We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

It’s important to understand the type of cover you have and the amount you’re covered for, which can be viewed easily through My Resolution Life portal. The portal helps you to stay updated about your level of cover.

You may be eligible to make changes to your insurance cover with us. You can learn more about the types of cover we offer and what else you need to consider when reviewing your insurance.

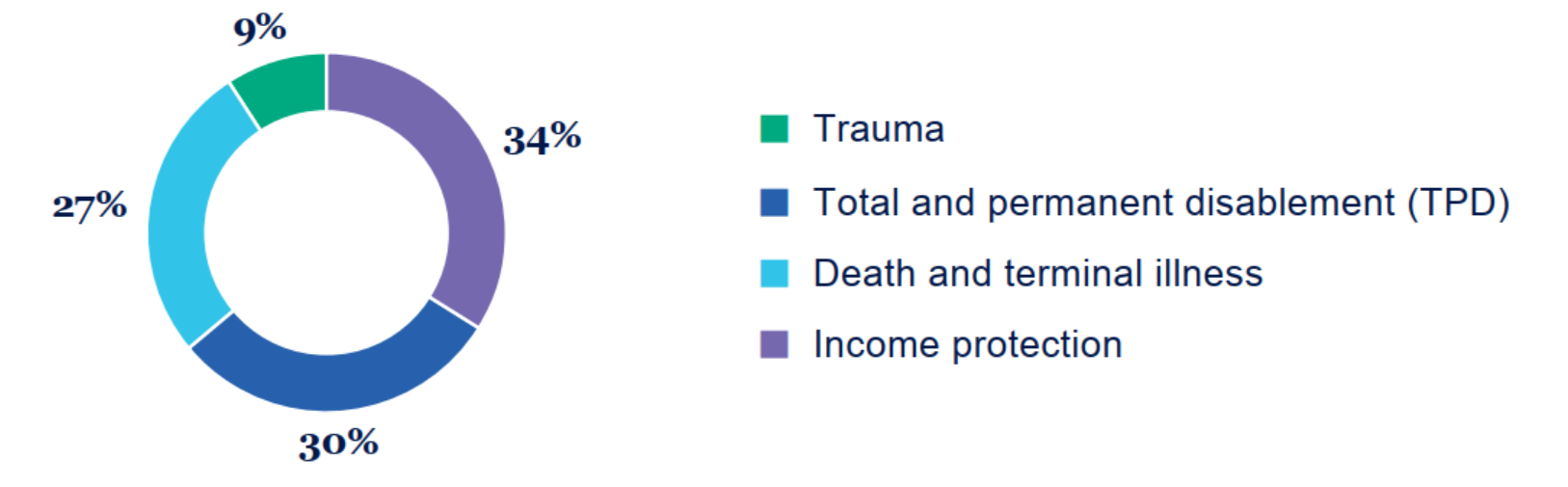

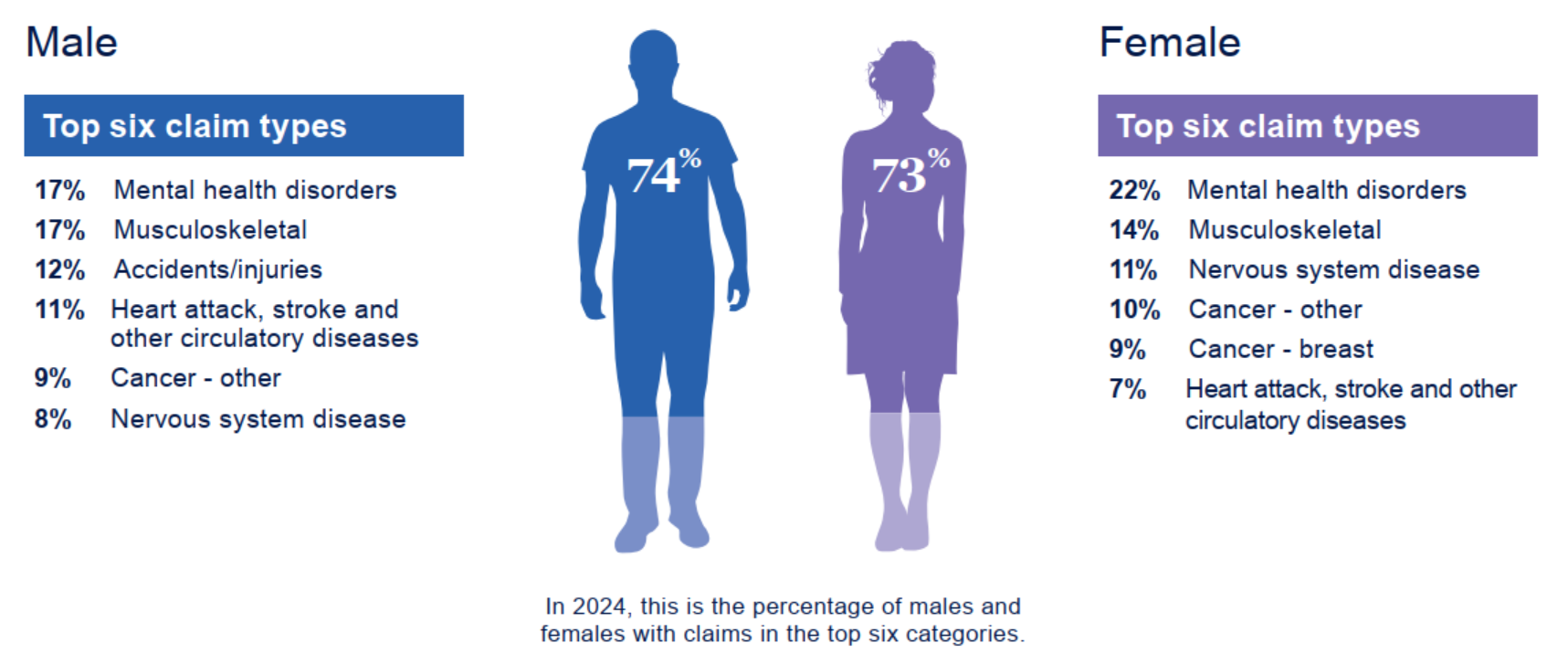

We manage a wide range of claims, reflecting the diversity of our products and our customers' needs. These claims cover a broad range of scenarios, meaning that we provide the necessary support when it’s needed the most.

At Resolution Life, we’re committed to being there for our customers to help them realise their best life. Our approach is built on three core principles:

1. Support: We are here to assist customers throughout their claims journey, providing the help and guidance needed.

2. Transparency: We believe in clear and open communication, ensuring customers understand every step of the claims process.

3. Caring: We approach each claim with empathy and compassion, making sure customers feel valued and supported.

To learn more about how much Resolution Life has paid for 2024, visit Resolution Life claims paid data 2024.

Any advice on this website is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), and is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the relevant product disclosure statement and/or policy document, available from Resolution Life at resolutionlife.com.au or by calling 133 731, before making a decision on whether to acquire, or continue to hold, the product.

The Target Market Determinations (TMDs) for our financial products (where applicable) can be found at Target Market Determinations (TMDs). The TMDs describe the key features and attributes of an applicable product that affect whether it is likely to be consistent with the objectives, financial situation and needs of consumers in the target market.

Resolution Life can be contacted via contact us or by calling the phone number mentioned above.