancelling your current insurance cover and replacing it, you need to know about certain risks that are involved. For example, you’ll probably need to provide current medical and financial information for the new application and, if the insured person’s health has changed, this may affect the terms of the new cover. Also, if you cancel your current insurance while you’re applying or before the new cover starts, there may be a period when you won’t be protected.

Insurance costs can sometimes stretch the household budget, particularly during times of financial strain. When evaluating whether to maintain, adjust or cancel life insurance cover, affordability becomes a critical factor. If the cost of premiums is becoming a burden, and you’re reviewing whether you can continue to maintain your cover, you have options including:

- Review the amount of cover you have.

- Opt out of the inflation (indexation) benefit which increases your sum insured each year to keep up with the increased cost of living, if your policy has this feature .

- Let us know if you have stopped smoking for the past 12 months – this could reduce the cost of your insurance (if you were a smoker when you took out your cover).

- Do you have any extra cost optional features on your policy that you no longer need?

Life insurance policies come with various features and benefits. When thinking about whether to retain your cover, consider these benefits. Cancelling a policy with valuable benefits may result in a loss of financial security.

Additionally, if you're comparing the costs of insurance products online, it may be important to recognise that not all products are created equal. Online comparison tools may not account for the specific features and benefits of each life policy. For example, industry changes in October 2021 to income protection product design means some products may not have the same features – learn more here.

Life insurance decisions are not purely financial. They also carry emotional weight. Cancelling a policy may evoke feelings of uncertainty or fear about the future. Conversely, keeping your policy may provide peace of mind and reassurance that loved ones will be protected in the event of your death. Acknowledging and addressing these emotional factors is essential in making a decision that aligns with your values and priorities.

Navigating the complexities of life insurance decisions can also be daunting, especially if you’re unfamiliar with insurance terminology. Asking for help from a trusted financial adviser or by reaching out to us for information can provide clarity and perspective when weighing the pros and cons of adjusting or retaining coverage. Your decision to retain or give up your life insurance is multifaceted, influenced by a combination of financial, health and personal factors. Considering your decisions and looking at all of your options before making a decision, means you can confidently navigate this critical decision and ensure that your life insurance strategy remains aligned to your personal situation.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.