We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

We understand that making a claim can be a challenging time for you and your family. Here is some information to guide and support you through this process.

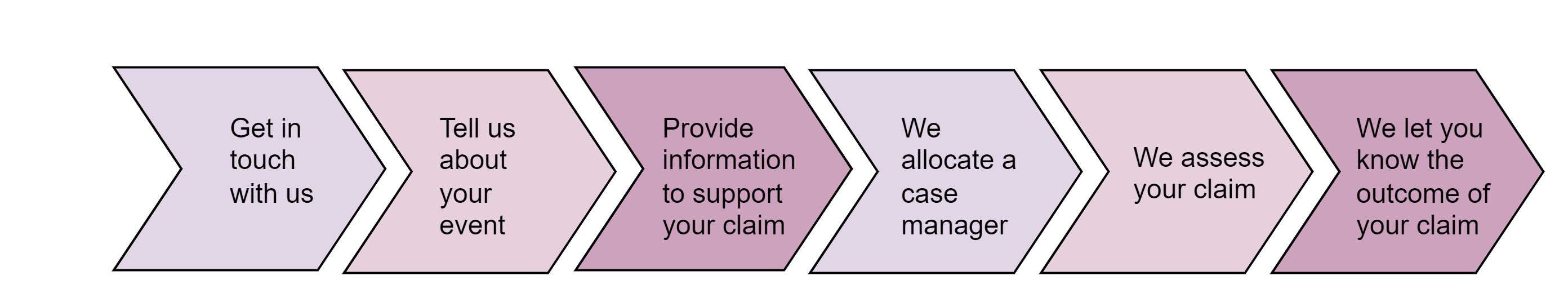

Here is what you can expect when you lodge a claim:

We’ve put together step-by-step guidelines to help you through each stage of your claim:

You should make the claim if you’re covered for:

- TPD (Total and Permanent Disablement)

- Terminal illness

- Trauma cover

- Income Protection

Your nominated beneficiary (usually a family member) can claim your life cover (death benefit) if you pass away.

To initiate your claim, contact us as soon as possible. We'll explain what you need to do and what will happen next. You can get in touch with us in one of the following ways:

![]()

Portal

If you are registered to the portal, you can lodge your claim by logging into the My Resolution Life portal.

Here is a step-by-step guide on how you can lodge your claim using our portal.

If you would like to register to our portal, it is easy – simply follow the steps.

![]()

Website

Notify us using our claims notification service

![]()

Call us

Call us 133 731

Everyone's situation is unique. When you contact us, our specialists will ask you to explain your situation and may request information or documentation to initiate your claim.

If you initiate your claim online, our claims team will contact you to ask you for information or documentation specific to your situation.

We will request information that is reasonably necessary for the assessment of your claim.

Typically, the information we request is specific to your claim. This may include your medical history, financial, occupational, and functional information. If the information needs to come from someone else, we will ask for your consent to collect this information about you.

Our claims team specialist will explain why we need the information and how you can provide it when they speak with you.

Where the claim is being paid as a regular payment and not paid as a lump sum, your claim manager will arrange regular updates to check in on your progress as you recover and determine what ongoing rehabilitation support is required. They will also advise you of what documents are required to determine your ongoing benefit entitlements.

We will allocate a case manager who will help you through the process.

The Life Insurance Code of Practice outlines the specific timeframes within which we must assess claims and the steps we must take if we are unable to assess the claim within those timeframes.

Your claims manager will notify you as soon as possible regarding the outcome of your claim. If we are unable to make a decision or accept your claim, we will provide an explanation.

Additionally, if your cover is provided through your superannuation, your super fund will notify you of the outcome of your claim.

Based on your situation and your product we'll let you know the outcome of your claim via phone and in writing.

Where a death benefit is payable under a super plan, we'll pay the sum insured to the Trustee.

- If this is ETSL, the proceeds of the plan will be paid to one or more of your dependants or to your legal personal representative.

- If this is a trustee of an SMSF or small APRA Super Fund, this will be managed as per the trust deed.

For any other claim under a super plan, the Trustee will need to be satisfied that you've met the condition of release before making any payment to you.

If your claim is not death related, your case manager and recovery specialist will discuss recovery options with you and, if appropriate, develop a tailored recovery plan.

The Australian Death Notification Service (ADNS) from the Registry of Births, Deaths and Marriages NSW provides the ability for people to notify multiple institutions of a death, via a single secure online environment. This service is provided by the department in NSW and covers all states and territories and is delivered in conjunction with the NSW Department of Customer Service. Please visit Australian Death Notification Service if required.

We are committed to helping you through this journey. While lodging a claim, if you ask or we identify that you need extra support to access our products or services due to vulnerability, we will work with you to find a suitable, sensitive, and compassionate option.

Here are some additional ways we can support you and take extra care of you if you’re vulnerable. This can be due to age, a disability, injury, a mental health condition, physical health condition, language barriers, literacy barriers, cultural background, remote location, Aboriginal or Torres Strait Islander status, family violence, suicidality or suicidal behaviours or financial distress.

We provide a free interpreter service to help you communicate with us if you need it. Please contact us to arrange.

We support the use of the National Relay Service (NRS). This is a free, confidential service provided by the Australian Government and can help if you’re deaf or find it hard to hear or speak to people on the phone.

If you're having trouble with your financial commitments, please call your Case Manager to talk about the options that may be available to you.

Discussing medical conditions or other vulnerabilities can be confronting, uncomfortable and upsetting. In addition to speaking with us, these organisations may be able to provide you with further assistance.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.